FX Markets:

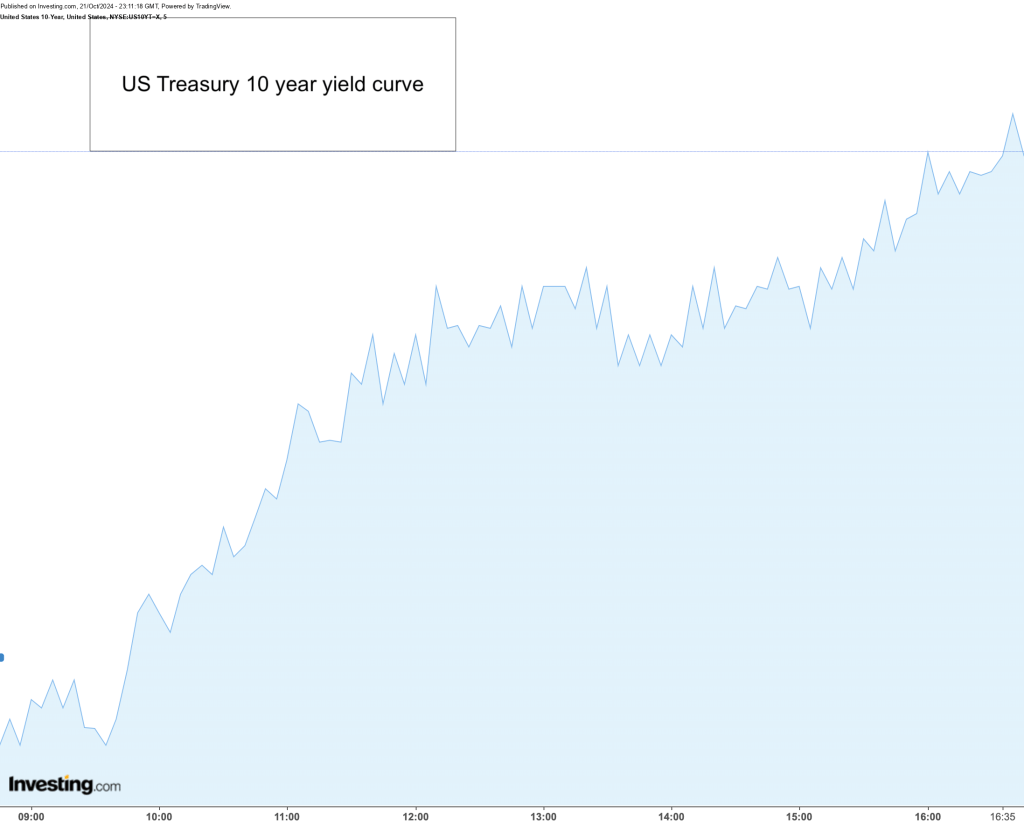

- Overall there were no news over the weekend and all the currency pairs were trading in a range. The main move of the day was the rise in US treasury yields after the US open which increased the chances of no rate cut in November from 7% to 13% and that overall caused the strengthening of the dollar across currency pairs.

- The overnight range for EUR/USD was 1.0845 and 1.0875(Friday range was 1.0850-1.0870). After the US open, the rise in yields caused the dollar strengthening and EUR/USD trended downwards from 1.0850 to 1.0815 till Market close where the low of the day was 1.0811. The low after the US Retail Sales on Thursday(10/17) was 1.0815 so we did break that low today. Overall it is going to be difficult to the break the 1.08 barrier without any news or further rise in yields. I expect EUR/USD to trade in its previous range of 1.0810 to 1.0840 for tomorrow.

- The overnight range for GBP/USD was 1.3020 and 1.3055(Friday range was 1.3000-1.3065). After the US Open, it trended downwards similar to EUR/USD and went from 1.3025 to 1.2985 will market close. After the UK retail sales on Friday, GBP saw some reprieve but it did not last long owing to very good inflation data before that and unless BOE governor Bailey who speaks tomorrow at 9:25 at Bloomberg Global Regulatory makes any surprise comment about being cautious/bearish in making 25bp in November, I expect GBP/USD to trade below 1.30 tomorrow.

- The overnight range for USD/JPY was 149.00 and 150.00 which is drastically more than last week. I think this was primarily because the trading/speculation happening on People’s Bank of China rate cut yesterday where they cut 25bp as anticipated to push growth. Similar to the other pairs, USD/JPY also drifted upwards to 150.75 after the US open. Currently, there are also a lot of people who have make long JPY bets and them unwinding or hitting stop-loss might also lead to more upward pressure for USD/JPY. BOJ has clearly said that they are happy to raise rates but it sounds very unlikely for them to raise amid so much internal as well Global volatility. I expect USD/JPY to break the 152 barrier this week given we US PMI data on Thursday(10/24) and we also approach closer to US election as well Japan domestic election(10/27).

US Equity Markets:

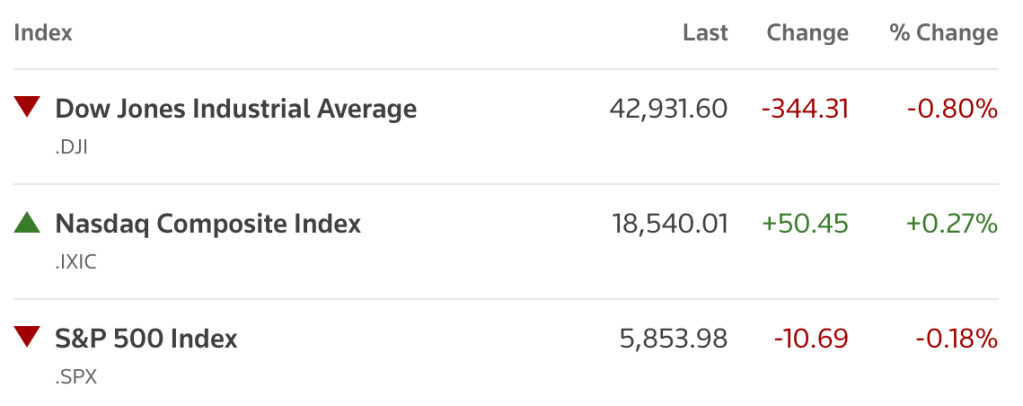

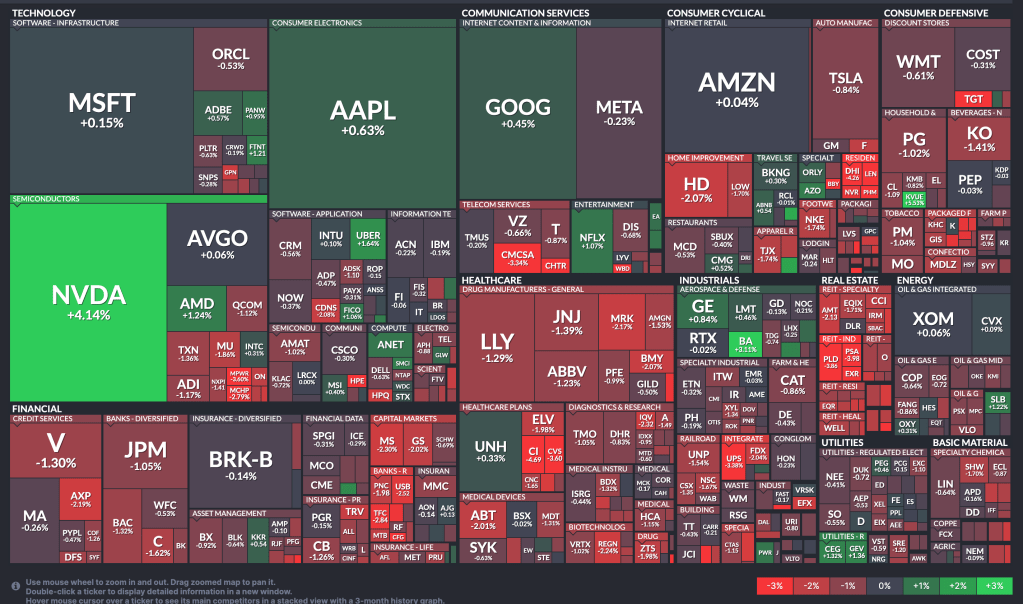

- Overall it can be seen from the difference in return from all 3 Equity indexes that it was the Industrials and small cap which caused the downtick. All the tech stocks were up slightly with Nvidia up the most at 4% and closing to its all time high.

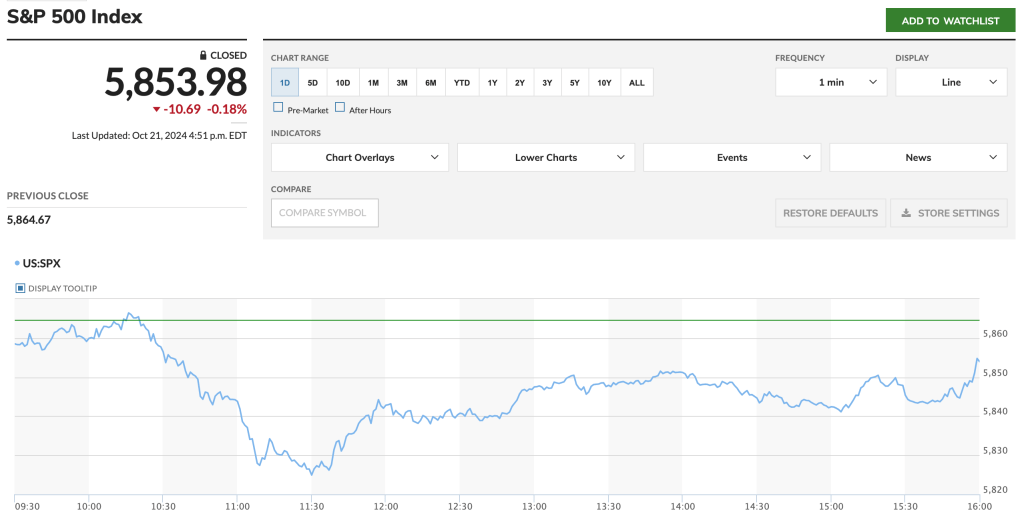

- Overall most of the sectors in S&P500 were down today with the major concern being the rise in yields and what that means for the next rate cut in November. Overall, we have seen NFP moving the odds drastically like it did in August as well as September and with NFP on 11/1 with the added volatility of election, the Equities rally on back the expected 25bp rate cut in November might evaporate rapidly even if earnings are in-line. Overall we have a lot of earnings over the week along with US PMI on Thursday(10/24) so I expect the markets to be volatile.

Macro View: Still hold the bearish view on Equity Markets and the rise in yields today support my argument on Friday which was, that there is more than 7%(Odds for 25bp were 93% on Friday Close) chance of no rate cut. I still think the odds of no rate cut in November are more than 13%. The main reason of 50bp last meeting was the weakness in US Job market but the recent numbers of Jobless Claims as well the September NFP(released 10/4) have been significantly better than expected and with inflation still not on a clear downward trajectory, there is a strong case for no rate cut. The Fed might also take some insights from the BOE’s rate cutting schedule where they cut 25bp in August and kept unch next cycle and their inflation is now below 2% as of now.

I still see dollar strengthening to continue across pairs as we move closer to the election but the strength as we approach closer to the election is going to decrease. Overall this dollar strengthening is caused on the assumption that whoever wins the election, their policies are going to cause inflationary pressure and that might push the rate cuts further away. Although, after Trump’s winning odds increased, the trend became stronger. Therefore, it looks like the trend is also dependent on the odds of USA Presidential election winner and would expect to see some weakening in dollar if Harris ever gains in polls.

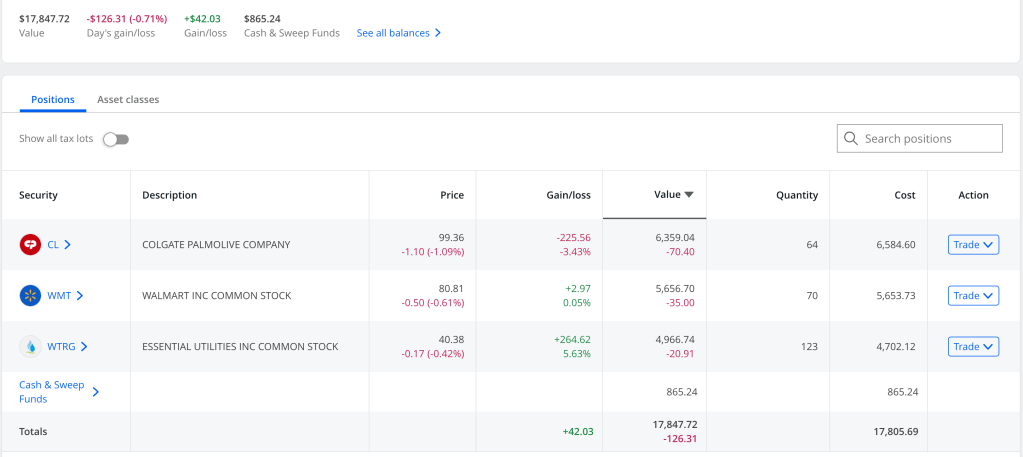

I still like my portfolio but post PG earnings on Friday before Open, all the other household products consumer defensive stocks have been dragged down with it. All the estimates for CL for the earnings are great but it is clear to me now that the stock picking as well as execution for this was pretty shitty.

News: VZ, GE and GM before Market Open and TXN after Market Close. BOE governor Bailey speech at 9:25.

Sources: Marketwatch(https://www.marketwatch.com/), Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), investing.com(https://www.investing.com/)

Leave a comment