- News: BOE governor Bailey speech at 9:25.

- Earnings: VZ, GE and GM before Market Open and TXN after Market Close

FX Markets:

- IMF growth Forecasts for US and Britain for 2024 were raised while they were lowered for Japan and Euro Zone. Overall, did not expect to sit to make an impact on the market but looks like I was wrong. ECB president Lagarde said that they are happy with the inflation data and Eurozone inflation might go below the target 2% faster than anticipated. This led to a drop in the Euro Zone yields as well the EUR/USD weakening. BOE governor Bailey’s speech did not have any comments about the current economy and hence saw no reaction on that.

- The overnight range for EUR/USD was 1.0815 and 1.0835(Yesterday range was 1.0815 and 1.0850). Because of the above mentioned IMF and Lagarde news, the overall trend overnight as well as after US open was that of dollar strengthening. The day range was 1.0800-1.0820. EUR/USD broke the 1.08 level 2 minutes before the 3 PM options expiration, therefore believe it was most likely driven by the delta hedging at that time. Although it did stay below the 1.08 after US close but I expect it to again trade between 1.0800 and 1.0820 overnight with no overnights news.

- The overnight range for GBP/USD was 1.2970 and 1.3015(Yesterday range was 1.2985-1.3025). I believe GBP saw some reprieve on the IMF news but it was short lived where it downticked from the overnight and the day’s high of 1.3015 to close at 1.2980. The day range was 1.2950 to 1.2990 where the low was 1.2946. I expect it to have a tight range tomorrow where it would trade between 1.2950-1.2990.

- The overnight range for USD/JPY was 150.50 and 151.00(Yesterday range was 150.00-150.75) with it breaching 151.00 multiple times. Some of the JPY depreciation can be attributed to the above mentioned IMF news. I still expect USD/JPY to break the 152 barrier this week give we have US PMI data on Thursday(10/24) and we also approach closer to US election as well Japan domestic election(10/27).

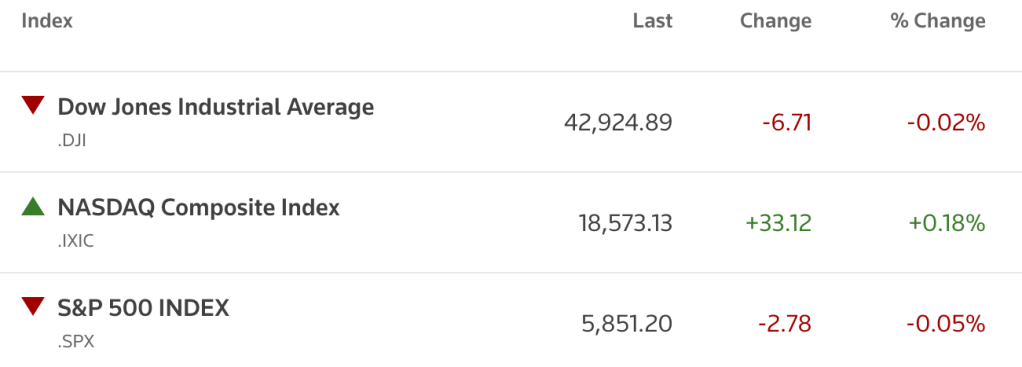

US Equity Markets:

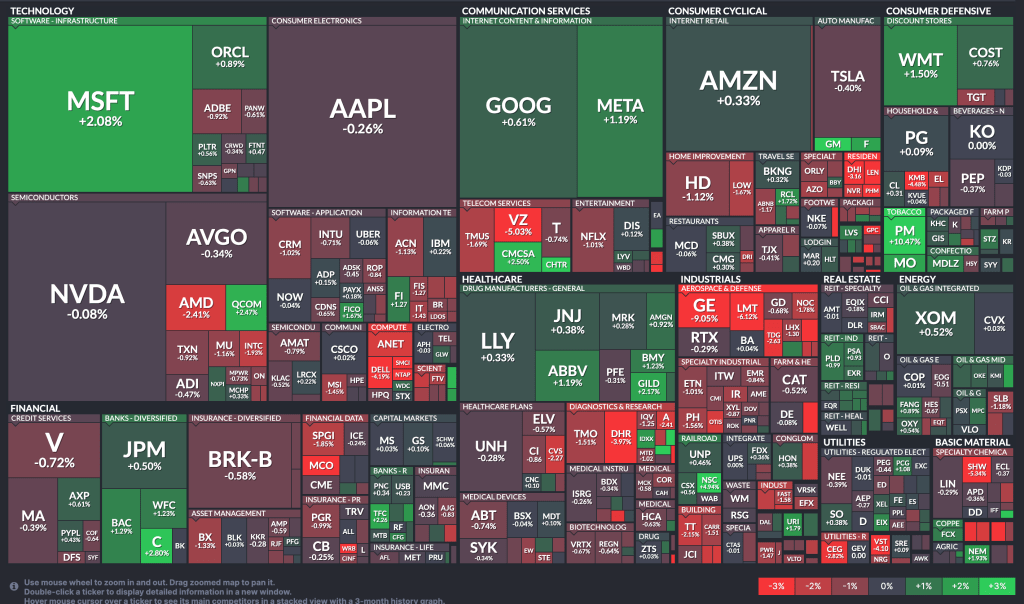

- Overall similar story as yesterday where Tech saw some uptick therefore Nasdaq positive and other 2 indexes slightly lower.

- Earnings were driving most of the moves today. GE(EPS beat but revenue miss) and LMT(EPS beat but revenue miss) dragged down the aerospace and defense sector with them 9% and 6% down respectively. GM(beat EPS by 20% and revenue by 10%) was up 10% after earnings, closed at its highest price in the last 2 years. Verizon(EPS in line but revenue miss) dragged down the communication sector with it being 5% in the day. We have AT&T and T-Mobile tomorrow which most likely combined might only pull down the sector further more given revenue miss from Verizon was from less sales in new phone devices in the quarter.

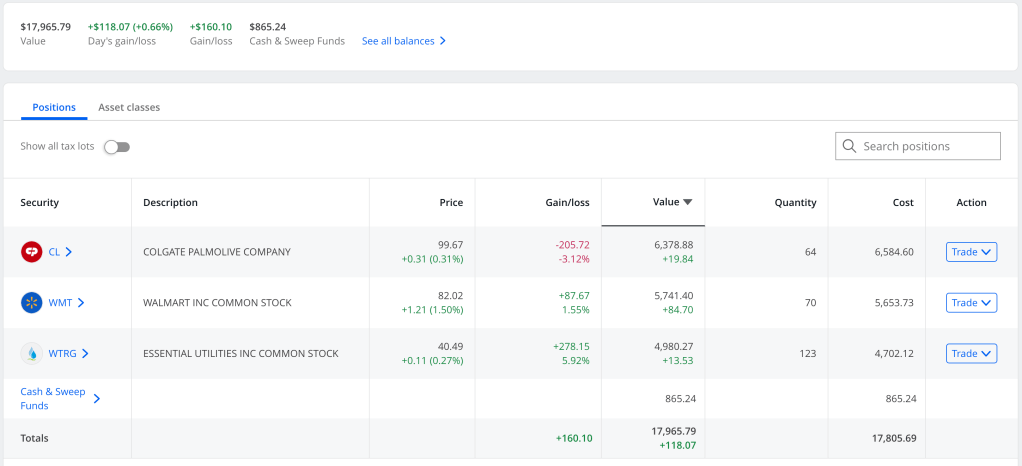

- WMT came out with the new initiative to deliver US prescription medications 30 minutes which was very well recieved by the market with its stock up 1.5% and closing at the year high. It also a lot of upside revision from some of the analysts on the street.

Macro View: Same view as yesterday, still like the bearish view on the market. Still expect to see dollar strengthening to continue till election. The latest odds for 25bp cut by Fed for November are back up to 91%. Still believe probability of no rate cut by Fed in November is more than 9% because of more volatility around the US PMI(10/24) and US NFP(11/1) data.

News: BA(Boeing), KO(Coca-Cola) and T(AT&T) before Market Open and TSLA(Tesla), IBM and TMUS(T-Mobile) after Market Close.

EUR Consumer Confidence, US Existing Home Sales and ECB President Lagarde speech about the Eurozone’s economic outlook at 10:00 AM. Beige Book at 2:00 PM. BOE Governor Andrew Bailey speech at the Institute of International Finance at 2:45 PM.

Sources: Marketwatch(https://www.marketwatch.com/), Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), investing.com(https://www.investing.com/)

Leave a comment