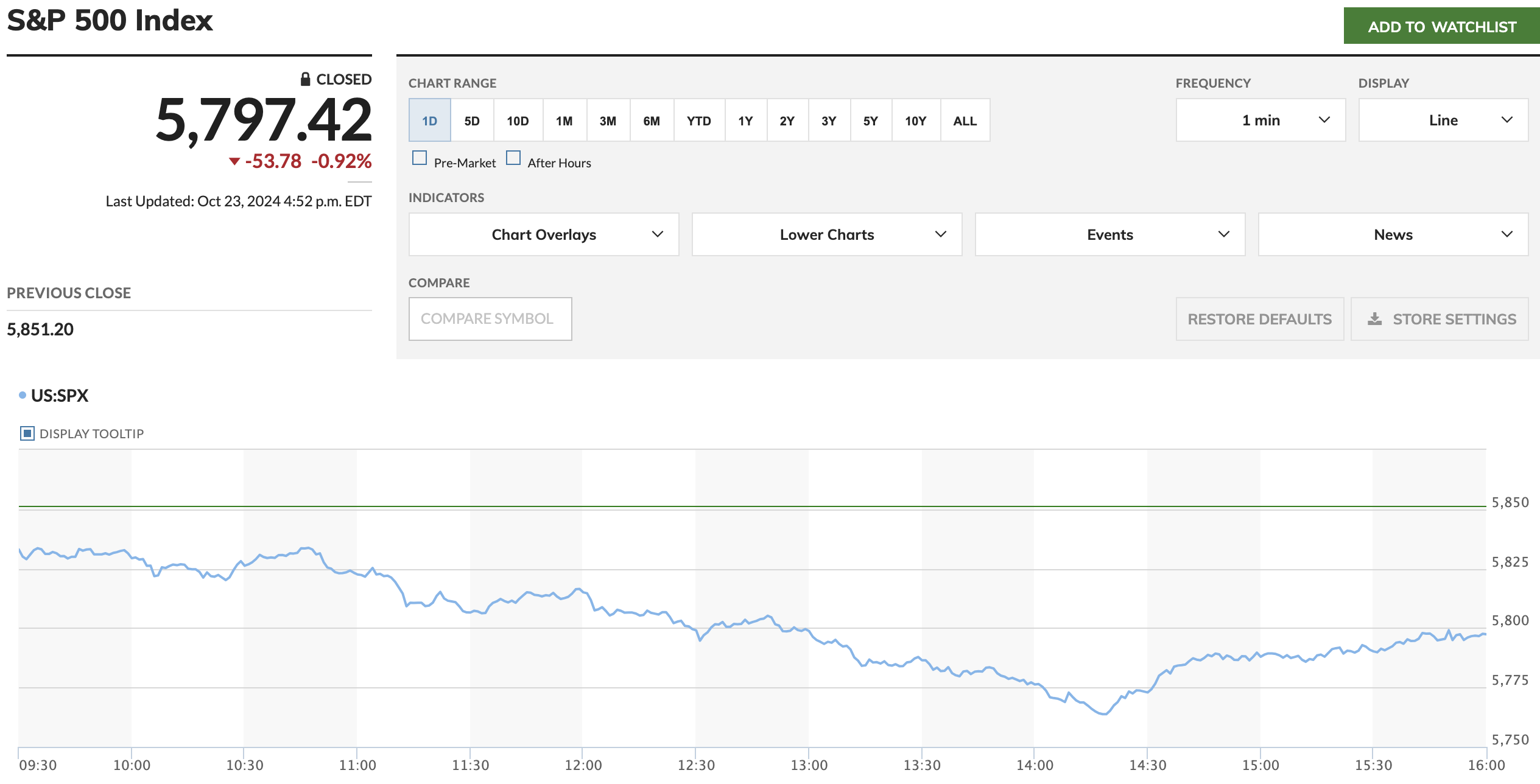

News: BA(Boeing), KO(Coca-Cola) and T(AT&T) before Market Open and TSLA(Tesla), IBM and TMUS(T-Mobile) after Market Close.

EUR Consumer Confidence, US Existing Home Sales and ECB President Lagarde speech about the Eurozone’s economic outlook at 10:00 AM. Beige Book at 2:00 PM. BOE Governor Andrew Bailey speech at the Institute of International Finance at 2:45 PM.

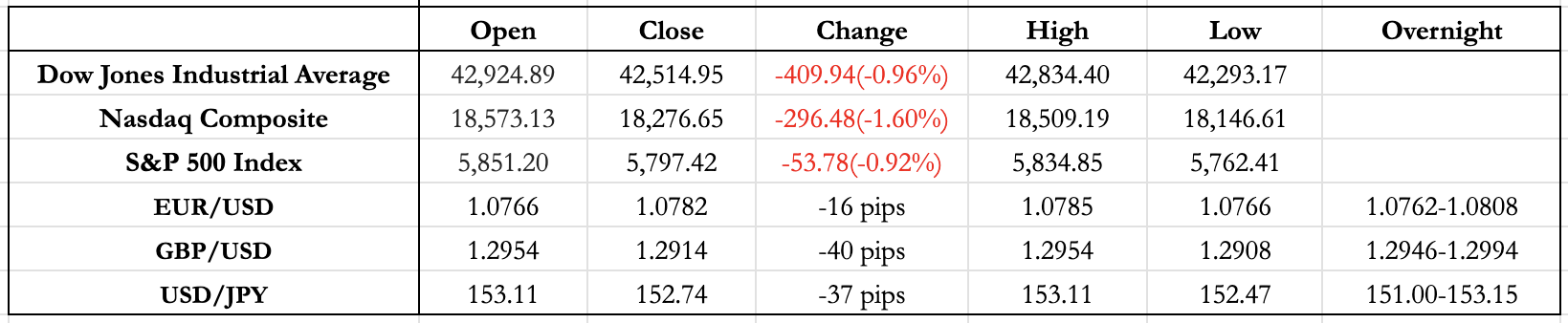

FX Markets:

- US Existing Home Sales was drastically less(-1M vs +2.6M) but no market reaction on that. Bank of Canada cut 50bp as per the expectation, reversal in overnight trend and dollar strengthening. The Beige book said that the economy saw moderate growth and employment also increased slightly. At the same time there was a slow down in pace for increase in prices for goods but prices of eggs and dairy increased at a faster pace.

- The overnight range for EUR/USD was 1.0762 and 1.0808(Yesterday range was 1.0800 and 1.0820). I was proved wrong today because after breaking the 1.08 barrier yesterday, EUR/USD always stayed below that level overnight as well as during US market hours. The day range was 1.0765-1.0785. It can be been from the above graph that USD strengthening has been happening after US open 6/8 days in 2 weeks with unch move in other 2 days. Given those moves are on the back of Fed commentary being bearish as well on Trump winning US elections and given no reaction on outlandishly less US Existing Home Sales, I expect this trend to continue. Although tomorrow we might see a trend reversal but can only happen if US data is much worse than expected which in unlikely and hence expect the trend to continue. Therefore, my expectation for range is 1.0750 – 1.0775.

- The overnight range for GBP/USD was 1.2946 and 1.2994(Yesterday range was 1.2950-1.2990). Overall GBP/USD has been surprise where even on IMF upgrading their Growth estimates, it still saw a big depreciation against USD in last 2 days. After breaking the 1.30 barrier on Tuesday, we have only stayed below it and has never tried to break it on the upside. The day range was 1.2910-1.2950. It did not try breaking the 1.2950 as well post the US open and if we see that happening tomorrow when we have UK as well US PMI, I expect it to breach 1.29 as well this week.

- The overnight range for USD/JPY was 151.00 and 153.15. Overall other than BOJ intervening I don’t expect this trend to stop before their rate decision on 10/30. We have Tokyo CPI which might give some relief but even if it’s an outlandishly great number, I don’t expect the USD strengthening to stop. Therefore, I expect the range for tomorrow to be 152.65 – 153.5.

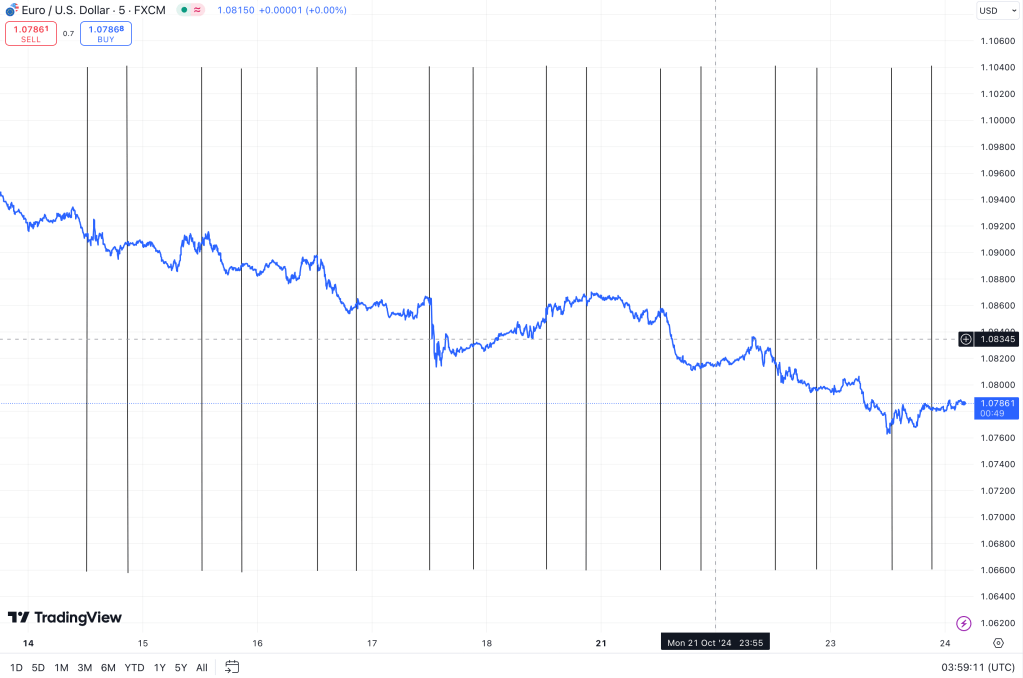

US Equity Markets:

- AT&T was up 5% today(beat EPS but revenue small miss 30.2B vs 30.4B) which also led to some bounce back in Verizon from yesterday’s low. TMUS is up 2% in after market trading post earnings(beat EPS and Revenue). TSLA is up almost 10% in after market trading after earnings(beat EPS significantly 0.72 vs 0.58 but slight revenue miss 25.18B vs 25.37B).

- McDonalds fell 5% today after there was a E. coli outbreak which affected at least 49 people in 10 states.

- There was definite some sell off in tech today with Nasdaq down 1.65% today. Even though we have a lot of earnings ahead, the US economic data and how it impacts the interest rate cut is gonna be a big drive for the next 2 weeks along with the US elections.

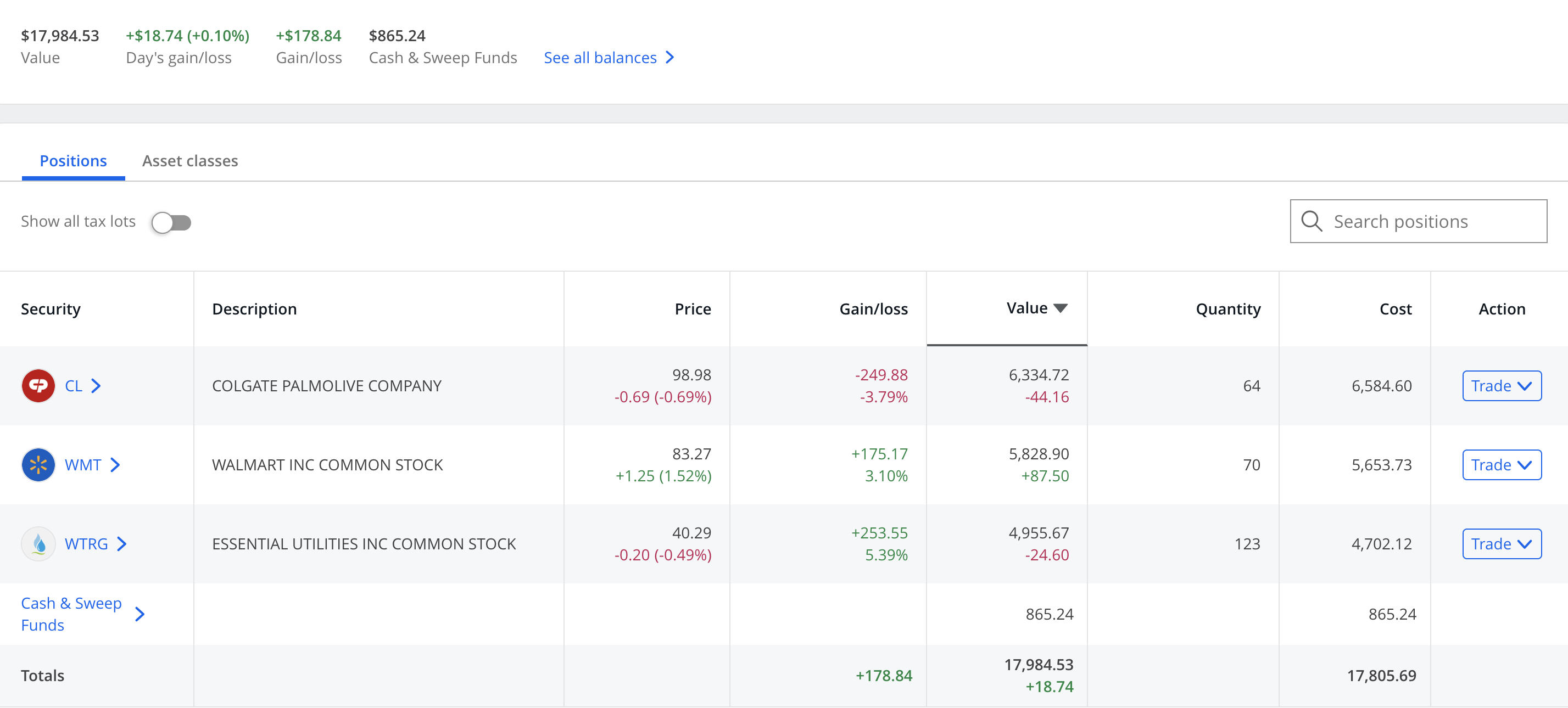

- WMT still rallying after yesterday’s news about their new initiative to deliver US prescription medications 30 minutes.

Macro View: I would like to think that the sell off today will start the downtrend till election where Earnings will dictate the industry but the overall trend would be on the downside. If we have one more data point which pushes the case of no rate cut, we might see a big drawdown on that day. As of now, there is only 10% of no rate in November but one economic data could move this number fast.

Overall, like my portfolio primarily because it has consumer defensive stocks and I expect them to do better when we see a big drawdown.

News: UPS, AAL(American Airlines), LUV(Southwest Airlines), HON(Honeywell International INC) and UNP(United Pacific Group) before Market Open and COF(Capital One Financial) after Market Close.

Euro PMI at 4 AM, UK PMI at 4:30 AM, US Initial Jobless Claims at 8:30 AM, US PMI at 9:45 AM, US New Homes Sales at 10:00 AM, Tokyo CPI at 7:30 PM

Sources: Marketwatch(https://www.marketwatch.com/), Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), investing.com(https://www.investing.com/), tradingview.com(https://www.tradingview.com)

Leave a comment