News: UPS, AAL(American Airlines), LUV(Southwest Airlines), HON(Honeywell International INC) and UNP(United Pacific Group) before Market Open and COF(Capital One Financial) after Market Close.

Euro PMI at 4 AM, UK PMI at 4:30 AM, US Initial Jobless Claims at 8:30 AM, US PMI at 9:45 AM, US New Homes Sales at 10:00 AM, Tokyo CPI at 7:30 PM

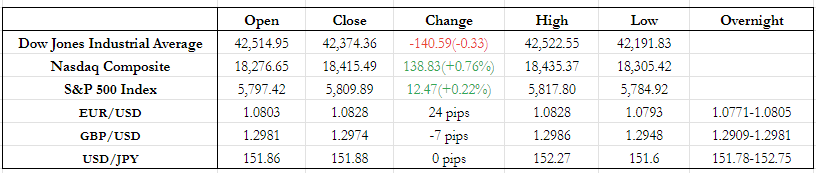

FX Markets:

- UK PMI worse than estimates for Services as well as Manufacturing. Euro PMI was in line with the estimates but still less than 50. The US Jobless Claims today were less than expected(227K vs 242K), US PMI was better than expected for Services as well Manufacturing, New Home Sales were better than expected(0.732M vs 0.72M).

- GBP/USD was trading at the middle of its range at 1.2930 in the overnight session before UK finance chief Reeves commented to change debt rules to provide headroom for additional spending. This would lead to more growth in the economy and strengthen GBP. Post those comments it trended up to 1.2965 till UK PMI after which it fell to 1.2950 owing to more expectation of rate cut by BOE seeing slowdown in economy. The odds for 25 basis-point rate cut by the BoE in November were up to 88% after UK PMI. Although, the UK PMI move washed off fast and it strengthened further to 1.2981 till US Open. The Overnight range was 1.2909-1.2981. There is definitely more strength in GBP today where even with weak UK economic data, GBP was holding its ground at stayed above 1.2950 in US session. Although it was helped by the slight USD weakening across the board on but most likely driven by the drop in 10 yr yields and Freddie Mac’s release that the 30 year mortgage rate rose to 6.54% from 6.44% last week. I still it is unlikely for GBP/USD to breach 1.30 without strong UK data numbers. The Day range was 1.2948-1.2986 and I expect it to be similar for tomorrow.

- EUR/USD saw some reprieve in the overnight session when Germany’s Central Bank president Nagel and Slovenia’s Central Bank governor Vasle expressed caution in cutting rates. There wasn’t a big reaction on Euro PMI and therefore the overnight range was 1.0771-1.0805. The trend of EUR strengthening continued into the US session primarily because of the slight USD weakening I mentioned above. Overall, ECB rhetoric has been more cautious than Fed and hence that could lead to further EUR strengthening for the short term till November but difficult for EUR to continue the trend upwards to breach 1.09. The day range was 1.0793-1.0828 and I expect it to be similar but with slightly more uptrend component in there, so 1.080 -1.085.

- USD/JPY has been trending downwards since US open yesterday but on no specific news about Japan. Japanese Finance Minister Kato issued a warning against currency speculation yesterday citing concerns over one-sided moves that have been driving down the yen’s value. Overall the overnight move in USD/JPY seems to be caused by the flow, unable to find anything that can explain JPY strengthening overnight. The overnight range was 151.78-152.75. JPY was also helped with the slight USD weakening in the US session and hence closed near the overnight lows on 151.85. Overall, not too much worried about this reversal given that BOJ Governor Ueda said in overnight session that the rate hikes would be done cautiously and gradually. Since I cannot point a finger to explain the overnight move in JPY, don’t really have a view for USD/JPY for tomorrow.

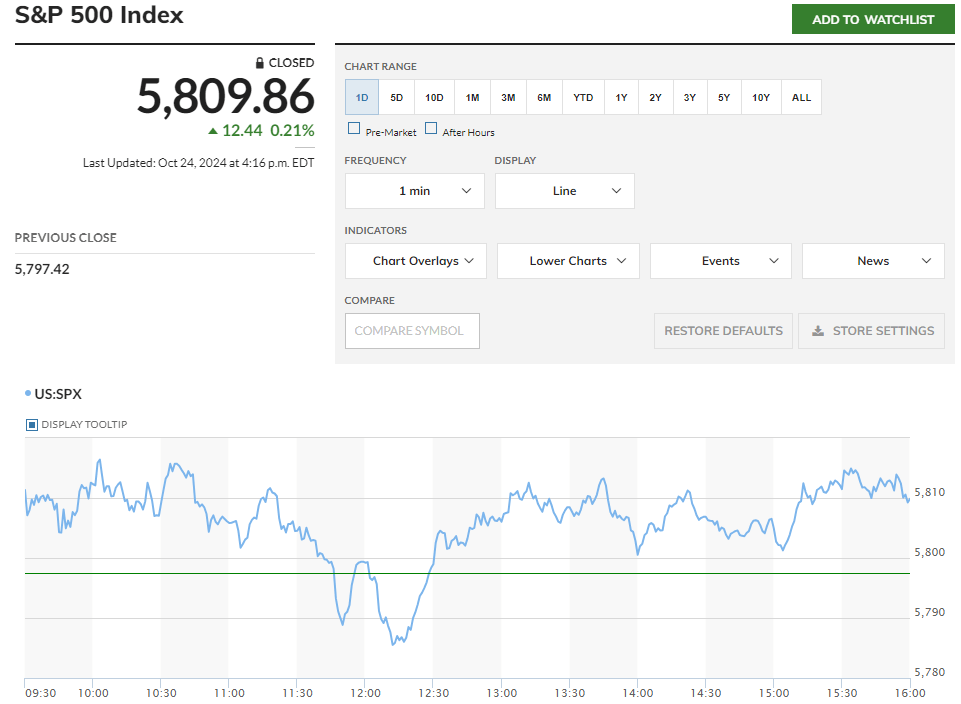

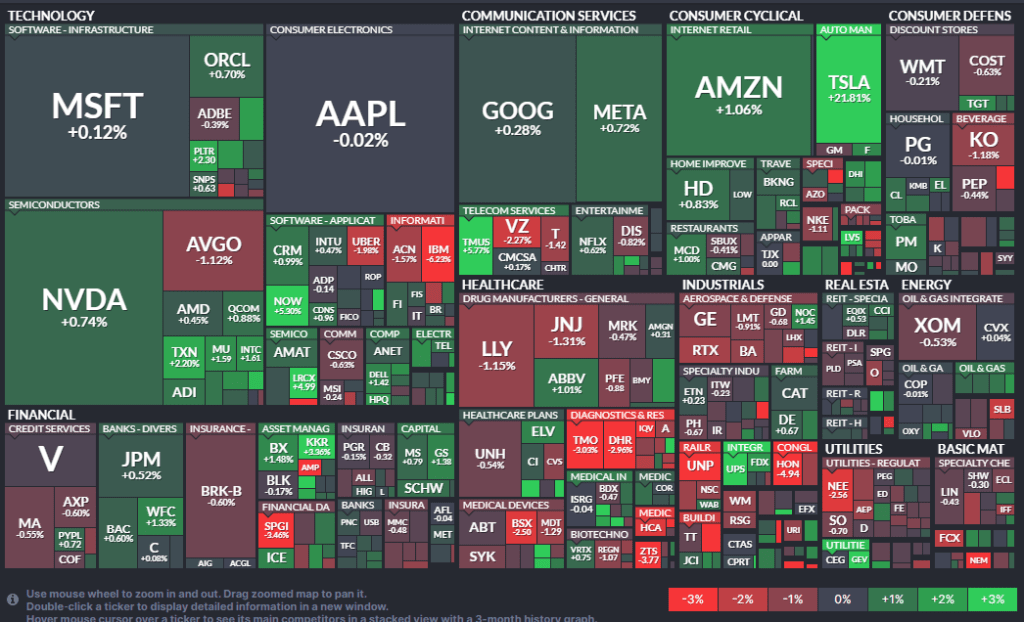

US Equity Markets

- TSLA was up 20% today on the back of their earnings yesterday which in turn accounts for 0.24% uptick in S&P500. UPS was also up 5% post earnings(beat EPS and revenue). IBM was down 6% post earnings on revenue miss, although their AI revenue saw growth.

- Overall we saw some bounce back from yesterday’s drawdown primarily on good US PMI data as well as on a small drop in 10 yr yields.

Macro View: All the 3 US data releases were better than estimates but overall that still did not move the odds of no rate cut in November, only 5%-7% probability of no rate cut as per Fed-watch tool. It feels like though this tool has been governed a lot by the Yields and not macro-economic environment and hence still believe the odds of no rate cut are significantly more.

Colgate earnings tomorrow, will cut some position post that. And remaining on Monday. Also saw a big drawdown in WTRG, will also look to cut it next week. Goal is to keep cash through US elections to avoid volatility in the portfolio.

News: CL(Colgate) and HCA(HCA healthcare) before Market Open.

Tokyo CPI at 7:30 PM and US Michigan Consumer Sentiment at 10:00 AM EST.

Sources: Marketwatch(https://www.marketwatch.com/), Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), investing.com(https://www.investing.com/), tradingview.com(https://www.tradingview.com)

Leave a comment