News: F(Ford Motor Company) after Market Close.

Japanese General Election on 27th October(before Overnight Market Open, i.e before Sunday 5pm)

FX Markets:

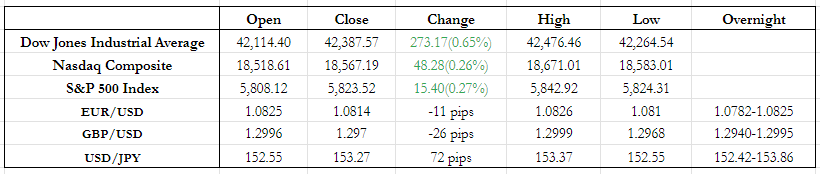

- No real overnight news other than the Japan General elections in which the current PM Shigeru Ishiba’s Liberal Democratic Party (LDP) and its junior coalition got 215 seats in the lower house of parliament, down from 279. The LDP has ruled Japan for almost all of its post-war history but the future for LDP remains uncertain now afer this election. The new PM voting might happen on November 11 with BOJ interest rate decision on 10/30.

- USD/JPY jumped to 153.15 from 152.30 at the open digesting the Japan General election outcome. The high for the overnight session was 153.86(JPY lowest in last 3 months) around the Asia Open post which there was relief with USD/JPY reaching the low of 152.42 just before the US Open(8:30 AM). Post the US Open, we again saw dollar strengthening where it only trended upwards all throughout the US session and closing at 153.27. I don’t expect the trend of USD strengthening after US open to stop till US election. Overall, the realized volatility for Japan General election was less than expected but I would the expect the realized Vol for BOJ interest rate decision to be more than this. I don’t see any more significant weakening for JPY for the overnight session but I expect USD/JPY to breach the 153.86(Overnight high) tomorrow after the US Open.

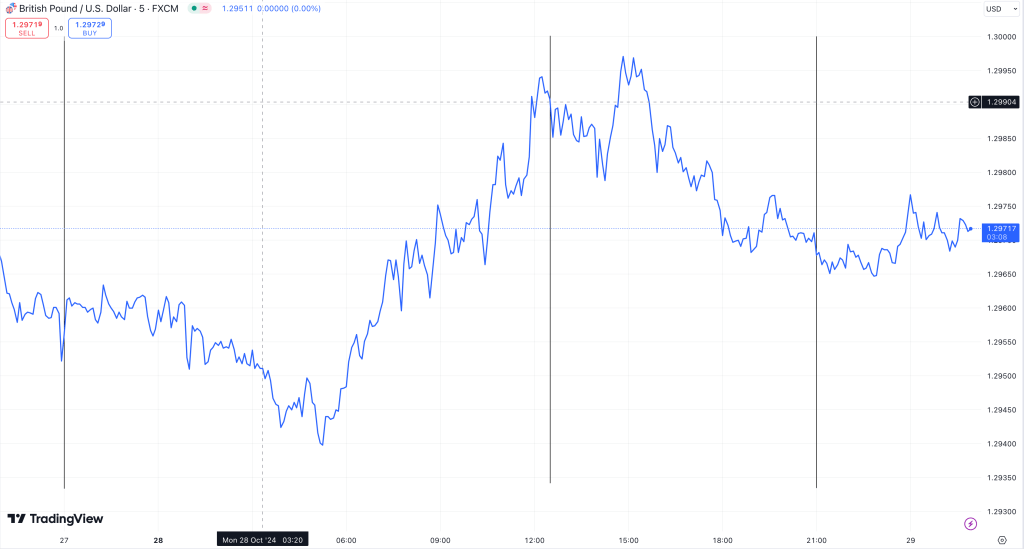

- GBP/USD opened at the overnight highs at US Open with the overnight range being 55 pips. Overall, the trend after US Open was a mixed one with dollar strengthening taking over post 11 AM. I don’t expect the trend of USD strengthening after US open to stop till US election. The overnight range for GBP/USD has been a significantly more than than the US session since last 3 days but breaching 1.30 is going to be difficult without any new news or data releases. I expect slightly tighter overnight range of 1.2950-1.2990 and the US session range being similar to that.

- EUR/USD also opened at the overnight highs at US Open with the overnight range being 43 pips followed by a very tight range of 16 pips during the US session. Expectedly the range for EUR/USD in US session has been fairly tight compared to all G10 currencies but it is important to note that it has opened and close above 1.08 in the last 3 US sessions with 15-20 pips range. I think we can expect a strong reversal with EUR strengthening if “Trump Trade” traders decide to take profit sooner or if we a bad US Jobs data in the next week. We have JOLTS tomorrow at 10:00 AM which most likely is going to drive the trend for EUR/USD. I expect the range for EUR/USD to be slightly more, around 30-40 pips tomorrow with JOLTS driving the trend.

US Equity Markets

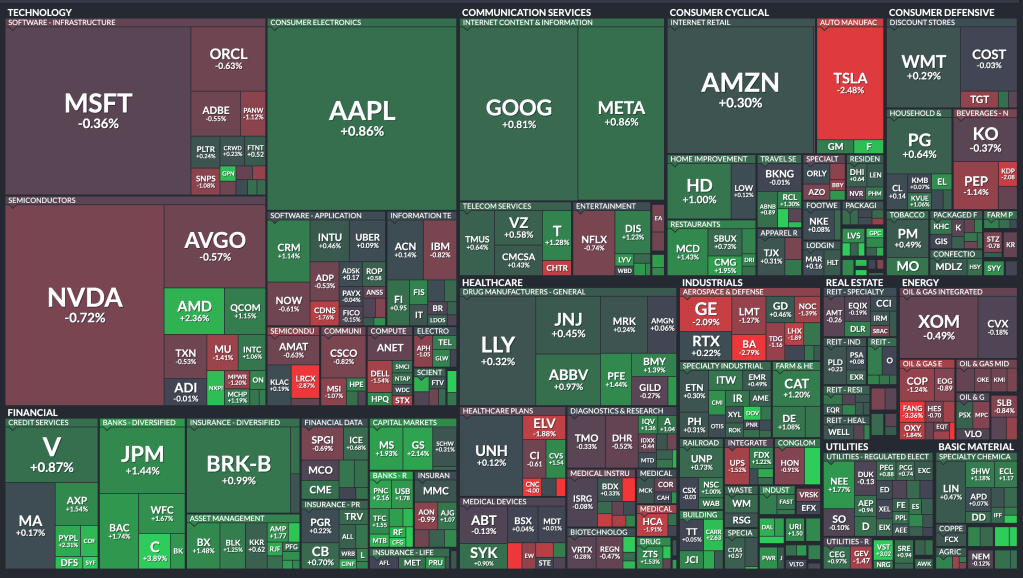

- After Israel said it does not plan to attack any of the Iran’s oil refineries or Nuclear plants, crude oil saw a 5% drawdown which also pulled the Oil and Gas stocks down with it.

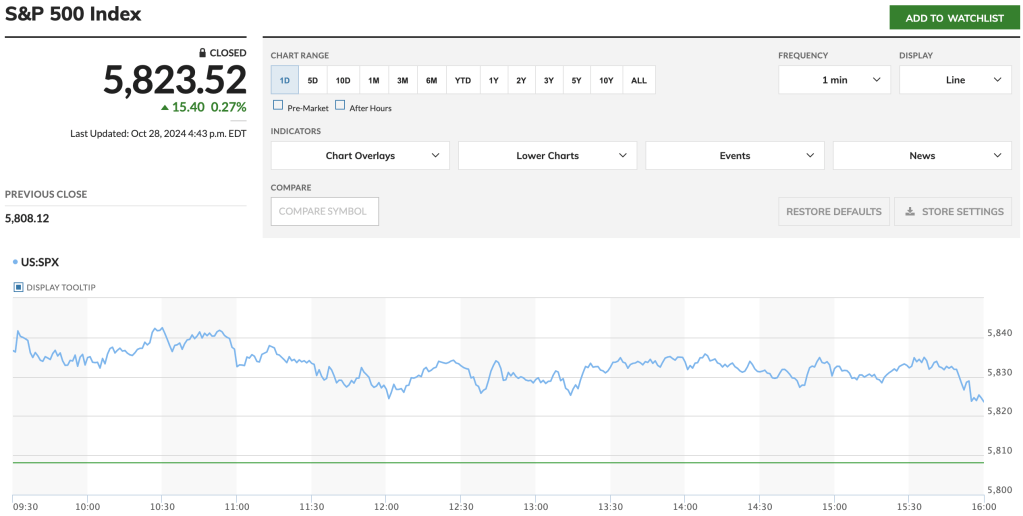

- Overall no news today. The rally today was led by the small cap which can be seen from the outperformance of DJIA as compared to SPX and NASDAQ.

- Ford reported better revenue and in line EPS but showed significantly less revenue from the EV and brought down its full year profit forecast to $10B which is the on the lower side of the previous estimates($10B-$12B). The stock was down 5% in after market trading.

Macro View: According to the Fedwatch tool, the chance of no rate cut is at 5% for 11/7. We have JOLTS tomorrow at 10:00 AM which might give some insight on NFP data which is out on 11/1. Overall a good JOLTS print might lean the market towards a good NFP print but dependent on a lot of other things. At the same time the NFP number might be a little biased because the of the recent hurricane as well as the Boeing strikes.

‘2024-02-02’: (‘NFP’,353K,187K), ‘2024-01-30’: (‘JOLTS’,8.79M,8,85M),

‘2024-03-08’: (‘NFP’,275K,198K), ‘2024-03-06’: (‘JOLTS’,9.03M,8.75M),

‘2024-04-05’: (‘NFP’,303K,212K), ‘2024-04-02’: (‘JOLTS’,8.76M,8.76M),

‘2024-05-03’: (‘NFP’,175K,238K), ‘2024-05-01’: (‘JOLTS’,8.49M, 8.68M),

‘2024-06-07’: (‘NFP’,272K,182K), ‘2024-06-04’: (‘JOLTS’,8.06M, 8.37M),

‘2024-07-05’: (‘NFP’,206K,191K), ‘2024-07-02’: (‘JOLTS’,8.14M,7.96M),

‘2024-08-02’: (‘NFP’,114K,176K), ‘2024-07-30’: (‘JOLTS’,8.18M,8.02M),

‘2024-09-06’: (‘NFP’,142K,164K), ‘2024-09-04’: (‘JOLTS’,7.67M,8.09M),

‘2024-10-04’: (‘NFP’,254K,147K), ‘2024-10-01’: (‘JOLTS’,8.04M,7.64M)

AMD and GOOG earnings tomorrow are gonna drive the rhetoric for upcoming Tech and Semi-conductors earnings in the coming weeks. I don’t have an opinion on specific earnings but I still think we are just one bad earnings away from a big drawdown.

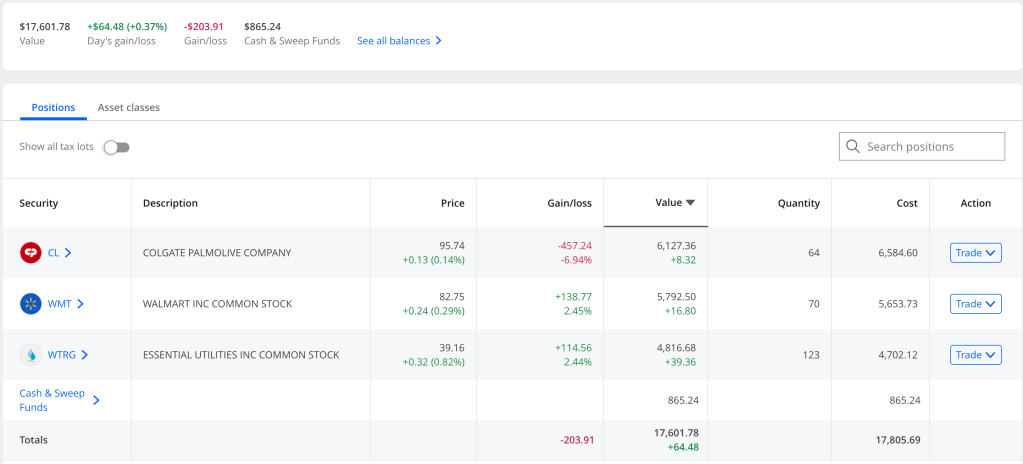

The Colgate earnings hurt me almost 4% with it also dragging down WMT slightly on Friday. Overall the Colgate earnings were better than the expectation with it beating EPS as well as revenue but the market downtick reaction was on the sales decrease in Latin and North America. Overall I still want to stay in consumer defensive stocks and Colgate still seems like the best stock in the sector although my cost basis is significantly higher hence, my profit target now is 3%-5%, down from 10%.

Overall my profit target for WTRG is also around 4%-6% with it not being the best hedge for the overall market drawdown.

News: PYPL(Paypal), MCD, PFE(Pfizer), BP and HSBC before Market Open. AMD(Advanced Micro Devices), GOOGL + GOOG, SNAP, CMG(Chipotle) and V(Visa) after Market Close.

US JOLTS at 10:00 AM.

Sources: Marketwatch(https://www.marketwatch.com/), Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html),

Leave a comment