News: PYPL(PayPal), MCD, PFE(Pfizer), BP and HSBC before Market Open. AMD(Advanced Micro Devices), GOOGL + GOOG, SNAP, CMG(Chipotle) and V(Visa) after Market Close.

US JOLTS at 10:00 AM.

FX Markets:

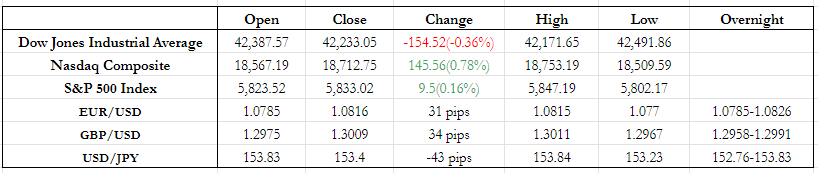

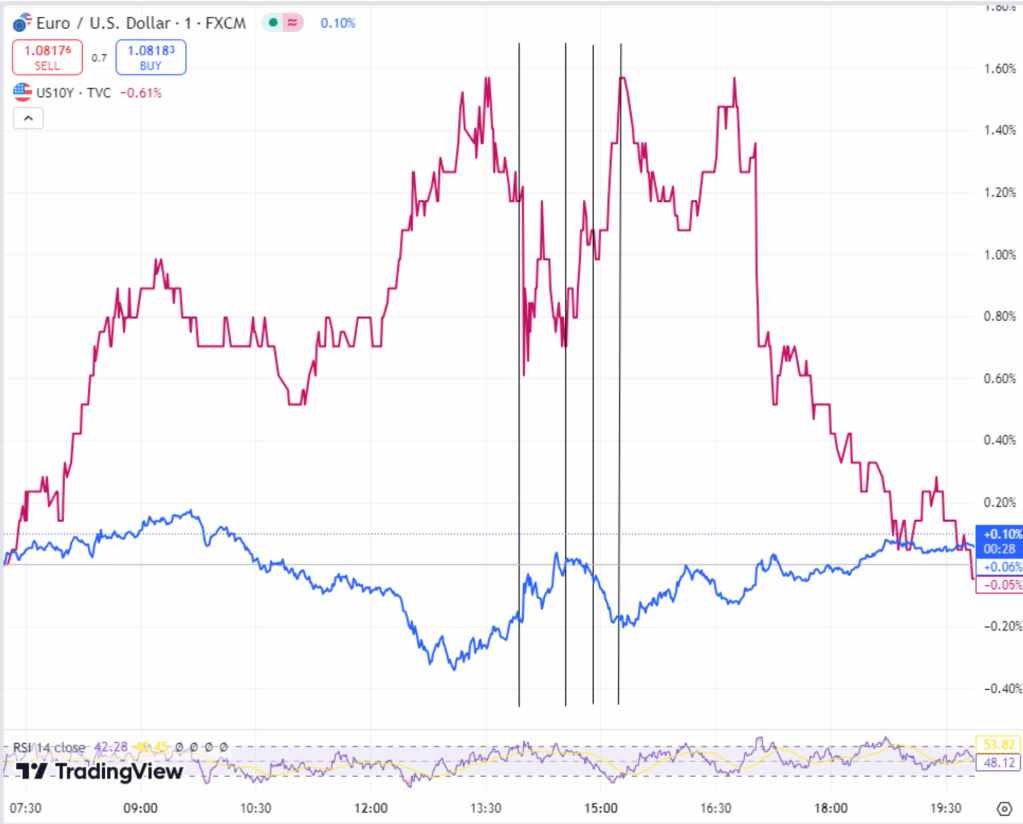

- ECB’s VP De Guindos in an interview with ANSA(leading news agency in Italy) made a statement that the target of 2% inflation over the medium term is not up for debate. He also said that they are satisfied with the inflation data but that much with the growth data. This could mean more rate cuts by ECB which led to EUR weakening on this news. US Jolts data(Job Openings) was a lower than expected(7.443M vs 7.99M) which led to US weakening across pairs and that set the trend for remaining for the day. It also felt like the US yields governing a lot of movements in the day for dollar pairs.

- EUR/USD also opened at the overnight lows at US Open with the overnight range being 41 pips(same as yesterday) and EUR weakening trend overnight on the back of De Guindos’s comments. We saw a 15 pips jump from 1.0787 to 1.0802 on the weak US JOLTS data followed by a strong reversion back to 1.0785 on the back of rise in US treasury yields till 11:30 post which the US weakening trend continued till close. We also had US 7-Year Note auction today in which U.S. Treasury Department successfully issued $44 billion of 7-year notes with a winning yield of 4.215%. This dragged the US yields back to the unch level at close. Today was the first day where EUR/USD day range was >20 pips(48pips) in last one week and first day EUR/USD opened below 1.08 at US Open. Overall, I think the ECB VP’s comments and JOLTS countered the overall trend for EUR/USD and with it behaving similar as yesterday after the number. With Eurozone GDP as well as US GDP tomorrow, only expect the range to be wider tomorrow. Till date, the Euro GDP has been weaker and that has been primary concern for the ECB where as US GDP has been strong even before the rate cut. Overall haven’t seen enough to see that trend changing, the hurricane might have some impact on the US GDP but don’t see it to be that significant. The US Yields have also gone lower Therefore, won’t be surprised if we see EUR/USD touching 1.075 tomorrow.

- GBP/USD opened at the overnight lows at US Open with the overnight range being 33 pips. It jumped from 1.2974 to 1.2995 on US JOLTS data. Overall, has been range bound for the past week where for the first time closing above 1.30. All of the movements in GBP/USD have been driven on the US news and today’s closing above 1.3 coming on the back of weak US JOLTS data. Overall, don’t expect the trend reversal, will see USD strengthening on the slightly longer term(>1month) with US data causing some GBP relief if they are not in line for the short term. Expect a very similar day as today for GBP/USD tomorrow where the range might still be 40 pips but between 1.2980 to 1.3020.

- USD/JPY opened at the overnight highs at US Open with the overnight range being 107 pips. It also It jumped from 153.73 to 153.35 on US JOLTS data and saw the range of 61 pips in US session. Overall don’t see any relief for JPY if BOJ decides not to hike tomorrow. In case of no hike from BOJ, USD/JPY might touch 160 just after the US election. On the other hand, if BOJ decides to hike, JPY relief might last through the end of the year with USD/JPY touching 147.5. I expect a similar range for USD/JPY which a strong chance of it touching 155 tomorrow if we see strong US data.

- Overall for the first time saw USD strengthening in the overnight session and USD weakening in US session where for the past whole week we saw USD weakening to unch moves in overnight session with USD strengthening in US sessions.

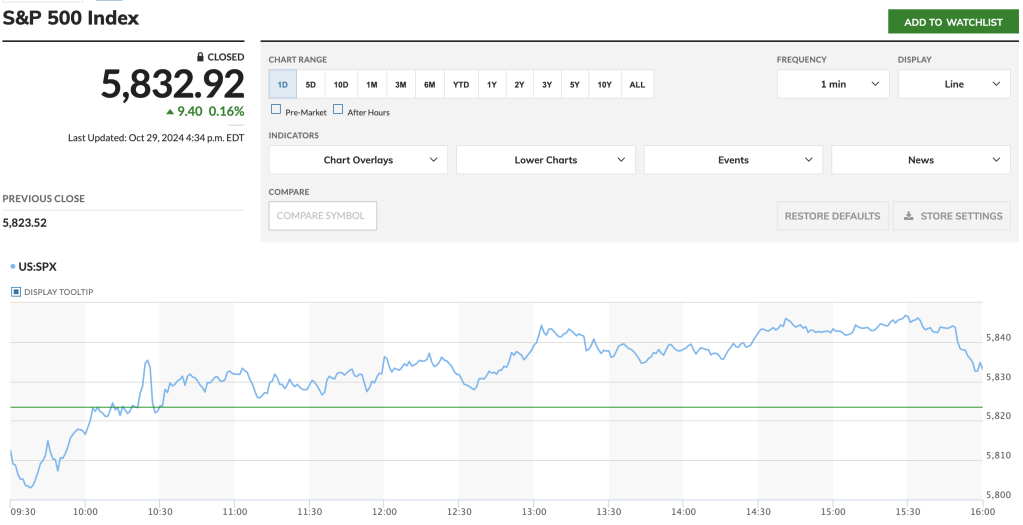

US Equity Markets

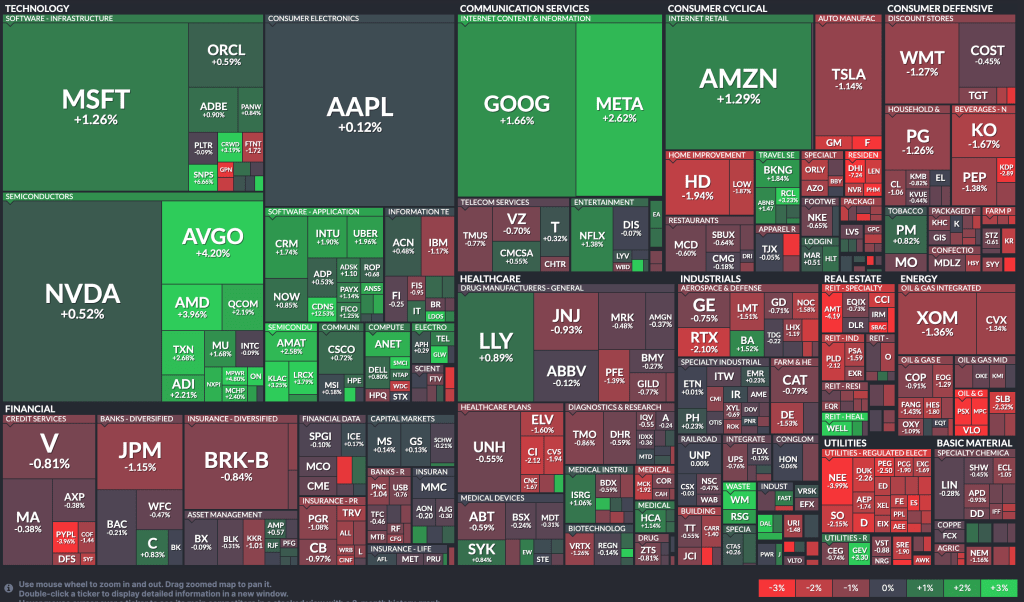

- Semi-Conductor stocks saw one of their biggest rallies if we were to exclude NVDA from them. This was on the back of the news of OpenAI developing their own AI inference chip with the help from Broadcom(AVGO) and TSMC while also buying chips from AMD. AMD reported earnings after the close with EPS and Revenue in line but less Q4 revenue outlook post which stock was down 8% in after market trading.

- PayPal fell 4% on Revenue miss where on the other hand HSBC was up 3% on their Revenue and EPS beat with their board approving $3B buyback for the next quarter.

- Chipotle stock fell 5% on Revenue miss owing to less same store revenue growth, would be interesting to see if we see any of it in Retail Spending data.

- Google stock was up 6% in after market trading after their earnings beat expectations. Google accounts for 3.6% weight in S&P500, therefore 6% stock price increase translates to 0.2% increase in S&P500.

- Consumer Defensive and Utilities saw the bigger drawdown today which can be seen from the negative return on DJIA compares to SPX and NASDAQ. Not entirely sure what led to the bigger drawdowns.

Macro View: There was a small reaction of JOLTS on yields which quickly vanished after the number but the 7-Year Note auction later pulled the yields down which now puts the chance of 25bp rate cut to 99% and chance of 50bp rate cut to 1% according to the FedWatch tool. Overall, ADP tomorrow might give some more light on the Jobs data but NFP is going to be the biggest driver and with yields down, unlikely we see a rate pause on 11/7 but still think NFP might surprise us.

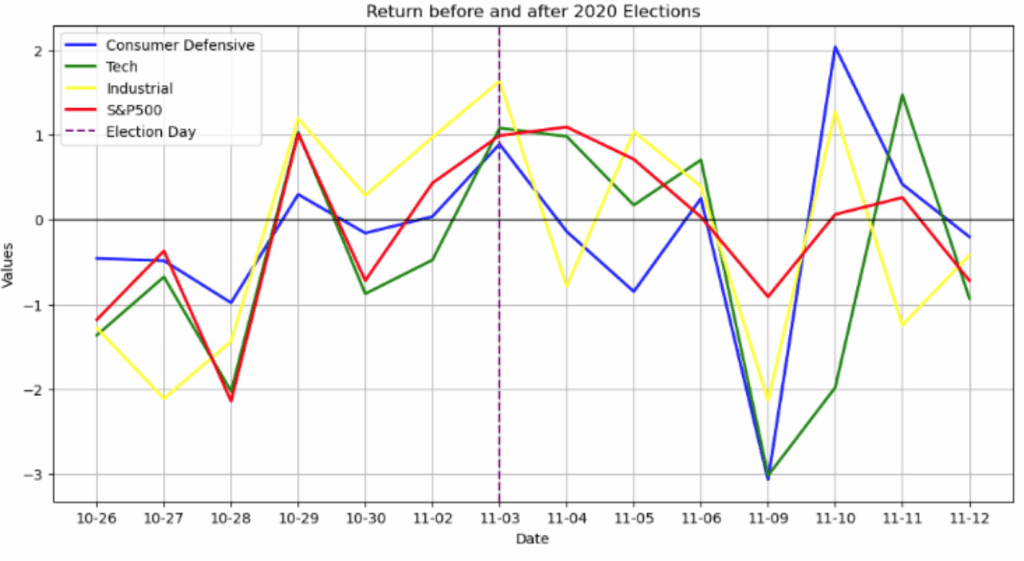

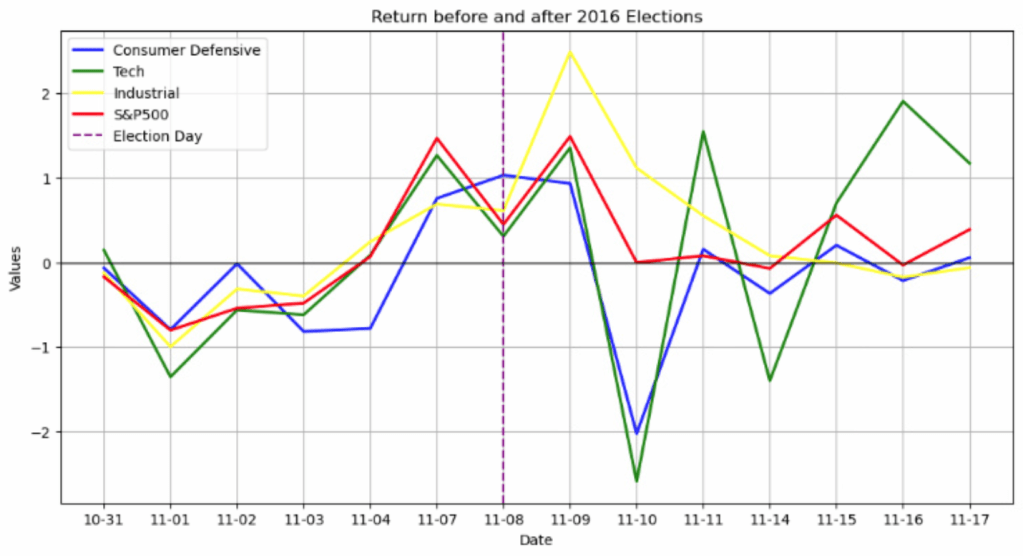

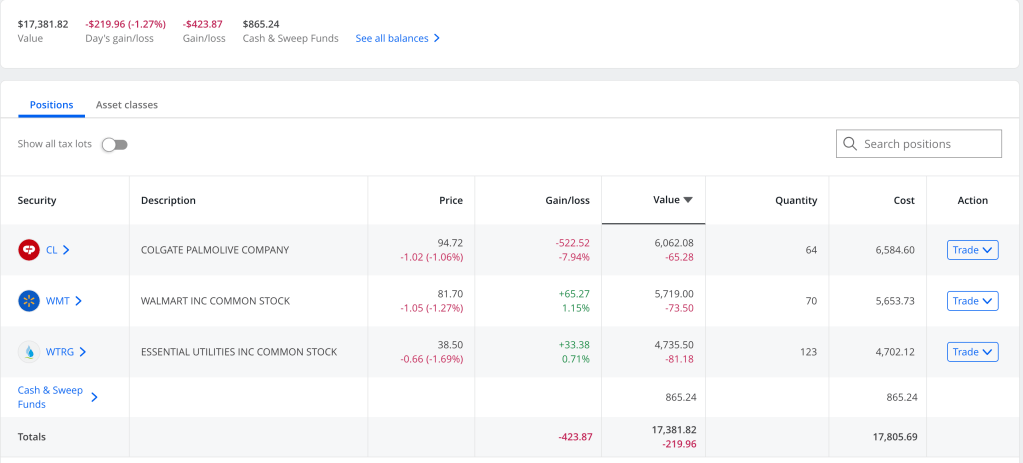

Overall we have entered into the US election volatility and my plan to exit before that has not gone according to the plan. With Tech and Semi-conductors leading the rally and going to new highs almost every day the pressure definitely has been on the Consumer Defensive and Utilities stock. Ideally, should exit at a loss and take some other position but don’t really a strong Equity trade idea for Election and hence am holding the investments through the elections. My whole trade idea was that Bad Jobs data will at some point reflect in GDP as well as Earnings and market would see a bid drawdown. To execute this trade idea, decided to bet on Consumer Defensive stocks which outperform the index when in falls but it backfired. In hindsight this execution was a lot more risky than I had thought of, I would have been better of growing them at a risk free rate for the remainder of the year than to take on active position in the market.

Consumer Defensive = [WMT,COST,PG,KO,PEP,PM,MDLZ,MO,CL,TGT]

Tech = [AAPL,NVDA,MSFT,TSM,AVGO,ORCL,CRM,SAP,ASML,AMD,ACN,CSCO,ADBE]

Industrial = [GE,CAT,RTX,UNP,HON,ETN,LMT,DE,UPS,BA,WM,RELX,TT,CTAS,GD]

Overall not a very strong trend for index or any particular industry around the election but the common theme being positive return across stocks on election day with another + positive return one day before and after election in 2016 when Trump won.

With MSFT and META earnings tomorrow, any news about them missing their AI revenue or too big AI spend, could lead to a downtick which would put pressure on other tech stocks as well the S&P500 given they account for 9% weight in S&P500 combined.

News: LLY(Eli Lilly Co.), CAT(Caterpillar) and ADP before Market Open. MSFT, META, SNAP, SBUX(Starbucks), MET(Metlife), BKNG(Booking.com) after Market Close.

Eurozone GDP at 6:00 AM, US ADP Employment at 8:15 AM, US GDP and Core PCE at 8:30 AM, EU Member states CPI at 9:00 AM. Pending Home Sales at 10:00 AM. BOJ interest rate decision arounad 10:00 PM.

Sources: Marketwatch(https://www.marketwatch.com/), Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html)

Leave a comment