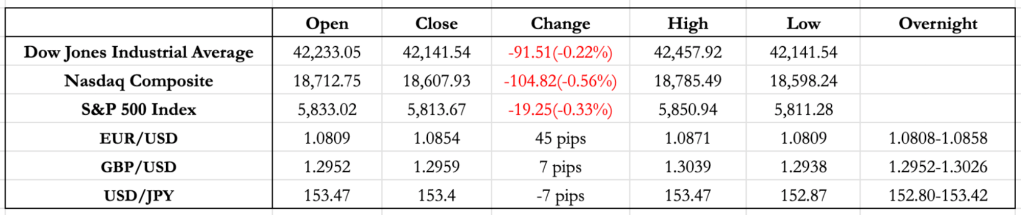

News: LLY(Eli Lilly Co.), CAT(Caterpillar) and ADP before Market Open. MSFT, META, SNAP, SBUX(Starbucks), MET(Metlife), BKNG(Booking.com) after Market Close.

Eurozone GDP at 6:00 AM, US ADP Employment at 8:15 AM, US GDP and Core PCE at 8:30 AM, EU Member states CPI at 9:00 AM. Pending Home Sales at 10:00 AM. BOJ interest rate decision around 10:00 PM.

Market Update: 1st November; US NFP ends Fed Decision debate, Equity Index bounces back on AMZN & INTC Earnings

FX Markets:

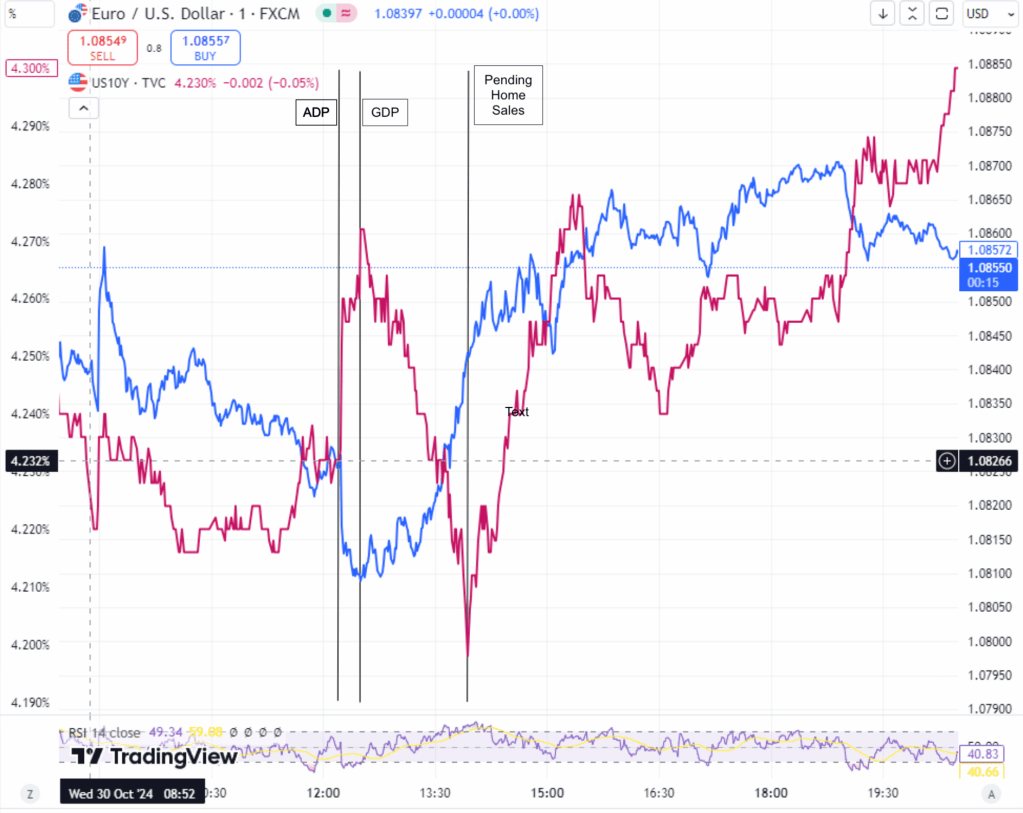

- Eurozone GDP better than expected(0.9% vs 0.8%) along with Germany and Spain. US ADP Employment which is number of people privately employed in US was double than the expectation(233K vs 115K). US GDP coming in at 2.8% vs 3% expectation, first time the GDP print was less than expectation since June. Core PCE coming at 2.2% vs 2.1% expectation, no market reaction on this owing to the fact the Core PCE-Price tomorrow is better indicator of inflation where as this is a better indicator of Consumer Spending. Pending Home Sales came in at 7.4% where the expectation was 1.1% which means some relief for the Housing Market.

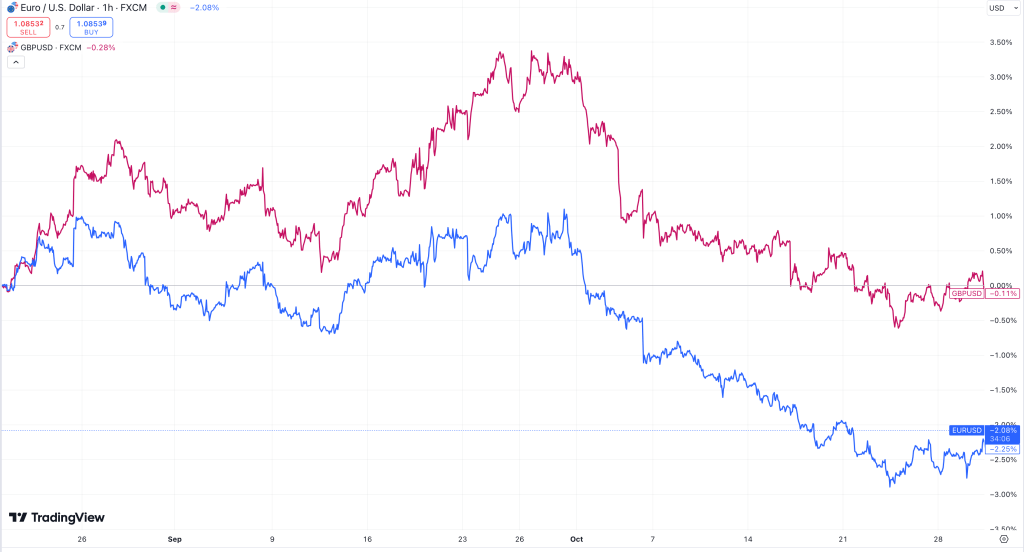

- EUR/USD trended higher in the overnight sessions with it strengthening on Spain, Germany and then Euro Zone GDP data and breaching 1.085. The positive growth data was a big relief to Euro. In the last 2 weeks the USD strengthening has affected EUR the most with the most important differentiator being the health of economy. USD strengthening was across the board but Euro weak growth was adding on to that fire which can be seen from the EUR/USD vs GBP/USD graph below.

Right at the ADP number at 8:15 AM we saw some reversion because of the strong Jobs data but that was countered by the weak GDP data at 8:30 AM which overall saw a very subdued reaction at the number but post that EUR/USD only trended higher for the remainder of the day with the high of the day being 1.0871. We can also see from the EUR/USD vs 10yr yield curve that there was a gradual decline in yields after a drastic spike on ADP data and that gradual decline was accompanied with USD weakening. Although that correlation broke at 10:00 AM when the Pending Home Sales data came out which affected the yields more than EUR/USD. Definitely see the USD strengthening trend going away now with two back to back days of USD weakening across the board. Overall, don’t see any existing trend and looks like a clean slate for tomorrow with Euro CPI at 6:00 AM and US Core PCE-Price at 8:30 AM determining the trend for tomorrow. The range might be similar with EUR/USD howering between 1.08 and 1.09 for tomorrow.

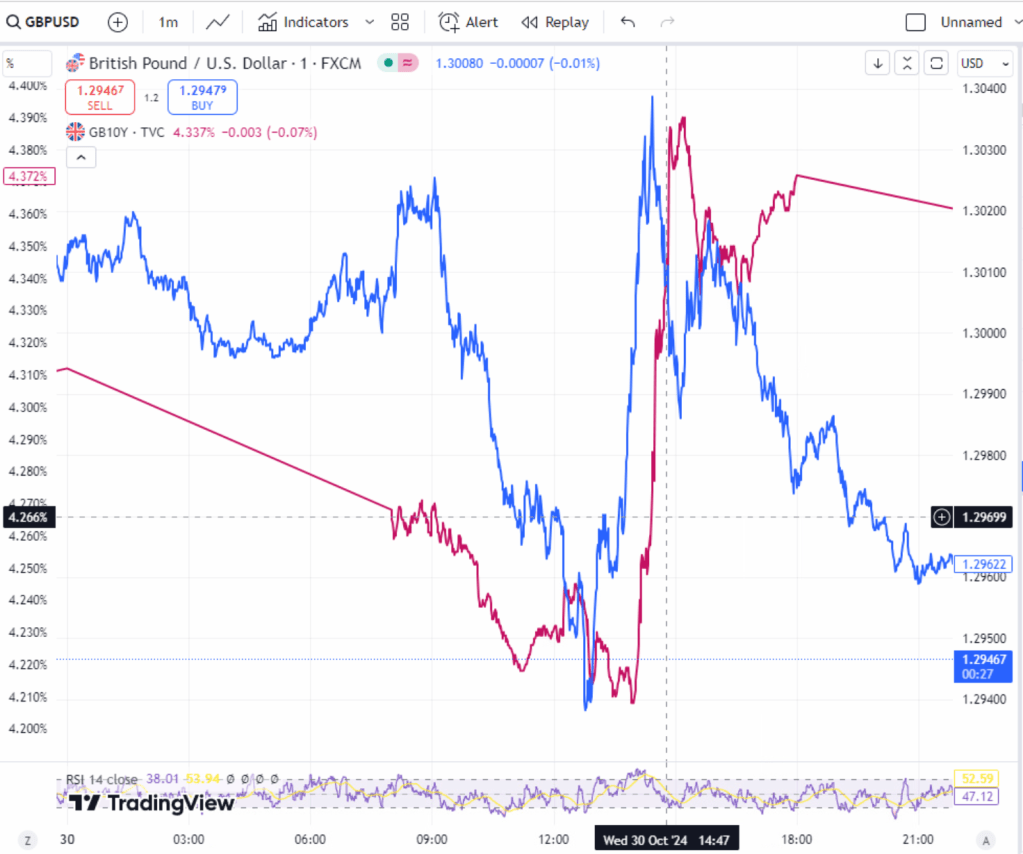

- GBP/USD had 75 pips range overnight while the day range was almost 100 pips. Was range bound between 1.2990 and 1.3025 till 5 AM EST post which saw a drop to 1.2950 where it opened during the US session. The most likely reason for this drop was the uncertainty in UK budget which was going to released at 12:30 PM along with the drop in UK yields. US ADP caused some reversion which was short lived because of weak US GDP number along with the rise in UK yields saw GBP strengthening till UK budget time post which we see a strong trend reversal and GBP/USD going to the overnight lows. Overall, will have to spend more time to understand the ramifications of the budget but initial understanding is that that the increase in taxes will cause a lot of deflationary pressure as well as slower growth which would force BOE to cut rates and hence GBP depreciation. Overall, not really sure if market has digested the UK budget till now or not hence no view for tomorrow but expect a similar range for overnight as well US session.

- USD/JPY was relatively quiet compared to EUR/USD and GBP/USD all through out the news. USD/JPY was trading in a range in the overnight session with it close to the middle of the range at 153 right before the ADP number at which it jumped to 153.4 and then traded between 153 and 153.5 rest of the day. BOJ decided to the hold the rates steady at 25bp this meeting while holding the pledge to keep raising interest rates which saw no reaction in the market overall. BOJ Governor Ueda speaks at 2:30 AM which might get some reaction in the market. Overall without BOJ intervention, it would be difficult for JPY to strengthen against other currency pairs. I still see USD/JPY going up, but with weak US data causing significant change in momentum, USD/JPY touching 160 just after the election might be a little difficult but 157.5 is definitely possible.

US Equity Markets

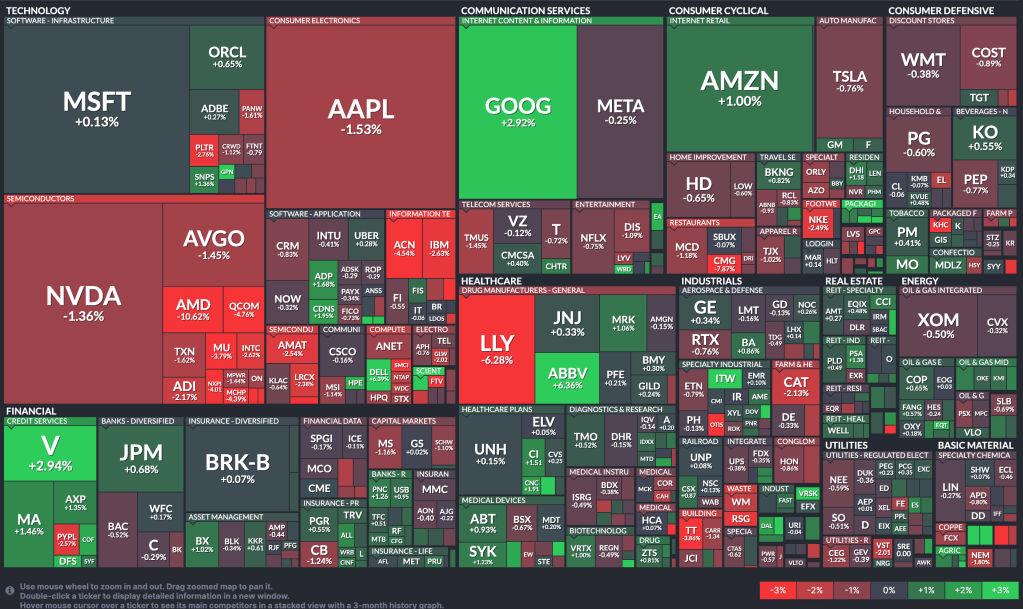

- Semi-Conductor stocks saw their second biggest drop in the year of 4.8%(first being on July 17 of 6.8% with concerns about trade restriction with China) and this was led by AMD who reported earnings yesterday after the close and was down 10.5% in the day.

- LLY dropped 6.3% after their earnings before open today on EPS as well as Revenue Miss.

- META fell 3% and MSFT 4% after their earnings after close. They account for 9% weight in S&P500, therefore translates to 0.31% decrease in S&P500.

- Overall, can be seen that tech was dragging down the indexes the most which can be seen from Nasdaq being down the most. Intel, Amazon and Apple tomorrow could decide the trend for the indexes and could trip the stop-losses which could lead to bigger drawdowns.

Macro View: As I mentioned yesterday that my trade idea was weaker jobs will reflect in GDP which we can see in today’s data finally but my execution of buying consumer defensive was pretty shit. After AAPL and AMZN out tomorrow, we will have 6 out of the Mag 7 earnings. Other than TSLA, rest of the earnings have been par at best and even in TSLA, I think some of it was part of the Trump trade. So, if we have similar earnings for AMZN and APPL along with semi-conductor stocks, if not now, we might see a drawdown after the US election dust settles because of too much earnings premium baked in this quarter.

News: UEBR, MA(Mastercard), EL(Estee Lauder), CI(Cigna) and ETN(Eaton Corp) before Market Open. AMZN, AAPL, INTC and TEAM(Atlassian) after Market Close.

Euro CPI at 6:00 AM and US Core PCE-Price + US Jobless Claims at 8:30 AM

Sources: Marketwatch(https://www.marketwatch.com/), Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html)

Leave a comment