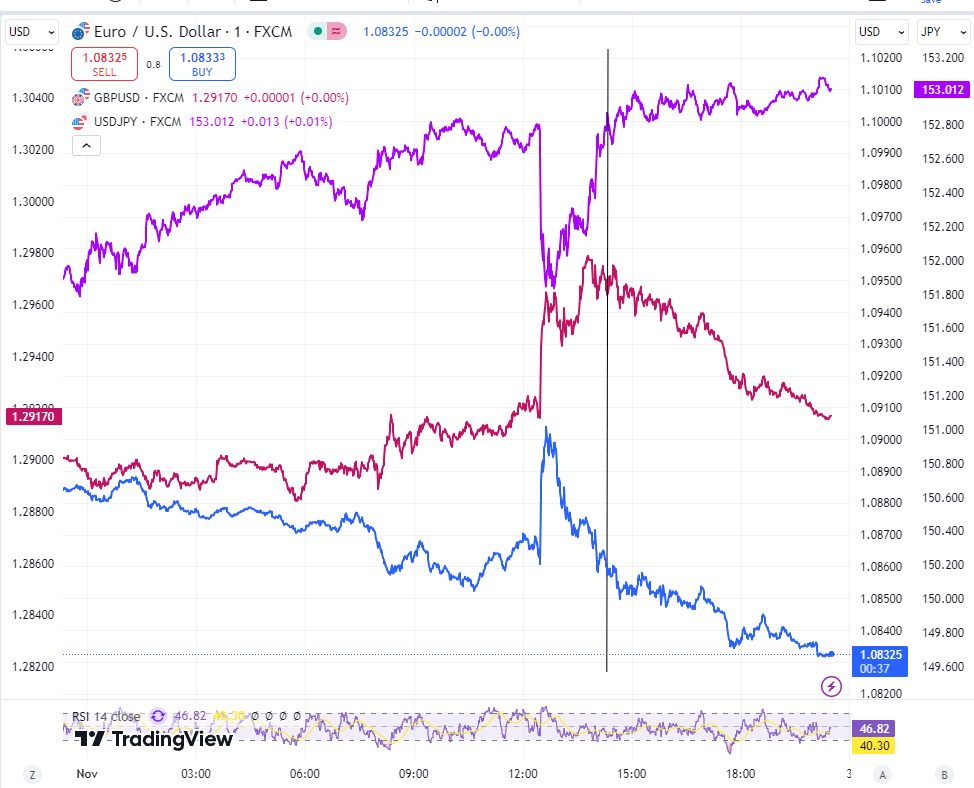

News Today(11/1): XOM(Exxon) – 1% of S&P, CVX(Chevron) – 0.5% of S&P and D(Dominion Energy) – 0.1% of S&P before Market Open.

US NFP at 8:30 AM and US ISM Manufacturing PMI at 10:00 AM

Highlights:

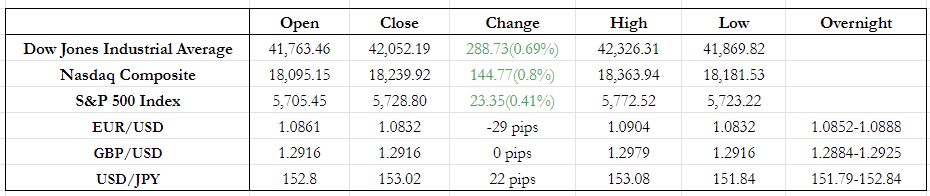

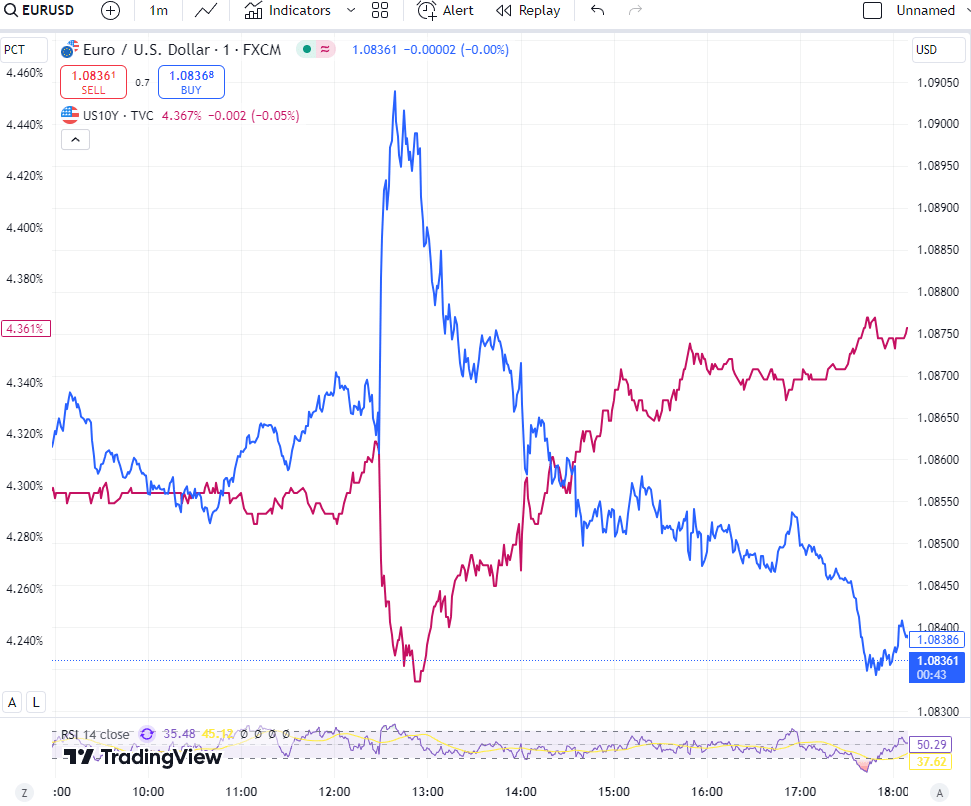

- US NFP drastically less(12K vs 113K). EUR/USD breached 1.09 but along with USD/JPY and GBP/USD, they saw a brief, short-lived appreciation against USD.

- US ISM Manufacturing PMI also less than expected(46.5 vs 47.6). These 2 were the final nail to the coffin for US Fed cutting 25bp on 11/7(Fed watch tool).

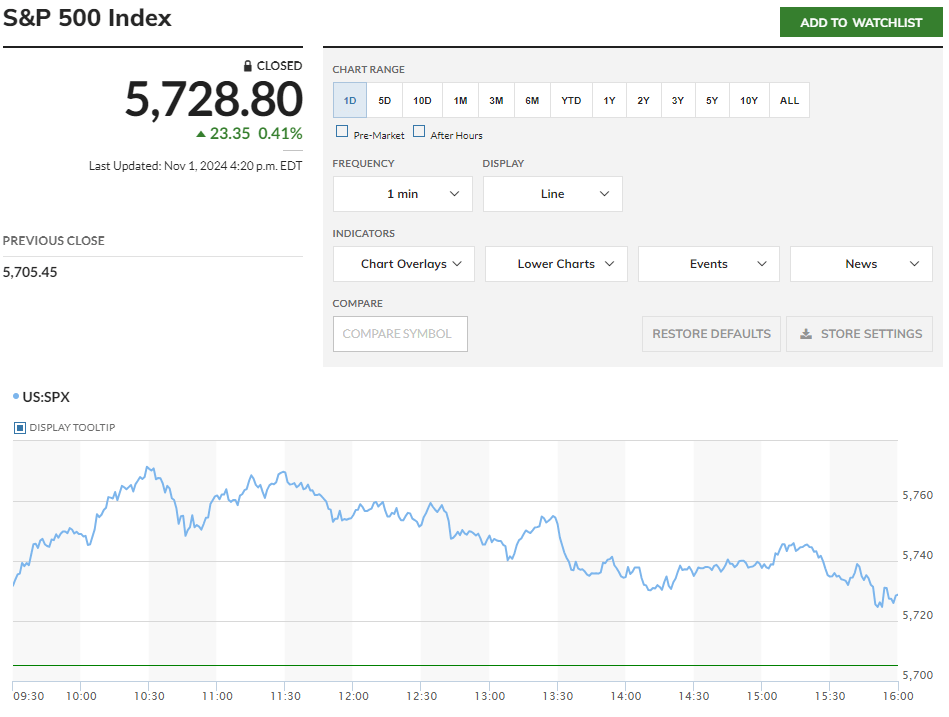

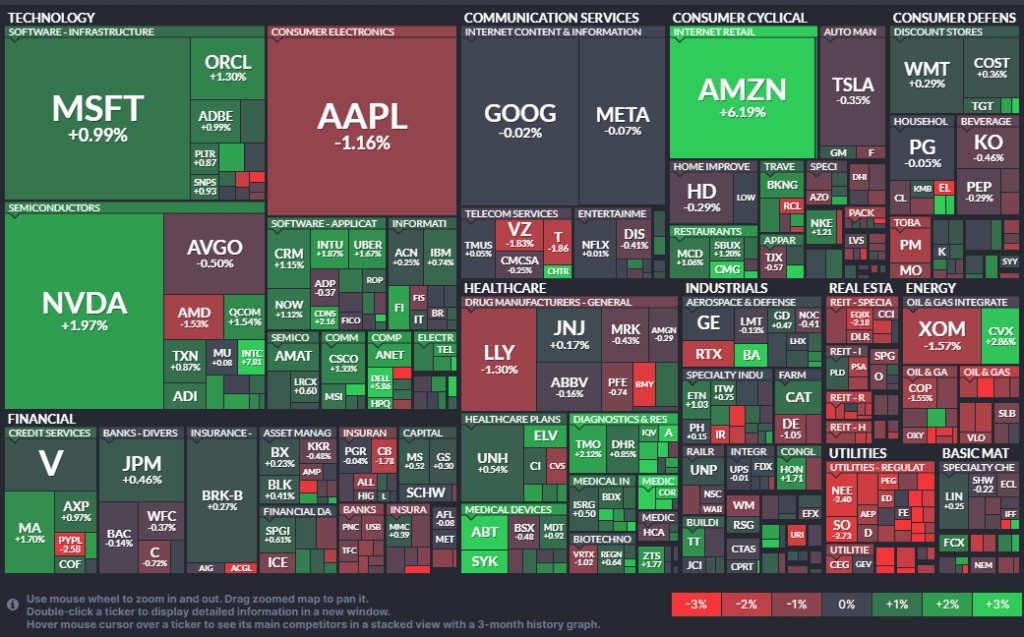

- AMZN up 6% while APPL down 1% after their earnings after close yesterday and this combined with continued appreciation in MSFT(earnings on 10/30), contributed to a rebound in the market. The rebound was also helped by INTC who saw its biggest daily gain of 8% (earnings 10/31 after close) which gave some much needed relief to the semi-conductor stocks(SP500.453010) which were down almost 8% in last 2 days.

Macro Deep Dive: NFP(Non Farm Pay Rolls) which are estimated by the US Bureau of Labor Statistics indicate the number of new jobs added by non-agricultural industry. This is most important indicator to check the health of the job market for the US economy. With US currently in Fed easing cycle, inflation and Jobs data play a very important role in them determining the rate decision to keep inflation and unemployment in control. Fed’s decisions affects the interest rate differential between US and other economies which is reflected in the FX market.

We saw a 50bp rate cut by Fed in September with them showing concerns about the Job market primarily because of bad NFP numbers in August as well September. Today’s number was clouded by the impacts of the hurricane and the Boeing strike in October, yet despite a big miss, the market reaction was quite subdued after the initial reaction.

After the initial reaction of USD weakening and drop in yields, yields as well USD recovered strongly till close with Yield closing in at the high of the day and USD at the lows. The most likely reason ties to US election volatility, under the assumption that both candidates’ policies are inflationary, which would lead to higher US interest rates on the back of no rate cuts.

FX Markets:.

- EUR/USD traded between 1.085-1.089 in the overnight session and jumped from 1.0861 at open to 1.0894 at the NFP number with a high of 1.0904 in just ten minutes after the news hit. No EUR news/headlines in the overnight session.

- GBP/USD traded between 1.2884-1.2925 in the overnight session and jumped from 1.0861 at open to 1.2954 at the NFP number with a high of 1.2965 in just ten minutes after the news hit. No GBP news/headlines in the overnight session.

- USD/JPY traded between 151.79-152.84 in the overnight session and jumped from 152.8 at open to 152 at the NFP number with a low of 151.84 in just ten minutes after the news hit. No JPY news/headlines in the overnight session.

- But the initial USD weakening faded fast even though there were no reassuring headlines. This feels like a flow-driven move, with bets on USD strength picking up again before the election. We saw this trend for two straight weeks leading up to Tuesday, when it briefly paused, but it looks like it’s back in play. With the election so close, I only see the trend of USD strengthening, especially since the weak jobs data didn’t really move the needle. Therefore, I believe we might see a wider range with the USD strengthening trend.

- One interesting thing to note here is that GBP/USD resisted the flow the most with GBP weakening much later than EUR and JPY. We saw optimistic comments from BOJ yesterday and positive Euro GDP numbers day before yesterday which did cause some relief for JPY and EUR. Meanwhile, the UK budget released this week has faced scrutiny, and with momentum now tilting to the downside, GBP/USD could see the most depreciation as we approach the US elections.

US Equity Markets

- XOM was down 1.5% while CVX was up 2.8% today after earnings release before open today. Both beat EPS estimates but XOM missed revenue expectation.

- No reaction in Equities after abysmal NFP number, focus was more on earnings.

- We saw a drawdown after noon where all the Equity Index gave back half of the gains till close. No specific reason but could be people taking profit and closing position before US elections.

News Tomorrow(11/4): BRK.B(Berkshire Hathaway) – 1.71% of S&P before Market Open and PLTR(Palantir) – 0.17% of S&P, PGR(Progressive Corp) – 0.29% of S&P after Market Close.

US Presidential Election results on 11/5.

Sources: Marketwatch(https://www.marketwatch.com/), Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html)

Leave a comment