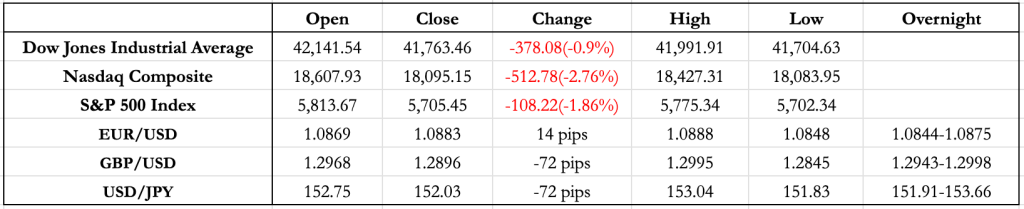

News Today(10/31): UEBR, MA(Mastercard), EL(Estee Lauder), CI(Cigna) and ETN(Eaton Corp) before Market Open. AMZN, AAPL, INTC and TEAM(Atlassian) after Market Close.

Euro CPI at 6:00 AM and US Core PCE-Price + US Jobless Claims at 8:30 AM

FX Markets:

- Euro CPI was slightly worse than expectation(2% vs 1.9%) which saw no reaction in the market. US Core PCE-Price slightly worse than expectation(2.7% vs 2.6%) and US Initial Jobless Claims better than expectation(216K vs 230K) which saw no reaction in US 10 Year Treasury yields but small USD depreciation across currencies.

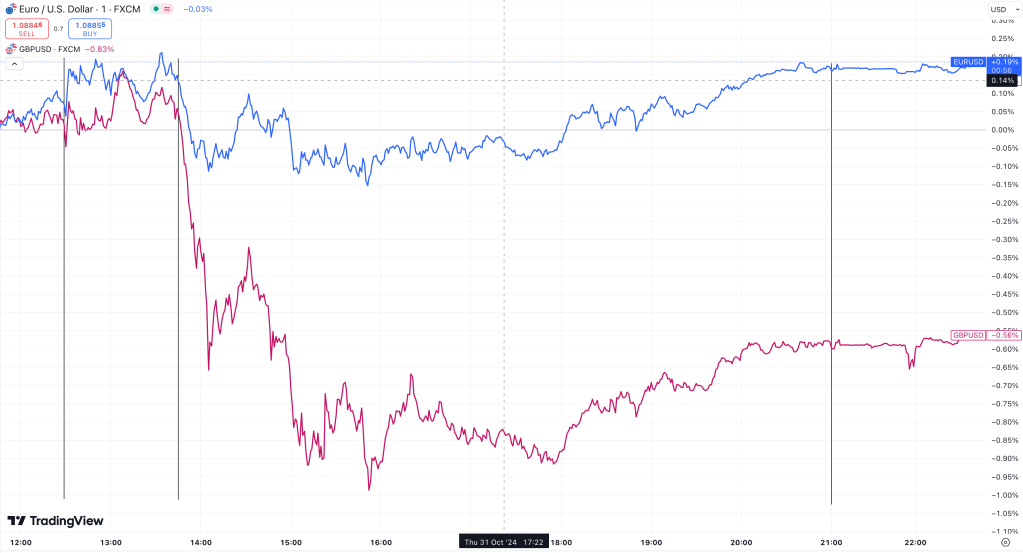

- EUR/USD was range bound in the overnight session with no reaction to Euro CPI number which you would expect when for EUR, the risk is on the growth aspect of the currency than inflation with ECB highlighting this multiple times. Saw almost +15 pips jump on the US PCE-Price and Jobless Claims data at 8:30 AM with most likely PCE-Price overpowering the Jobs number and pushing for 25bp rate on 11/7. Overall EUR/USD has been much more stable and looks like momentum shifting towards EUR. Unless we have an extremely good NFP number tomorrow, we will see EUR/USD breaching 1.09 primarily because after tomorrow, we would know with 100% certainty(currently 95% chance according to Fedwatch tool) if it is 25bp rate cut or not. Expect a similar overnight range of 1.084 and 1.09 but NFP is gonna drive the trend for US session.

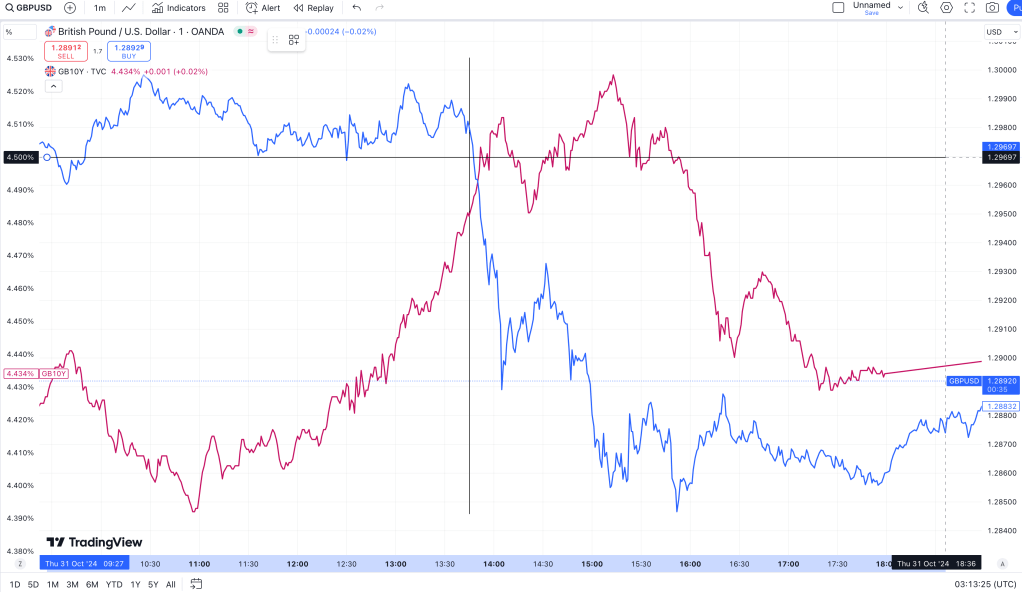

- GBP/USD saw its biggest drop since September which started at 9:45 AM when it was at 1.2984 and dropped to 1.2889 in the next 20 minutes and the scope of the move can be seen from EUR/USD and GBP/USD which clearly says it was a GBP move. Overall this was on the back of the UK budget that came out yesterday and saw the rise in UK yields above 4.5% which saw a lot of unwinding primarily because of panic and growth uncertainty of new budget. The reaction was definitely driven by flow and less liquidity going into the US election but still a strong momentum trend going forwards. Contrasting to EUR/USD, even an in line to better NFP number might get GBP/USD to new lows.

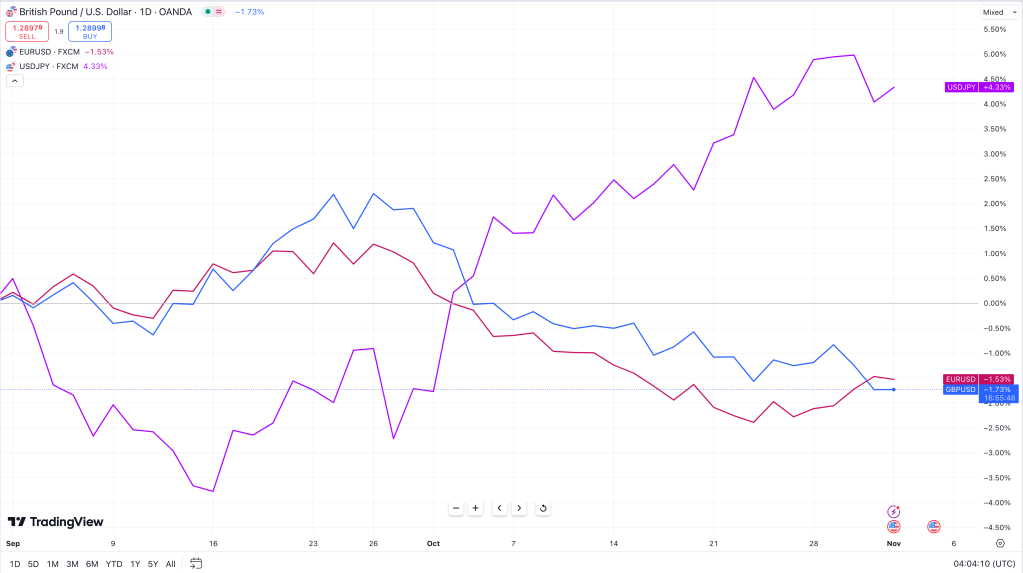

- USD/JPY saw a fairly wide range in overnight session because of the BOJ interest rate decision at 10:00 PM followed by the BOJ conference at 2:30 AM. No reaction on the no rate hike decision but overall saw almost 100 pip appreciation from 152.92 to 152.05 because of the optimistic comments by BOJ Governor Ueda about Japan inflation on the right path and US risks subsiding which gives them confidence about the path ahead. They believe that the volatility in USD/JPY came from the US Jobs and inflation data and hence will subside now with better numbers. Although if we see below, USD/JPY has depreciated almost 3x compared to EUR/USD and GBP/USD and hence cannot just be attributed to USD data. US election still is a big risk to USD/JPY with the chance of it breaching 155.5(revised down from 157.5 from yesterday) amid the US elections volatility. Given how USD/JPY has been more sensitive to US data, NFP tomorrow might help USD/JPY breach 154 or 151 with it more likely to breach 151 now with shift in momentum to USD weakening in last 3 days.

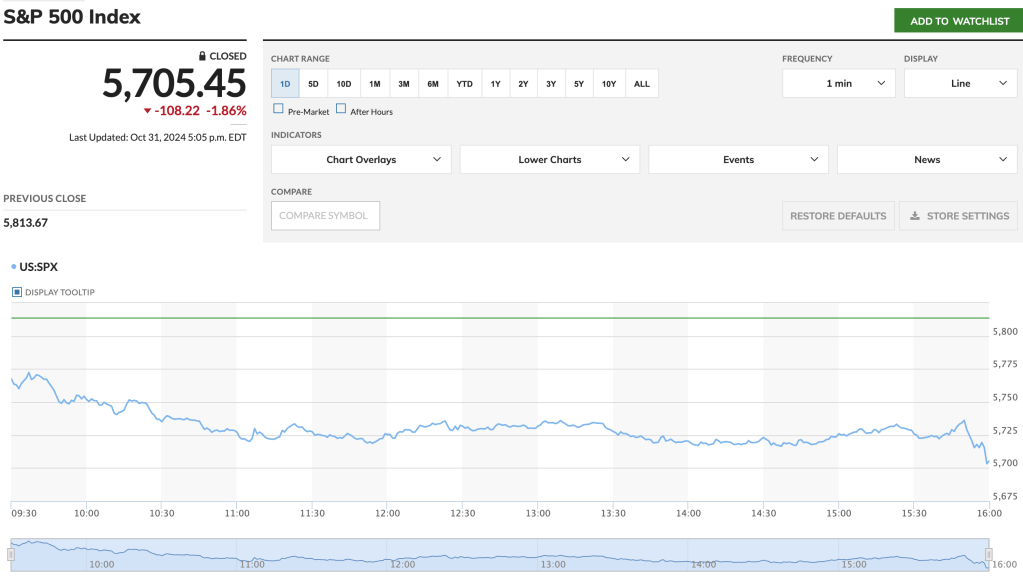

US Equity Markets

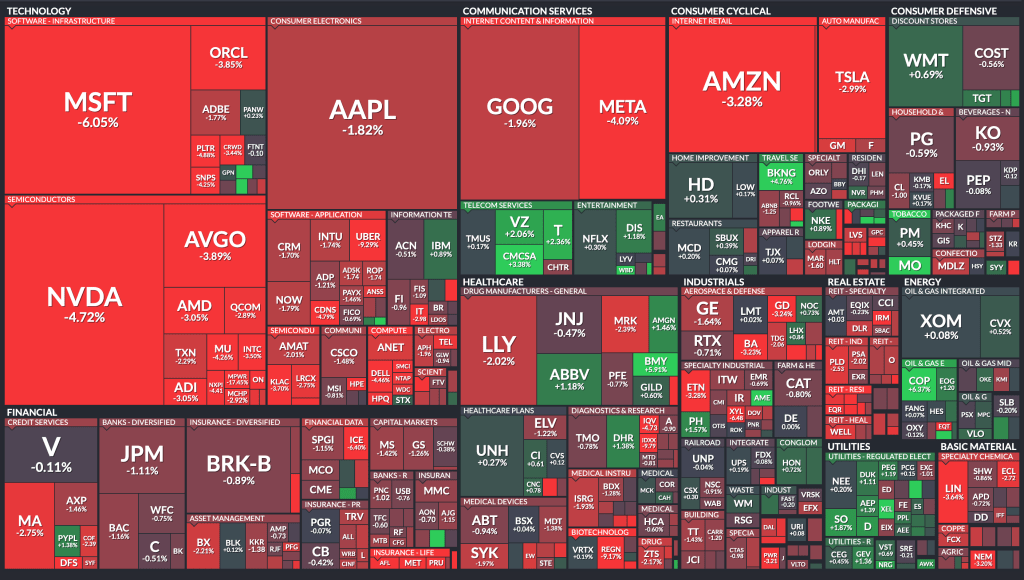

- MSFT and META led the drawdown for Mag-7 because of their earnings after close yesterday. MSFT & META beat EPS as well revenue but fell on weaker revenue projection for Q4 where as on the other hand META fell on higher expenditure projections for next year. These two account for 9% of S&P500 and hence they explain 0.45% drop in S&P500.

- UBER fell 9.5% after their earnings before open primarily because of slower growth in delivery and ride bookings.

- AMZN up almost 8% in after market trading post their earnings after close where as AAPL is down 3%(because of one time income tax charge of $10.2B to Ireland of an old case).

- INTC(Intel) is up 8% post their earnings after close. INTC might pull the other semi-conductors up tomorrow with the overall semi-conductors falling more than 4% consecutively.

Macro View: MSFT and META led the drawdown for Mag-7 because of their earnings after close yesterday. As of now, AMZN and AAPL might give some relief tomorrow but the Oil and Gas stocks tomorrow might throw a curve ball tomorrow with the ongoing volatility in Oil prices on the back of Israel-Hamas escalation. Overall, the earnings have been good but the expectation was for them to be great and hence we see a drawdown.

NFP tomorrow could overpower any earnings trend even if it is slightly less than the estimates given how much Jobs data have affected the market so far.

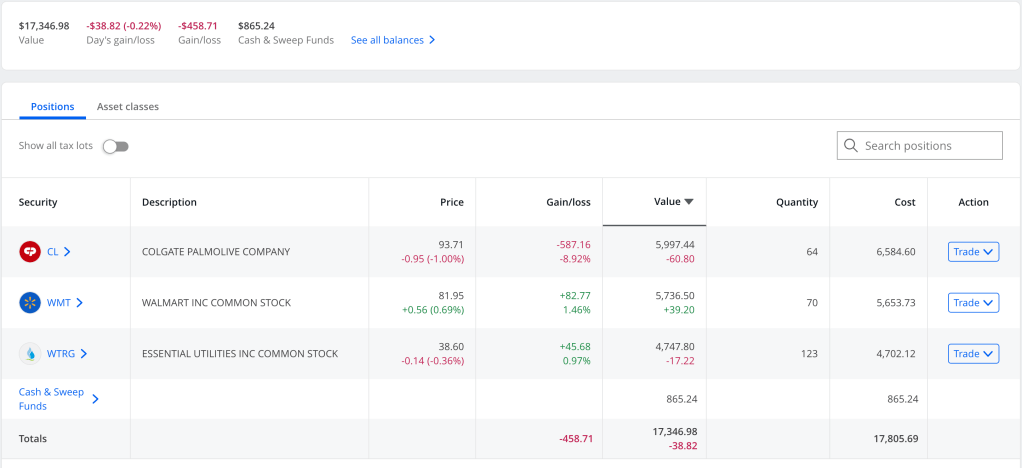

Reiterating on my day before yesterday’s point where the stock selection has hurt my portfolio the most with Colgate dragging it down the most. Happy to stay in it during the volatile time right now given don’t have any other investment to put cash in but next time onwards, would have to get better at selecting the stocks.

News Tomorrow(11/1): XOM(Exxon) – 1% of S&P, CVX(Chevron) – 0.5% of S&P and D(Dominion Energy) – – 0.1% of S&P before Market Open.

US NFP at 8:30 AM and US ISM Manufacturing PMI at 10:00 AM

Sources: Marketwatch(https://www.marketwatch.com/), Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html)

Leave a comment