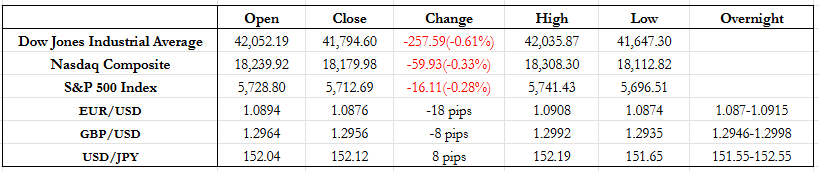

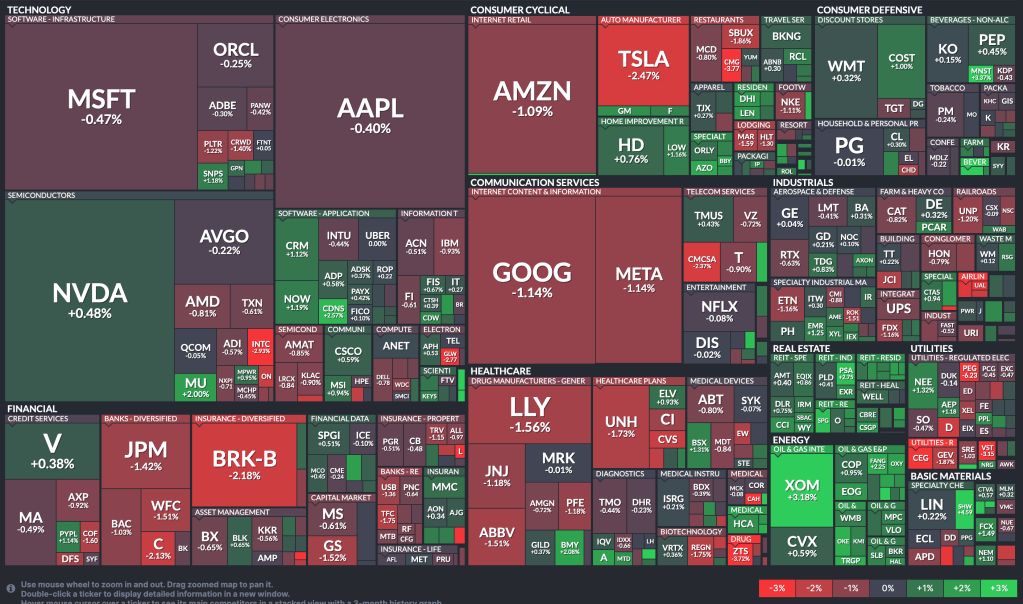

News Today(11/4): BRK.B(Berkshire Hathaway) – 1.71% of S&P before Market Open and PLTR(Palantir) – 0.17% of S&P, PGR(Progressive Corp) – 0.29% of S&P after Market Close.

Highlights:

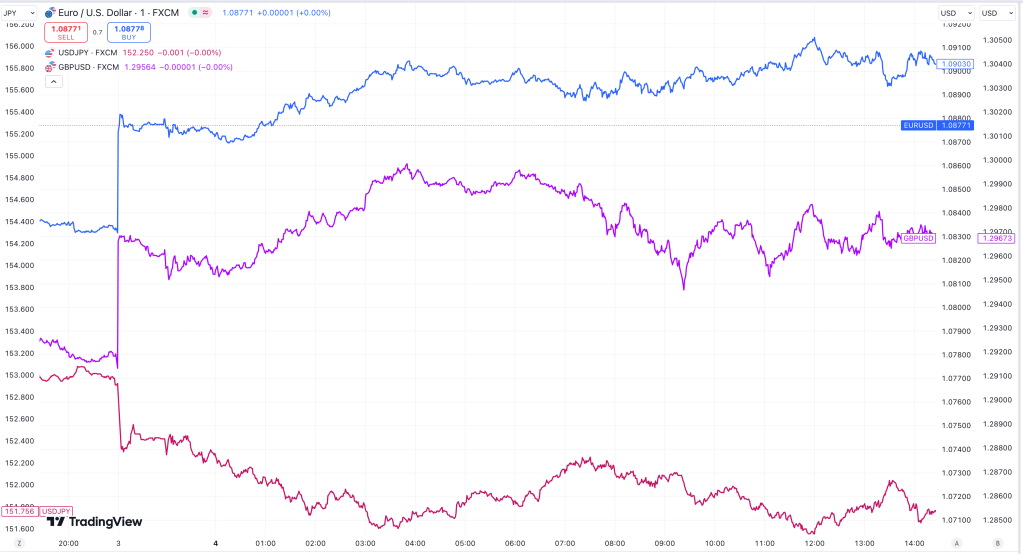

- Slowly and gradually over the last 5 days, USD appreciation has been dying out across currency pairs. Even for GBP which saw new recent lows on the back of new UK budget has recored. JPY which over the last quarter has been the most volatile to US related news and data releases has been appreciating as well.

- I would like to believe that this has to do driven by either “Trump Win – USD Appreciation” traders taking profit or Harris rising on polls which has been happening over the last 5 days as well.

- Berkshire Hathaway fell 2% after reporting less than expected operating profits. The important headline though was that it is holding $325B cash, highest as ever amid the election volatility.

- Tesla saw its 6th consecutive day of drawdown after a 20% appreciation post-earnings. A good amount of this drawdown could be driven by profit-taking by investors, but I believe this also has to do with Trump’s win odds sliding downwards over the last week.

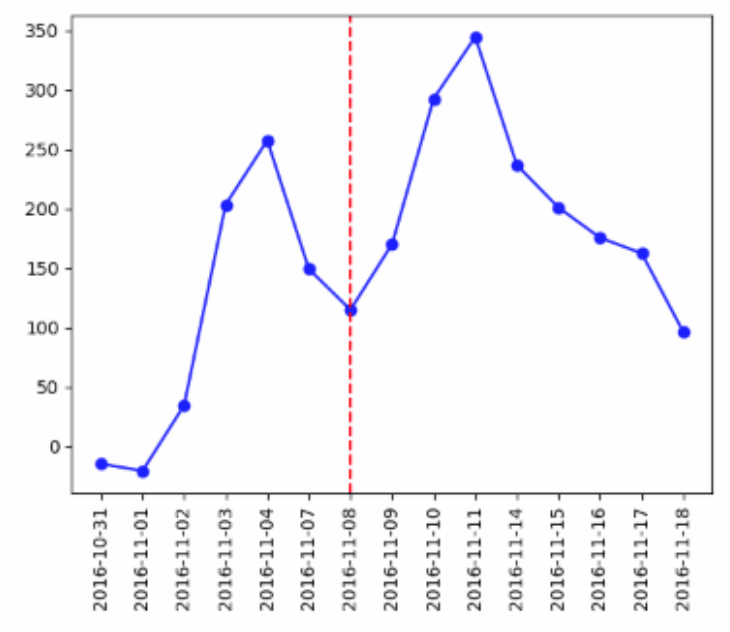

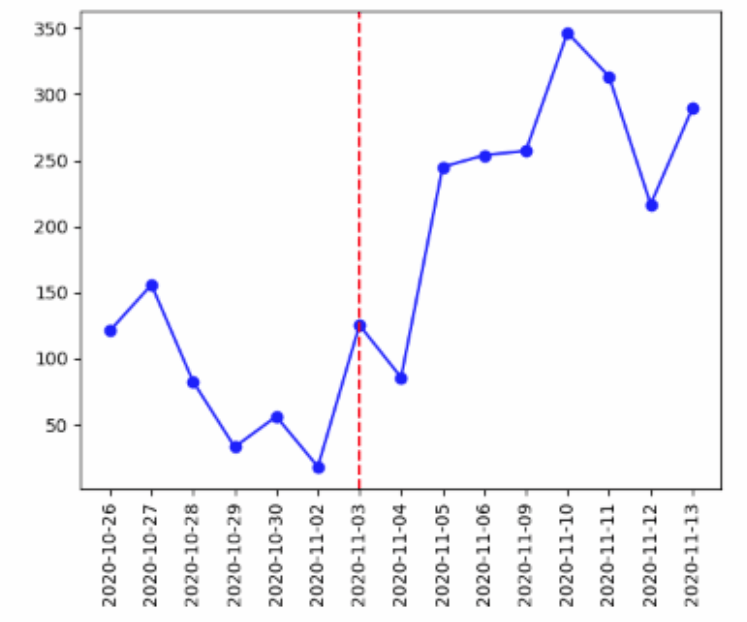

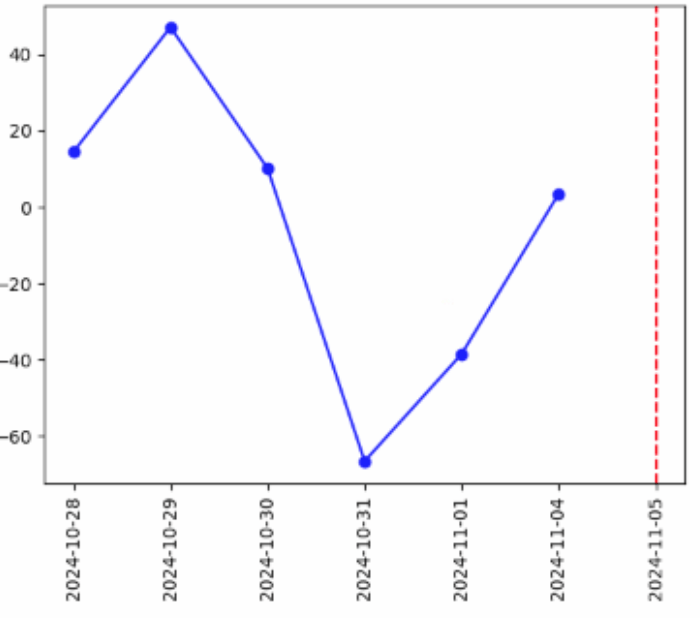

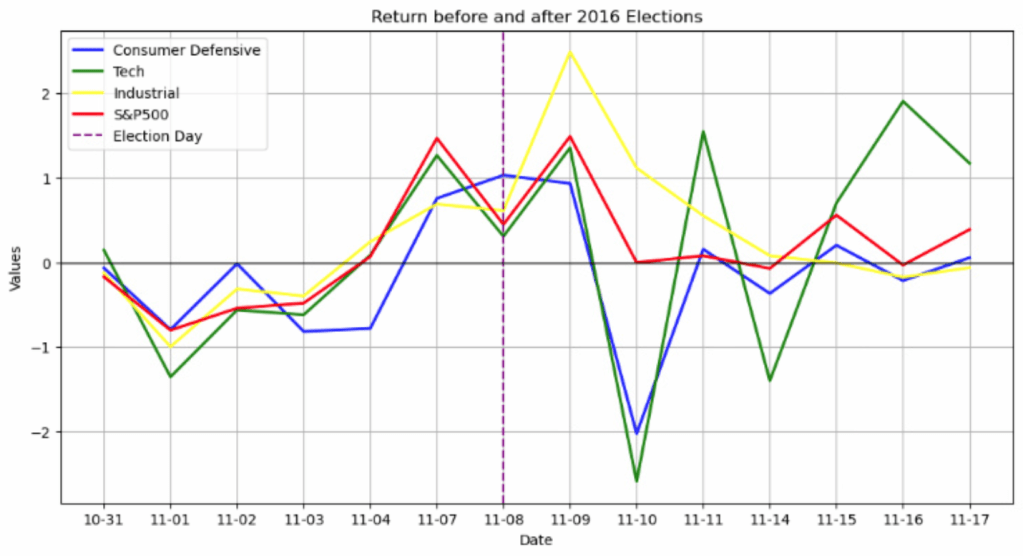

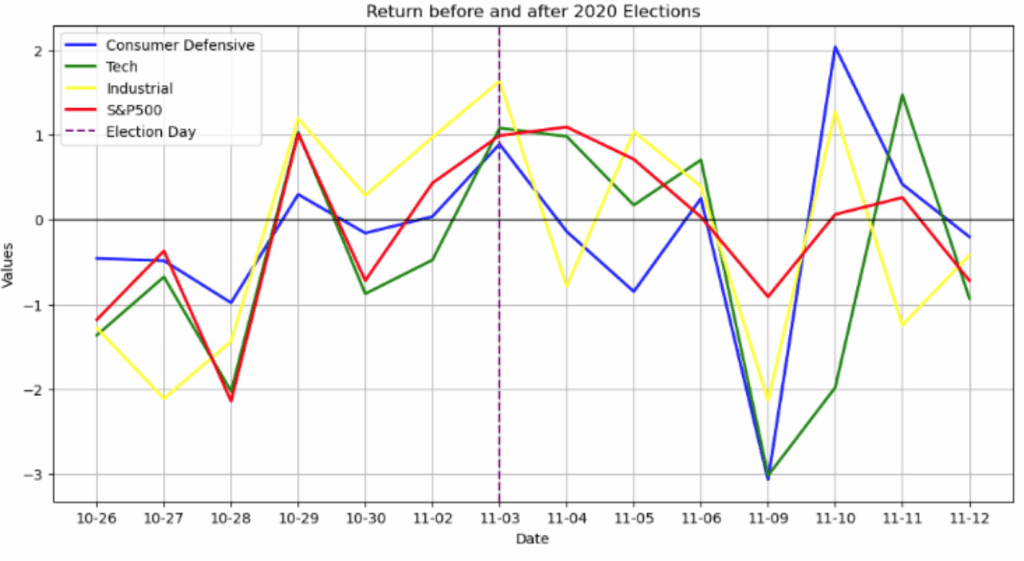

US Elections Deep Dive: This election cycle resembles the 2016 and 2020 elections, where there was a tight race between candidates and little movement on Election Day and the day after. Historically, we tend to see stronger trends emerging toward the end of election week, as shown by the day-wise change in EUR/USD (# of pips) in previous cycles in below graph.

With the anticipated 25bp rate cut on 11/7, we will likely see USD depreciation this week, which could be amplified by post-election sentiment, as shown in the graph below with nearly 150 pips of USD depreciation in last two elections. I expect some initial stability in EUR/USD, followed by potential USD weakness later in the week as election results and policy directions start taking shape.

As far as US Equities go, we can expect a positive to unch day tomorrow based on historical election results. Historically, election-related rallies have favored specific sectors depending on policy expectations. Industrial and infrastructure-related stocks could see some attention, similar to how industrials outperformed in 2016 when Trump won.

Consumer Defensive = [WMT,COST,PG,KO,PEP,PM,MDLZ,MO,CL,TGT]

Tech = [AAPL,NVDA,MSFT,TSM,AVGO,ORCL,CRM,SAP,ASML,AMD,ACN,CSCO,ADBE]

Industrial = [GE,CAT,RTX,UNP,HON,ETN,LMT,DE,UPS,BA,WM,RELX,TT,CTAS,GD]

FX Markets:.

- EUR/USD traded between 1.087-1.0915 in the overnight session, opening almost 50 pips higher than Friday’s close. The most likely reason for this move is the 25bp rate cut solidifying, along with Trump’s winning odds slightly declining. The EUR strengthened further after a positive Manufacturing PMI (Purchasing Managers’ Index – which tracks changes in production outlook based on surveys of senior executives). It did drift downwards during the US session with the range of 1.0874-1.0908, but not significantly enough to alter the momentum. I expect the EUR strengthening to continue amid historical election trends.

- GBP/USD traded between 1.2946-1.2998 in the overnight session, opening almost 50 pips higher than Friday’s close, similar to EUR/USD. There were no significant GBP news or headlines during the overnight session. GBP/USD recovered most of the drawdown caused by uncertainty and panic surrounding the UK budget, with the 29th October close at 1.3005 and today’s close at 1.2956, reaching a high of 1.2998.

- USD/JPY traded between 151.55-152.55 in the overnight session, while the day range was 151.65-152.20. It opened almost 60 pips lower than Friday’s close, similar to EUR/USD. There were no significant JPY news or headlines during the overnight session. Surprisingly, USD/JPY has been fairly stable over the last week, even during the BOJ interest rate decision and the US NFP report, trading between 151 and 153. I would like to believe it is itching for a breakout on both sides, and with the 25bp rate cut and US elections, we might see it breaking 150 this week.

US Equity Markets

- No real news other than Berkshire Hathaway reporting earnings before the market open, which resulted in a 2% drawdown amid lower profit numbers.

- According to a Reuters article, US equity funds experienced one of the largest outflows in the past five weeks. This trend is understandable as investors are taking profits and avoiding the volatility associated with the upcoming US elections.

News Tomorrow(11/5): ISM Services PMI at 10:00 AM. US Presidential Election results on 11/5.

Sources: Marketwatch(https://www.marketwatch.com/), Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/).

Leave a comment