News Today(11/5): ISM Services PMI at 10:00 AM. US Presidential Election results on 11/5

Highlights:

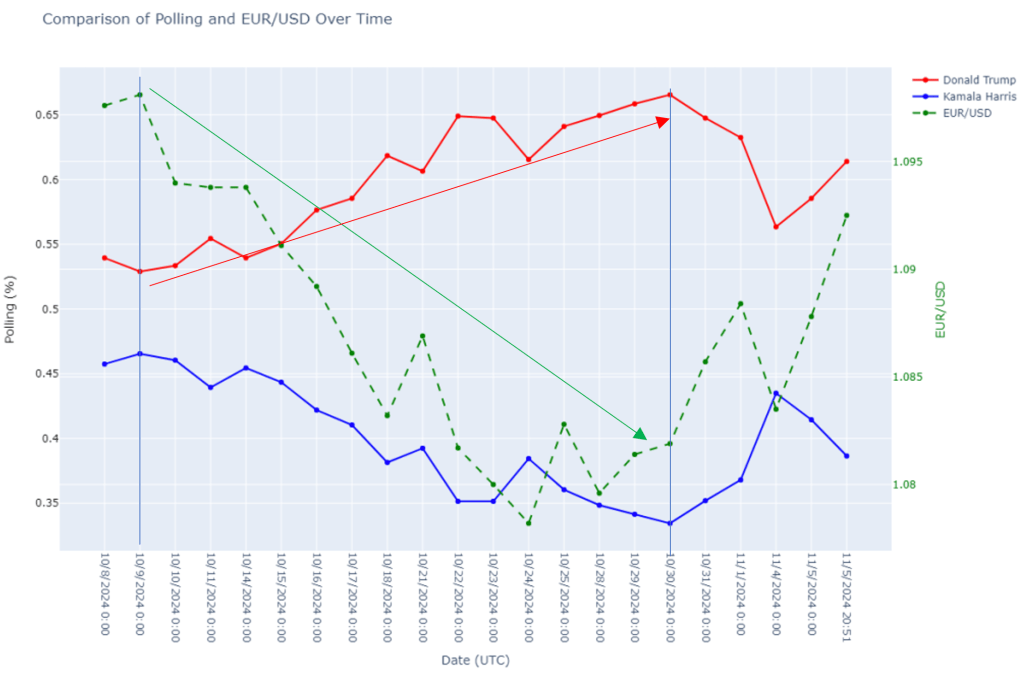

- I think the USD appreciation trend that had been building up toward the election has now lost steam, with the reversal seen last week likely to extend into this week as we approach the Fed’s rate decision on 11/7. JPY, in particular, seems set to gain against USD, helped by recent positive news from the BOJ and a still-undervalued position due to U.S. election uncertainty.

- The U.S. presidential election remains a close race, with poll numbers starting to be released as early as 6 PM and the last by 1 AM tonight.

- Arizona: 9:00 PM (EDT)

- Georgia: 7:00 PM (EDT)

- Michigan: 9:00 PM (EDT)

- Nevada: 10:00 PM (EDT)

- North Carolina: 7:30 PM (EDT)

- Pennsylvania: 8:00 PM (EDT)

- Wisconsin: 9:00 PM (EDT)

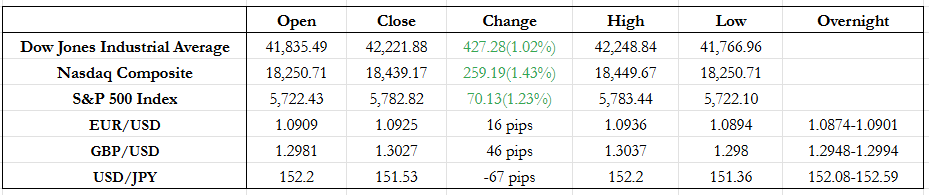

- U.S. equity indexes rose over 1% in line with historical election trends since 2000, with the Nasdaq leading the gains.

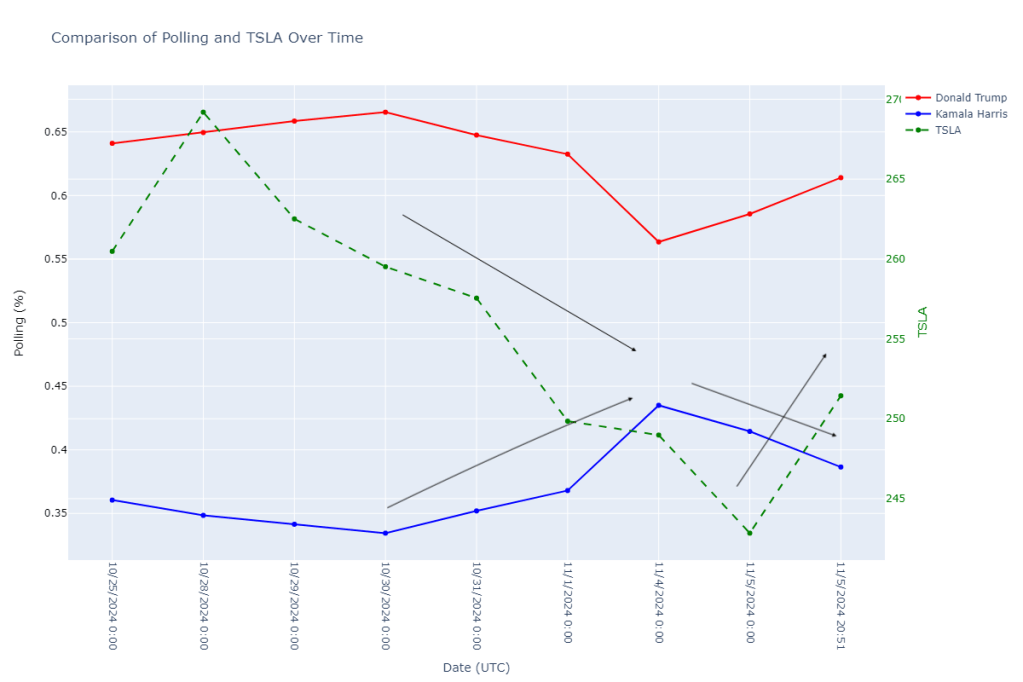

- Interestingly, Tesla was the biggest gainer, which suggests that markets might be pricing in a Trump win, especially as Harris’s poll numbers slipped yesterday.

FX Markets:.

- USD/JPY traded between 152.1-152.55 in the overnight session, while the day range was 151.35-152.20, with no significant JPY news or headlines. Given the recent strength seen in last week, I expect this trend to continue, making a breach below 150 more likely than a move up to 154.

- EUR/USD traded between 1.089-1.094 in the overnight session, while the day range was 1.091-1.0925. The historical trend shows continued EUR weakening post election, a pattern I expect to persist with some volatility. This makes a breach below 1.10 possible in the short term.

- GBP/USD traded between 1.2948-1.2994 overnight, with a wider day range of 1.0298-1.304. Like JPY, GBP showed strong momentum, pushing back against the UK budget dip and recovering.

US Equity Markets

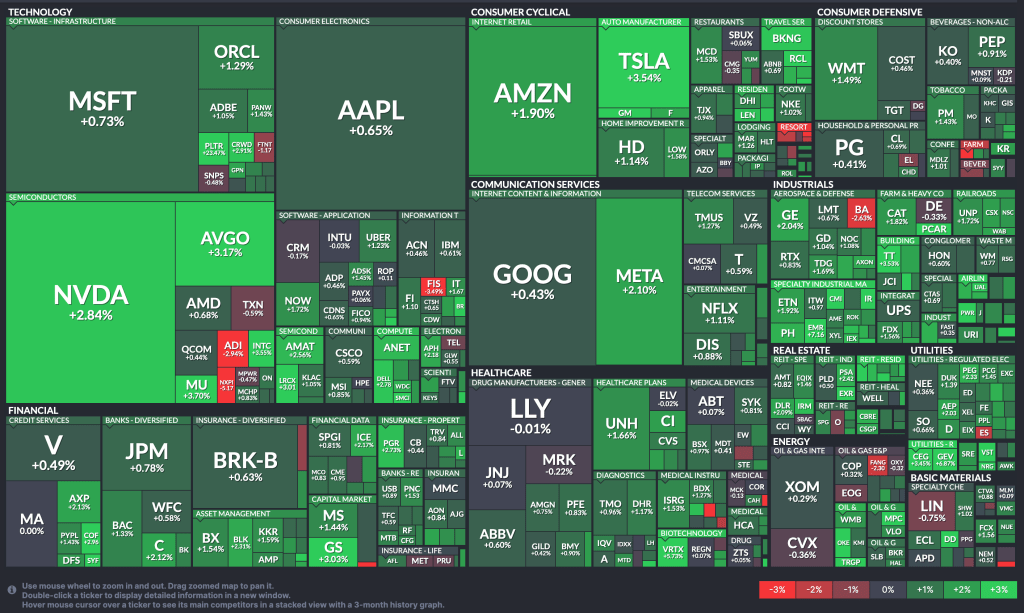

- All major indexes up, consistent with typical election day trends.

- TSLA led gains, closing up 4%, with all sectors also in positive territory.

News Tomorrow(11/6): CVS – 0.14% of S&P before Market Open and QCOM(Qualcomm) – 0.38% of S&P after Market Close.

Eurozone Services PMI at 4:00 AM, Eurozone PPI at 5:00 AM, US Presidential Election results starting 11/5 6:00 PM.

Sources: Marketwatch(https://www.marketwatch.com/), Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/).

Leave a comment