News Today(11/15):

UK GDP at 2:00 AM, France CPI at 2:45 AM, Italy CPI at 4:00 AM, US Retail Sales + US Import & Export Price Index at 8:30 AM

Highlights:

- UK GDP was in line, but monthly GDP was a small miss. There wasn’t much reaction overnight, but it showed up after the US open, with the Pound drifting lower throughout the day.

- US Retail Sales in line with upward revisions to last number which pushed the odds of no rate cut in December higher, with Fed-Watch tool showing 62% from 72% for a 25bp cut. The US Import Price index was also higher than expected which along with expected Retails Sales print drove USD appreciation for the remainder of the day.

- Yen saw its biggest relief, closing almost 200 pips under, after Japan’s Finance Minister Kato said they’re seeing a lot of one-sided sharp moves and will take appropriate action against excessive moves.

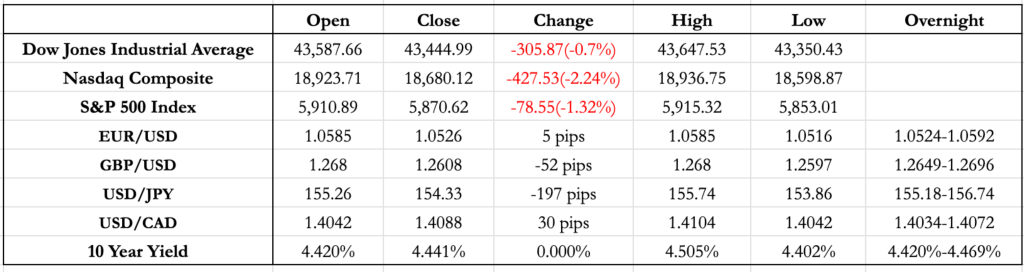

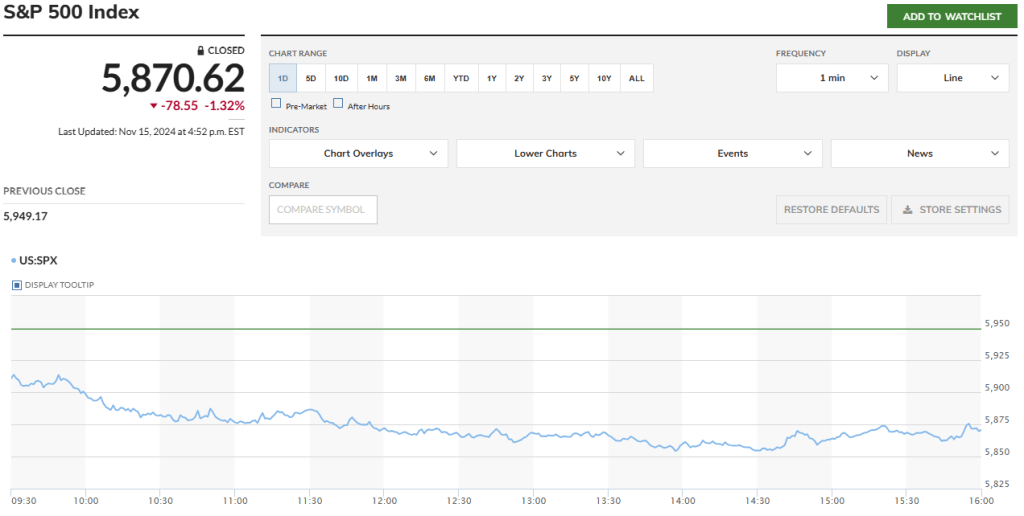

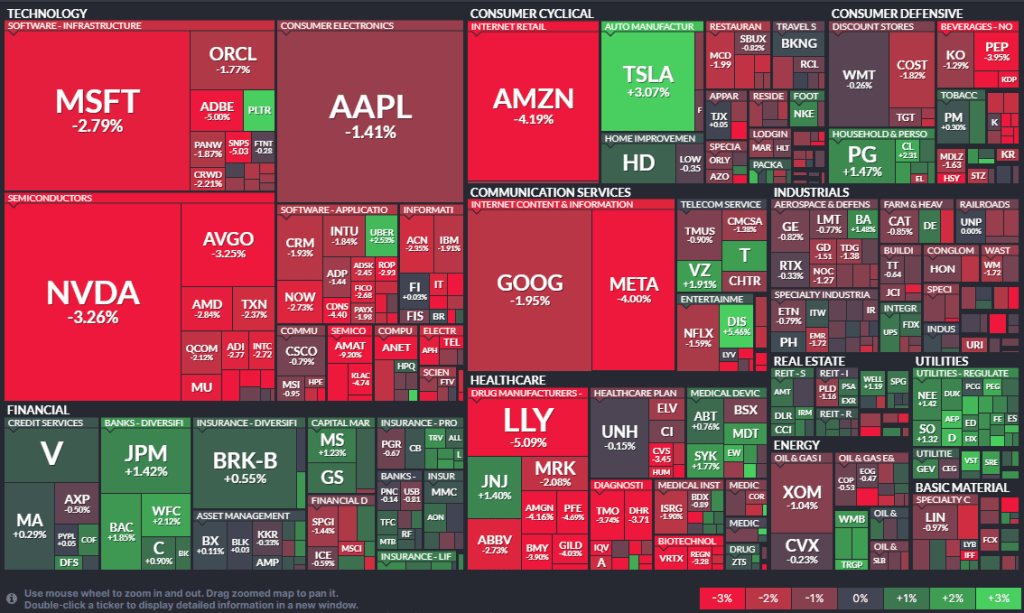

- The biggest driver for equities was Fed Chair Powell saying the economy is strong and more rate cuts might not be needed. That was the tipping point, and we saw the first big drop after the US elections, with Nasdaq down 2.24%.

- Healthcare stocks were hit hardest after Trump announced RFK Jr. as the Health Chief.

FX Markets:

- EUR/USD trended upwards, helped by in-line CPI prints from Italy and France, after breaching 1.05 a few hours before the US Open yesterday. The move was more driven by flow and people getting out of trades than Euro appreciation. USD strengthening then continued in the US session because of US Retail Sales and Powell comment, although EUR/USD did not breach 1.05 again. Euro has taken the biggest hit against USD till now, primarily because of weak economy prints (although improved recently), leading to a comparatively faster rate cut cycle by ECB, and it has also not been helped by anticipated Trump tariffs. I don’t expect a big relief anytime soon, but USD weakening could help Euro. As of now, that seems like a far sight.

- GBP/USD breached 1.26 today, primarily because of US Retail Sales and Powell comment but also helped by a slight miss in UK GDP in the overnight session. Since the BOE has been on a slower rate cut cycle compared to the Fed, GBP has seen more resistance compared to the Euro, even though the economies of both are on a similar page. With the Fed also on a slower rate cut cycle now, we might see a lot more pressure on GBP, making it likely to breach the yearly low of 1.23, which occurred at the end of April.

- USD/CAD has been trending upwards after breaking the 1.4 barrier on Wednesday. CAD resisted USD appreciation for the longest time after the US elections, only moving 100 pips in the week following the elections and trading at the 2-year high of 1.39. As I said on Wednesday, after breaking this high, the momentum is going to continue primarily because Trump’s policies on immigration and tariffs are going to impact Canada the most, and that impact has not yet been reflected in CAD.

- USD/JPY recorded its recent high of 156.75 after the Yen carry trade debacle. But Japan’s Finance Minister Kato’s comment that they would intervene if they see too many one-sided sharp moves gave the biggest relief to the Yen. Even after the strong US data, JPY strengthening continued. I would like to believe some of it was definitely driven by people taking profits or pulling out some of the orders on the chance of Japan’s government intervening. This might be a short relief, primarily because Japan is likely to suffer from Trump’s tariffs and with their inflation still not on a downward trajectory, they still have a long path ahead.

US Equity Markets

- Tech stocks took the biggest hit, reflected in the Nasdaq being down 2.25%.

- Tesla, along with Bitcoin and Banks, were up, while Crude Oil was down, hinting at the continuation of the Trump trade.

- Nvidia’s earnings on 11/20 could be the tipping point for another drawdown this month.

News Tomorrow(11/18): BOJ Governor Ueda’s Speech at 9:05 PM and 12:45 AM and ECB President Lagarde’s speech at 2:30 PM.

Sources: Marketwatch(https://www.marketwatch.com/), Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/), Sectorspdrs(https://www.sectorspdrs.com/sectorheatmap)

Leave a comment