News Today(11/18): BOJ Governor Ueda’s Speech at 9:05 PM and 12:45 AM and ECB President Lagarde’s speech at 2:30 PM

Highlights:

- The BOJ Governor, in his speech last night, didn’t give a clear answer about a rate hike in December but did say gradual rate hikes are on the way. Led to JPY weakening there by cancelling the Minister Kato’s comment relief rally on Friday.

- BOE external member Greene said the risk of cutting rates too aggressively is higher than cutting slowly and noted that the UK budget could add to inflation. This helped keep GBP/USD above 1.26 throughout the day.

- Yields dropped after the US Open (8:30 AM), which drove USD weakening during the US session.

- ECB President Lagarde, in his speech, said that since Europe’s economy is more open than others, it faces more competition from China. He also mentioned that Europe is falling behind in emerging technologies. There was no market reaction during or after the speech.

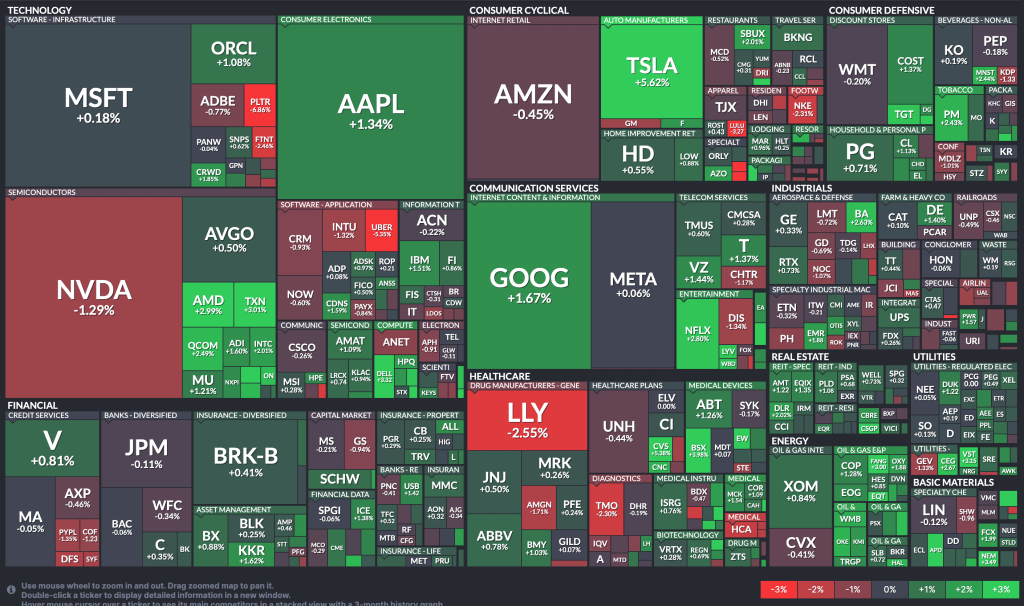

- News about Trump considering federal regulations for autonomous vehicles led to a 5% rally in Tesla.

- Nvidia saw a small drop of 1.25% following reports that its next-generation Blackwell processors are facing overheating issues.

- Crude Oil prices bounced back, rising by $2 per barrel after news that production at Norway’s Johan Sverdrup oilfield, which accounts for one-third of Norway’s oil output, had been halted. This added to earlier gains driven by the escalation of the Russia-Ukraine war.

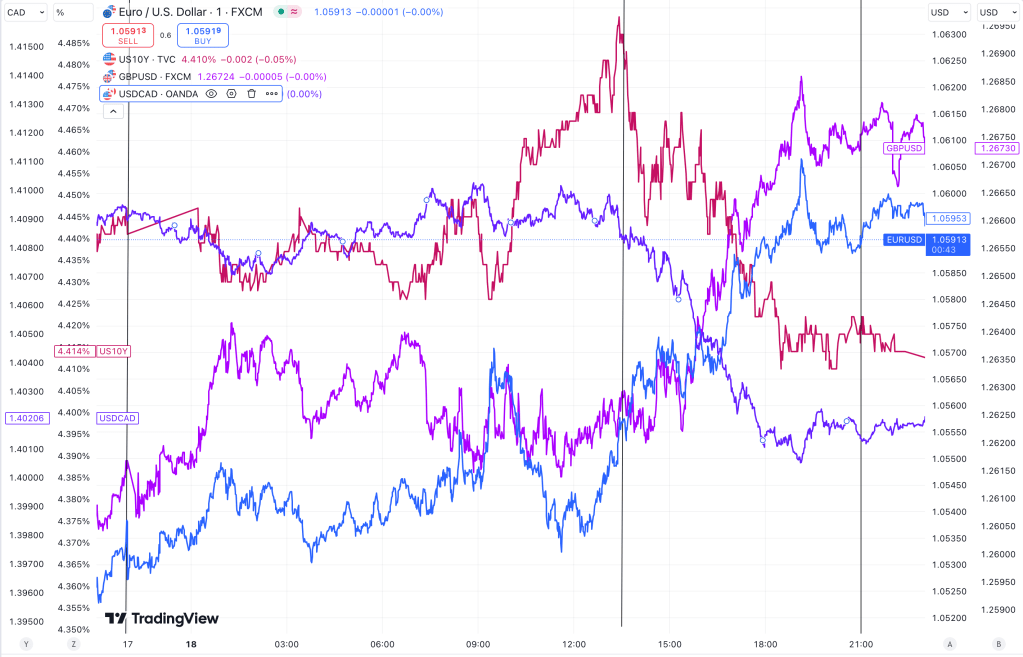

FX Markets:

- From the above plot, it’s clear that all major G10 moves, except for JPY, were driven by the drop in US yields.

- EUR/USD breached 1.06 on the upside but closed just below it. This move doesn’t seem to be driven by any fundamental change in interest rate or growth differentials but looks more like a bounce back after a significant drawdown. I don’t expect it to last long, but if we see EUR/USD closing at new local highs daily, it could build strong momentum for the Euro.

- GBP/USD bounced back strongly, supported by BOE members’ comments about slower rate cuts and the drop in US yields. The upcoming UK CPI and PPI data on Wednesday and Retail Sales on Friday will provide a clearer picture of UK inflation. Unless these prints are very strong, GBP will likely continue to face downside pressure, as only a strong print could push the GBP interest rate differential higher.

- USD/CAD saw slight relief after the US Open with the drop in US yields. It is currently trading above 4-year highs set after COVID, but Canada CPI tomorrow could stall CAD depreciation. Canada’s inflation has been falling faster than expected, allowing quicker rate cuts compared to counterparts, which has added worsened their interest rate differential. With new US tariffs, CAD depreciation could become a longer trend.

- USD/JPY’s relief was short-lived after BOJ Governor Ueda refrained from commenting on a definite rate hike in December, halting the JPY appreciation that began on Friday. This also explains why USD/JPY was the only currency that didn’t see relative USD appreciation today, despite the drop in US yields. I still stand by my view from Friday that Japan is likely to face challenges from Trump’s tariffs, and with their inflation not yet on a downward path, they have a long road ahead.

US Equity Markets

- The earnings reports from consumer retail stocks like Target, Lowe’s, Walmart, Gap, and BJ’s, along with their comments and future projections, will provide insights into the economy’s strength.

- Nvidia’s earnings on 11/20 are expected to drive major market movements this week, as no significant US macro data is scheduled.

- Bitcoin continues to hold above $90,000.

News Tomorrow(11/19): WMT(Walmart) – 0.73% of S&P and LOW(Lowe’s) – 0.31% of S&P before Market Open,

EU HICP at 5:00 AM, Canada CPI at 8:30 AM and US Building Permits at 8:30 AM

Sources: Marketwatch(https://www.marketwatch.com/), Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/), Sectorspdrs(https://www.sectorspdrs.com/sectorheatmap)

Leave a comment