News Today(11/19): WMT(Walmart) – 0.73% of S&P and LOW(Lowe’s) – 0.31% of S&P before Market Open,

EU HICP at 5:00 AM, Canada CPI at 8:30 AM and US Building Permits at 8:30 AM

Highlights:

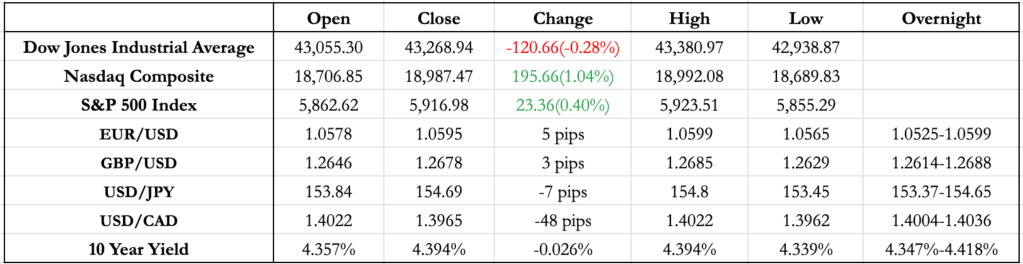

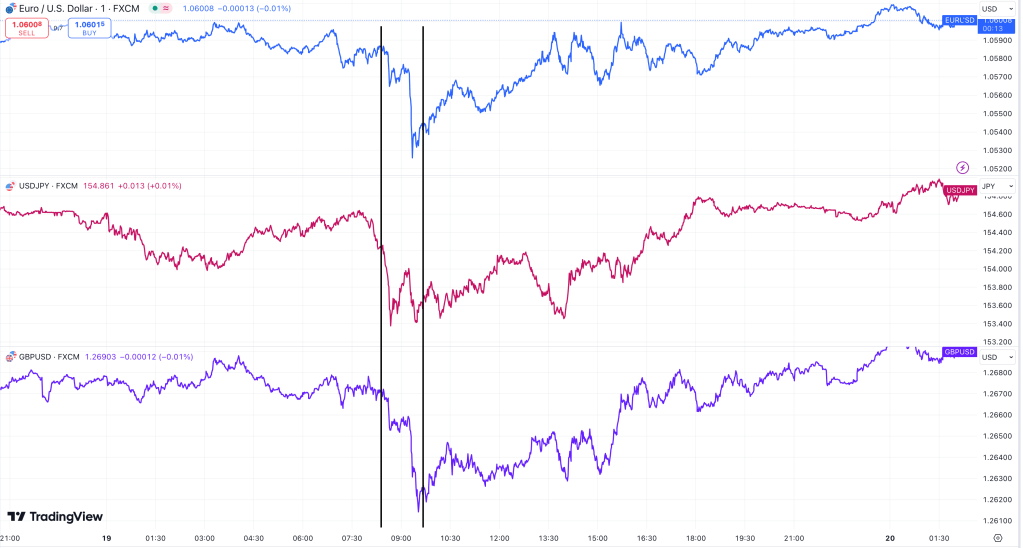

- The Eurozone HICP came in as expected, resulting in little to no movement in the markets.

- The threat of escalation in the Russia-Ukraine conflict caused a rally in safe-haven currencies, particularly the USD and JPY during the overnight session. JPY possibly because Putin’s remarks mentioning the U.S involvement

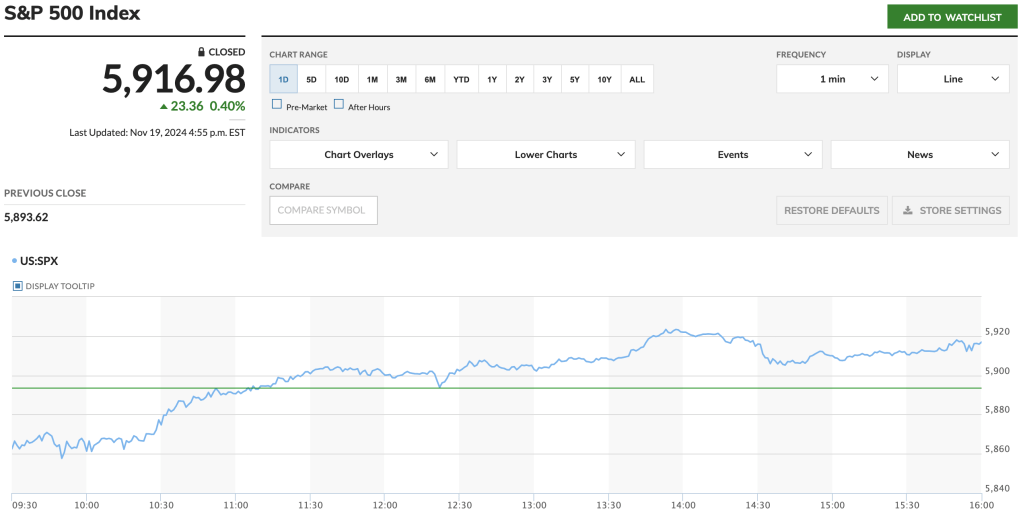

- This, in turn, also contributed to a lower open for equities.

- Although the changes in indexes and currency pairs were small, there was significant volatility at the start of the U.S. session, with markets aggressively pricing in the risk of war escalation. However, this quickly and gradually reversed back to yesterday’s close.

- At 1:00 PM, cautious comments on inflationary pressures by Schmid, a non-voting Fed member, provided further relief for the EUR and GBP along with the further drop in yields in the day.

FX Markets:

- EUR/USD couldn’t break 1.06 in the overnight or U.S. session but closed at the highest point of the day. I still believe that if EUR/USD continues to close at new highs, it could create strong momentum for the Euro.

- GBP/USD traded in a narrow range during the U.S. session, with no clear movement in either direction. Tomorrow’s inflation data could cause a big move, with the downside risk a bit higher since USD strength hasn’t completely faded. If the CPI and PPI numbers are in line or lower, it could help GBP, but even a slightly worse reading could push the price lower.

- USD/CAD saw its biggest relief after the U.S. elections, with Canada’s CPI coming in worse than expected (2% vs 1.9%), which gives the Bank of Canada a reason to slow down rate cuts. As I mentioned yesterday, Canada’s inflation had been falling faster than expected, allowing the BOC to cut rates more quickly to support growth, but this new data could slow down that rate-cut cycle. The risk of new tariffs still weighs on the CAD, so I believe this is only a short-term relief, with CAD depreciation likely to continue.

- USD/JPY didn’t break 155 in the U.S. or overnight sessions, but the risk of JPY weakening is still there. Tariffs haven’t been fully priced in, and there are no clear comments about a December rate hike, which isn’t helping.

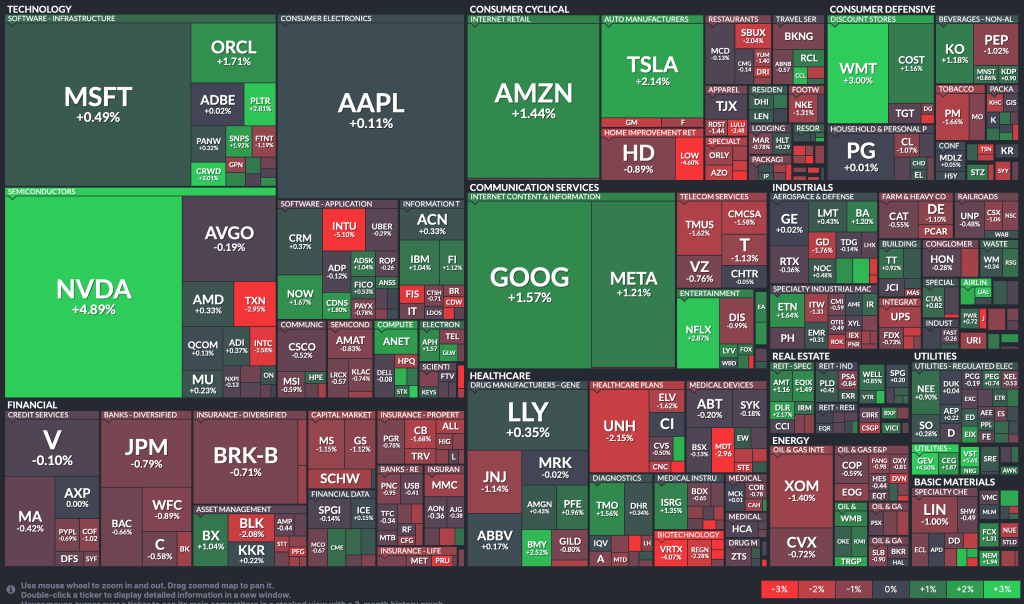

US Equity Markets

- Walmart’s stock climbed to an intraday high of $87 after reporting better-than-expected earnings, with both EPS and revenue exceeding forecasts.

- Walmart Executives said new tariffs could raise costs for consumers, agreeing with the broader market concerns about inflationationrry pressure caused by Trump policies.

- Bitcoin reached a new all-time high, breaching the $93,000 mark.

- Nvidia’s earnings tomorrow will set the trend for the rest of the week with no big US Macro data releases in the calendar.

News Tomorrow(11/20): TGT(Target) – 0.15% of S&P before Market Open and NVDA(Nvidia) – 6.91% of S&P after Market Close,

UK CPI & PPI at 2:00 AM and ECB President Lagarde speech at 8:00 AM. BOE Speakers at 10:30 AM and 11:00 AM and Fed Speakers at 11:00 AM and 12:15 AM.

Sources: Marketwatch(https://www.marketwatch.com/), Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/), Sectorspdrs(https://www.sectorspdrs.com/sectorheatmap)

Leave a comment