News Today(11/21): BOJ Governor Speech at 12:10 AM and US Jobless Claims at 8:30 AM

Highlights:

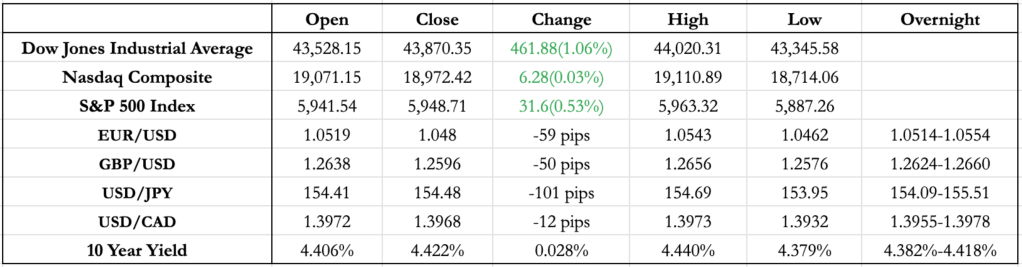

- All the G10 currency pairs saw some bounce back after US Jobless Claims which were less than expected(213K vs 220K), which brings up the odds of 25bp cut in December to 60%.

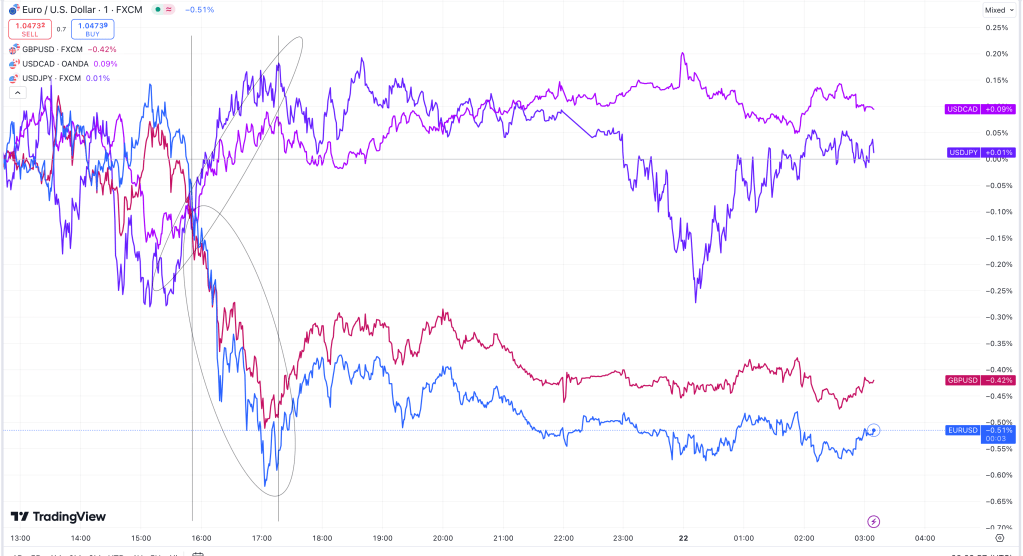

- USD/JPY had a volatile overnight session following a speech by BOJ Governor Ueda. He mentioned that the Bank of Japan will carefully review multiple datasets and assess the economic outlook, including yen fluctuations, before making policy decisions. This led to JPY appreciation which carried into US session as well.

- Very strong USD pressure around 10:30 AM, which can be clearly seen from the above graph with EUR/USD closing below 1.05 and GBP/USD closing below 1.26 at close. Comparatively, USD/CAD and USD/JPY gave more resistance. This USD pressure was coming from rise in US yields but more so from rising Russia Ukraine tensions.

- Bitcoin came close to $99,000, up nearly 40% now since the U.S. elections.

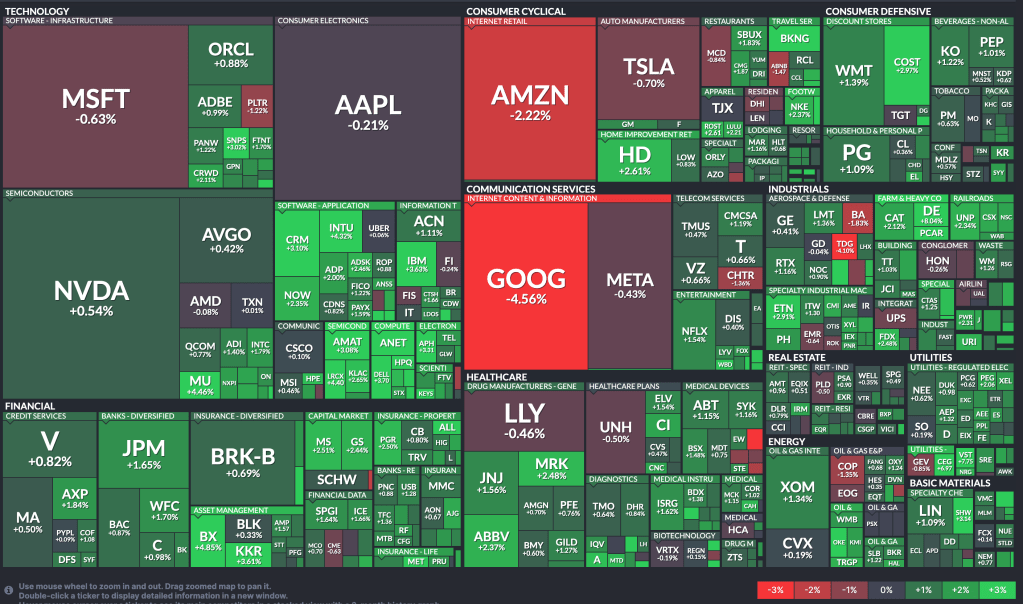

- Nvidia had a volatile day post their earnings yesterday after close. The company beat expectations on both revenue and EPS and gave a positive outlook for the future. The stock was up 5% at open but went down to as low as down 3% and closed the day up 0.5%.

- Google saw one of its biggest drawdown of the year, down almost 5% after DOJ raised questions about the Sale of Chrome to end their Monopoly.

News Tomorrow(11/22): Germany GDP at 2:00 AM, UK Retail Sales at 2:00 AM, France PMI at 3:15 AM, Germany PMI at 3:30 AM, ECB President Lagarde Speech at 3:30 AM, Eurozone PMI at 4:00 AM, UK PMI at 4:30 AM and US PMI at 9:45 AM

Sources: Marketwatch(https://www.marketwatch.com/), Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/), Sectorspdrs(https://www.sectorspdrs.com/sectorheatmap)

Leave a comment