News Today(11/22): Germany GDP at 2:00 AM, UK Retail Sales at 2:00 AM, France PMI at 3:15 AM, Germany PMI at 3:30 AM, ECB President Lagarde Speech at 3:30 AM, Eurozone PMI at 4:00 AM, UK PMI at 4:30 AM and US PMI at 9:45 AM

Highlights:

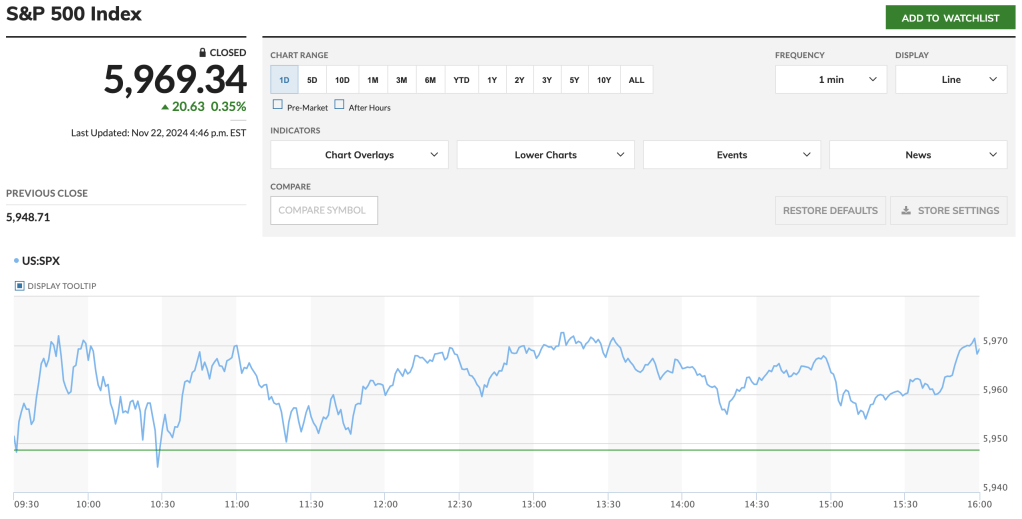

- Heavily packed macro data drove the markets today, with most of the moves happening in the overnight session on Eurozone and UK PMI data releases.

- Germany’s GDP missed expectations (-0.3% vs. -0.2%), and UK Retail Sales were a big miss (2.4% vs. 3.4%). Germany, Eurozone, and UK PMI data also came in below expectations.

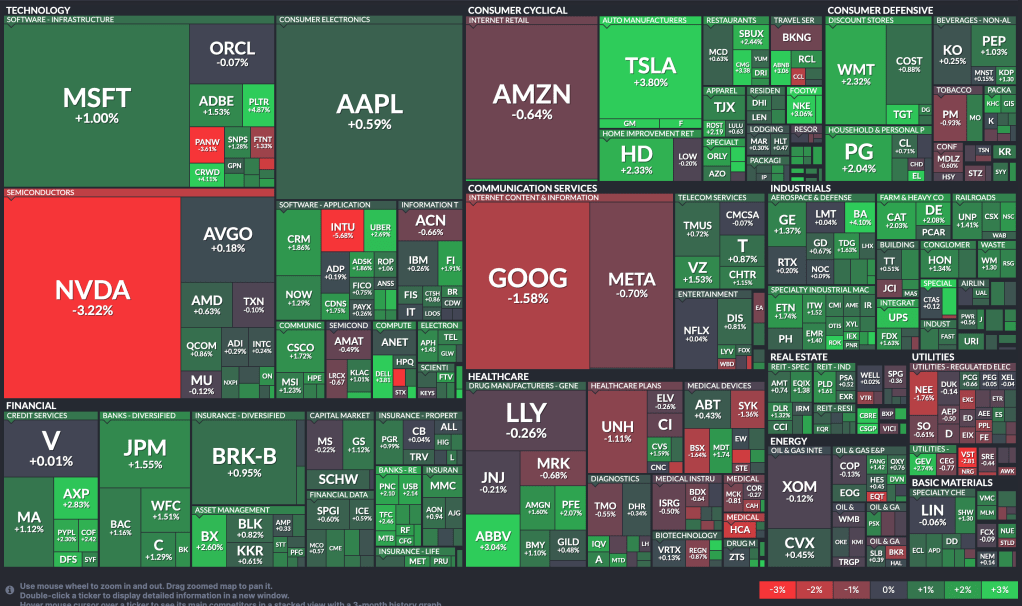

- The Trump trade is still powering on, with banks, Tesla, and industrials rallying today and Bitcoin just shy of $100K, showing strong momentum to breach the barrier.

- With U.S. PMI coming in line with or slightly better than expectations, the chance of a 25 bps rate cut by the Fed is now down to 53%, making it more of a coin toss.

FX Markets:

- EUR/USD breached 1.04 in the overnight session on the back of weak Germany GDP, Germany PMI, Eurozone PMI, and France PMI. This data reinforces the ECB’s concerns about weak economic growth and increases the likelihood of a 25 bps rate cut in December. With anticipated new U.S. tariffs and the strength of the U.S. economy contrasting with the weak Eurozone economy, we could easily see EUR/USD breach parity.

- GBP/USD, similar to EUR/USD, experienced a significant drawdown in the overnight session due to disappointing UK Retail Sales and PMI data. However, compared to the Euro, the BOE remains on a slower rate-cutting cycle than the ECB, giving GBP slightly more resilience. Additionally, the UK is less affected by U.S. tariffs, and the new UK budget could introduce inflationary pressures, potentially delaying further BOE rate cuts.

- USD/JPY once again failed to breach the 155 level in both U.S. and overnight sessions. Rising geopolitical tension from the Russia-Ukraine conflict has halted JPY depreciation for now, but the risk of further weakening remains, especially with the potential impact of tariffs still not fully priced in.

News Tomorrow(11/25): ECB chief economist Lane’s speech at 11:30 AM and BOE chief economist Pill’s speech at 1:00 PM

Sources: Marketwatch(https://www.marketwatch.com/), Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/), Sectorspdrs(https://www.sectorspdrs.com/sectorheatmap)

Leave a comment