News Today(11/25): ECB chief economist Lane’s speech at 11:30 AM and BOE chief economist Pill’s speech at 1:00 PM

Highlights:

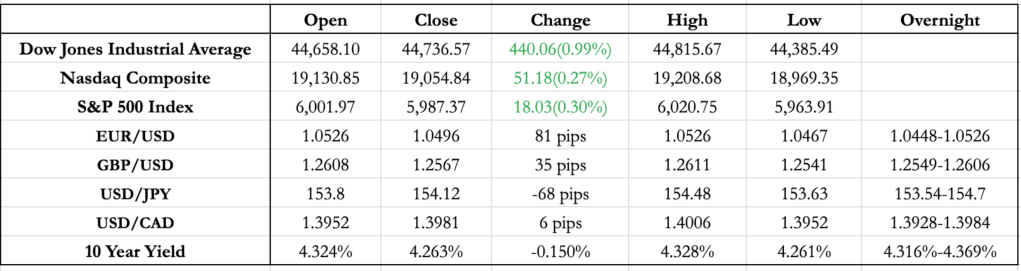

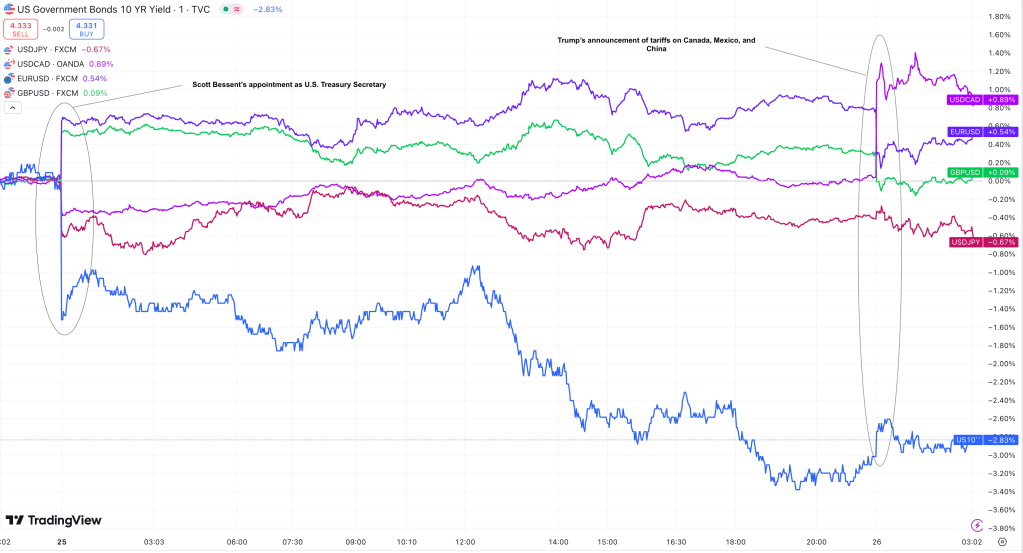

- Scott Bessent’s appointment as U.S. Treasury Secretary eased inflation concerns tied to Trump’s tax cuts and tariffs.

- Bessent emphasized tax and spending cuts as priorities on Sunday after his appointment and suggested a gradual rollout of tariffs back in early November.

- 10-year Treasury yields dropped by 0.08%, and major currency pairs gained 50-60 pips against the dollar after the Sunday open.

- Oil prices fell $2 following reports that Israel and Lebanon agreed to end the Israel-Hezbollah conflict.

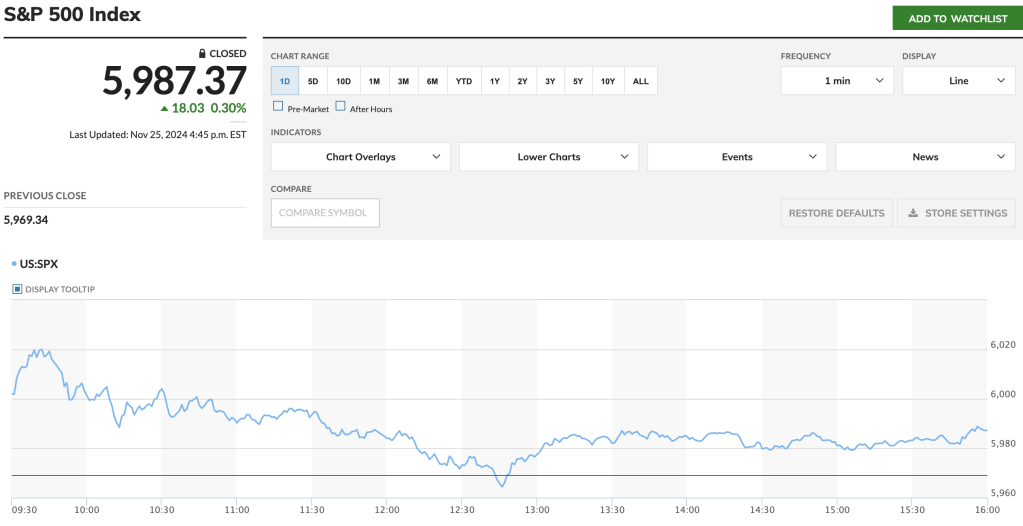

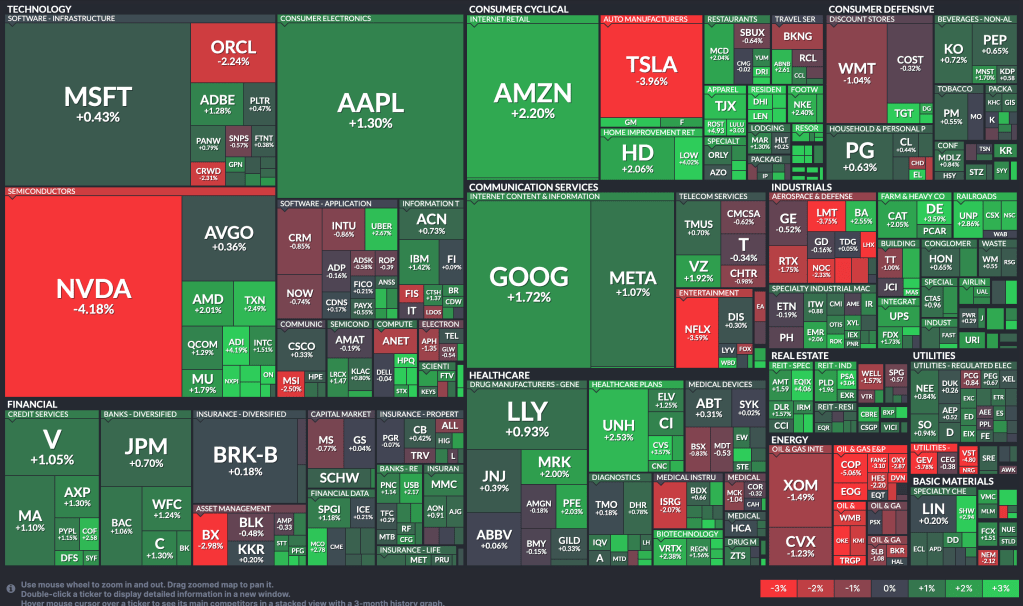

- Equities rallied at the open due to Bessent’s appointment and the Israel-Lebanon peace deal but failed to close above the 6000 level again.

- Nvidia fell 4.18% amid reports of a senior executive meeting with a Chinese official.

- Trump’s post-market announcement of tariffs on Canada, Mexico, and China erased 60-70% of earlier currency pair gains.

- ECB Chief Economist Lane called for a cautious, step-by-step approach to rate cuts and stressed the importance of flexibility due to global risks that include wars and shifts in global politics.

FX Markets:

- EUR/USD jumped 60 pips at the overnight open following Scott Bessent’s appointment as U.S. Treasury Secretary, briefly breaching 1.05 in the overnight session. However, the relief was short-lived as gains were slightly eroded during the U.S. session and further wiped out after Trump’s tariff comments. With the strength of the U.S. economy contrasting with the weak Eurozone, and the potential impact of anticipated new tariffs, EUR/USD looks poised to breach parity in the near future.

- GBP/USD saw significant overnight appreciation, mirroring the moves in EUR/USD, but retraced back to Friday’s close following Trump’s comments on tariffs. While GBP has shown greater resistance to USD compared to other pairs, this resilience stems from expectations of a slower BOE rate cut cycle. However, risks remain tilted to the downside, given the strength of the U.S. economy and a 50% chance of a Fed rate cut in December.

- USD/JPY once again failed to break the 155 level during both the overnight and U.S. sessions. Rising geopolitical tensions have provided temporary support for JPY, preventing further depreciation. However, this relief may not last, as the impact of U.S. tariffs on USD/JPY is yet to be fully priced in and could surface when geopolitical concerns subside.

- USD/CAD initially gained 30 pips after Scott Bessent’s appointment but reversed sharply, losing over 100 pips following Trump’s tariff announcement. The pair surged from 1.3990 to 1.41, suggesting the potential for further CAD depreciation this week, especially with lower liquidity expected due to Thanksgiving. The full impact of Trump’s tariffs hasn’t been priced in yet and could lead to more significant moves in USD/CAD in the coming days.

News Tomorrow(11/26): ANF(Abercrombie & Fitch), BBY(Best Buy), KSS(Kohl), DKS(Dick’s Sporting Goods), BURL(Burlington) before Market Open, DELL & HP after Market Close.

BOE chief economist Pill’s speech at 10:00 AM, New Home Sales at 10:00 AM and FOMC minutes at 2:00 PM

Sources: Marketwatch(https://www.marketwatch.com/), , Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/), Sectorspdrs(https://www.sectorspdrs.com/sectorheatmap)

Leave a comment