News Today(11/26): ANF(Abercrombie & Fitch), BBY(Best Buy), KSS(Kohl), DKS(Dick’s Sporting Goods), BURL(Burlington) before Market Open, DELL & HP after Market Close.

BOE chief economist Pill’s speech at 10:00 AM, New Home Sales at 10:00 AM and FOMC minutes at 2:00 PM

News:

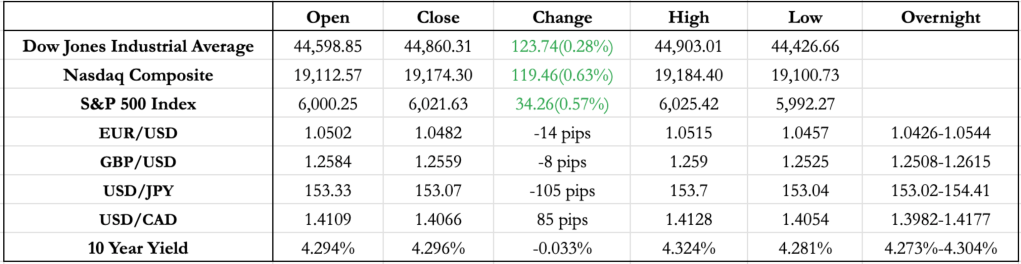

- The relief of Scott Bessent’s appointment as the U.S. Treasury Secretary over the weekend overpowered Trump’s comments about tariffs on Canada, Mexico, and China, with all major currency pairs retracing the move and equities closing at new highs.

- The Canadian dollar suffered the most, closing 85 pips higher but almost 100 pips lower than the overnight high, which happened just after Trump’s comments.

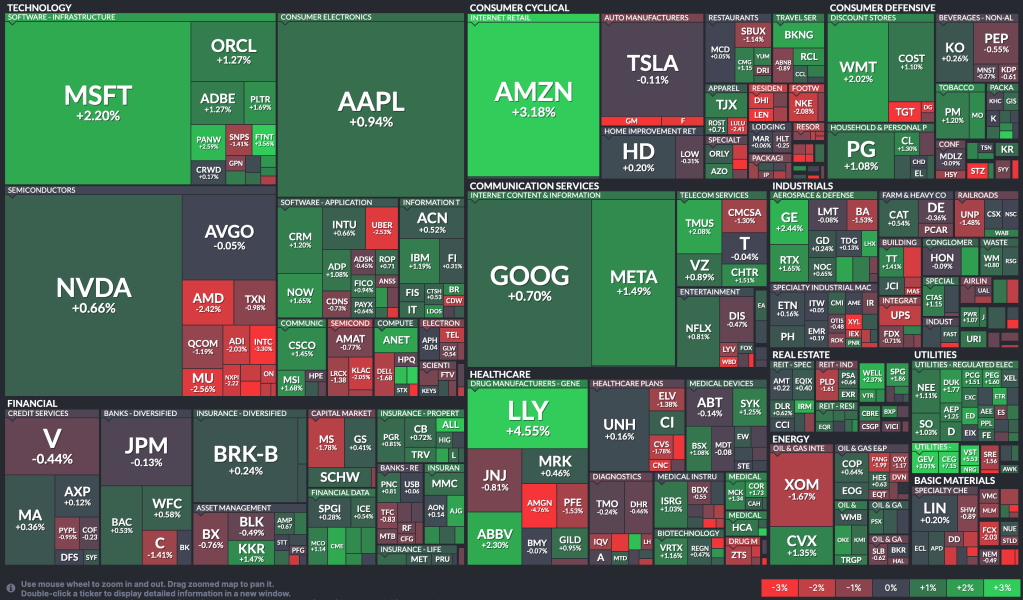

- General Motors, along with Ford, fell 9% and 2.6%, respectively, after Trump’s comments about tariffs on Mexico because they have auto plants in Mexico.

- Contrary to all the other G10 currencies, JPY strengthened against the dollar for the second consecutive day.

- Bitcoin continued its second down day, closing at $93,000, which clearly signals a stop to the momentum rally after Trump’s win.

- ECB policymaker Villeroy said that the new Trump administration’s economic policies may have a “relatively limited” effect on European inflation but could have a more noticeable impact on long-term interest rates.

- BOE Chief Economist Pill told the House of Lords Economic Affairs Committee that the increase of £25bn in national insurance for employers, announced in the new UK budget, would likely add pressure to inflation, although a small impact, and it would also place some strain on the job market.

- No big moves on FOMC minutes, in which the highlight was that “many participants observed that uncertainties concerning the level of the neutral rate of interest complicated the assessment of the degree of restrictiveness of monetary policy and, in their view, made it appropriate to reduce policy restraint gradually.” This puts some dampening on the extremely positive outlook by the Fed in September, followed by a neutral speech in November.

- The current odds for a 25 bp rate cut in December stand at 60%, according to the FedWatch tool.

Tomorrow Outlook:

- US Core PCE and GDP data releases tomorrow will play a key role in determining the USD’s trend, with even an in-line reading likely to trigger strong USD appreciation.

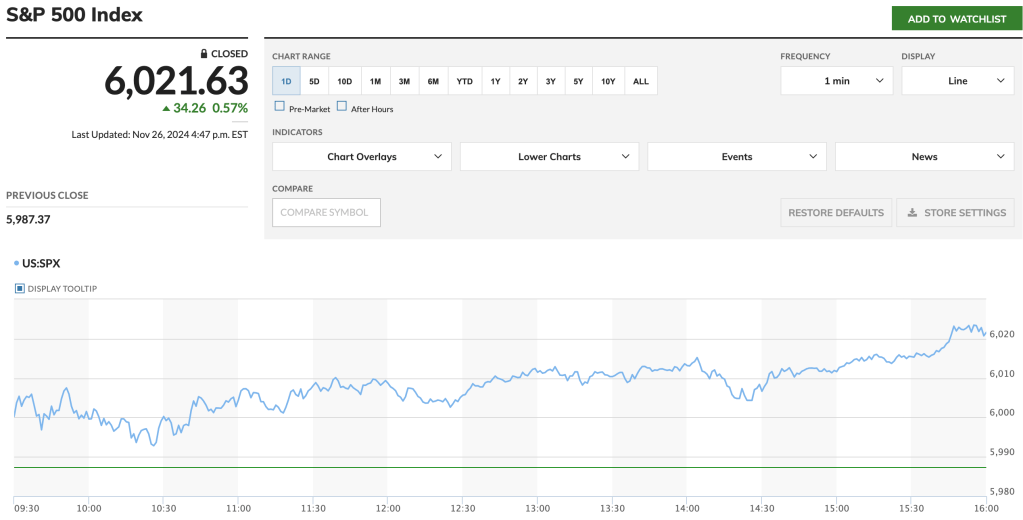

- The S&P 500 closing above 6000 could drive further momentum for equities to reach new highs, especially with no earnings reports scheduled tomorrow and reduced liquidity due to the Thanksgiving week.

FX Markets:

- EUR/USD recovered to yesterday’s close, erasing the euro depreciation that followed Trump’s comments. Germany’s CPI on Thursday (Thanksgiving) and the Eurozone CPI on Friday could provide a clearer view of the struggling Eurozone economy, which has been lagging behind the U.S. in terms of growth.

- USD/JPY has shown resilience this week with the yen appreciating for the second consecutive day, likely driven by safe-haven flows following Trump’s tariff comments, as no news from the BOJ or Trump regarding Japan has emerged; however, I believe the tariff impact on JPY is not fully priced in, and momentum could eventually reverse, leading to a sharp yen depreciation.

- USD/CAD bore the brunt of Trump’s comments on tariffs against Canada, with the pair reaching a four-year high of 1.4175 almost 200 pips more than yesterday’s close. While there was some relief during the U.S. session, it still closed above 1.4050. Canadian Prime Minister Trudeau spoke with Trump afterward and gave a positive comment about finding common ground, though several Canadian officials questioned the rationale, arguing it could be equally harmful to the U.S. Despite CAD trading near four-year lows, it appears the tariffs are not fully priced in, and I believe if they are implemented, CAD could weaken further.

US Equity Markets:

- ANF (Abercrombie & Fitch), BBY (Best Buy), KSS (Kohl’s), DKS (Dick’s Sporting Goods), and BURL (Burlington) all fell after their earnings, with Kohl’s dropping the most at 17%. Other than ANF, which had an EPS surprise of 17%, all reported weaker earnings or a weaker future outlook, pointing to a weaker retail sales outlook and continued weak consumer spending.

- Dell fell nearly 10% in after-market trading after reporting lower-than-expected revenue. HP also dropped 10% in after-market trading due to weaker EPS estimates for the next quarter.

- A common theme was that both Best Buy’s CEO and HP’s CEO stated that the cost of potential tariffs would be passed on to customers, reinforcing market fears of inflationary pressure from Trump’s tariffs.

News Tomorrow(11/27): US Core PCE and US GDP at 8:30 AM, BOE chief economist Pill’s speech at 1:00 PM

Sources: Marketwatch(https://www.marketwatch.com/), , Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/), Sectorspdrs(https://www.sectorspdrs.com/sectorheatmap)

Leave a comment