News Today(11/27): US Core PCE and US GDP at 8:30 AM, BOE chief economist Pill’s speech at 1:00 PM

Highlights:

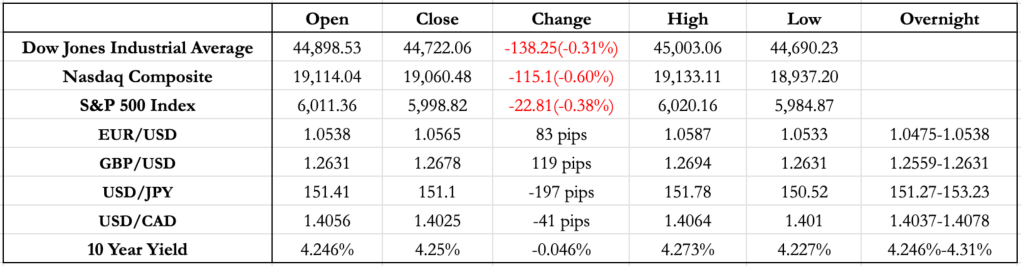

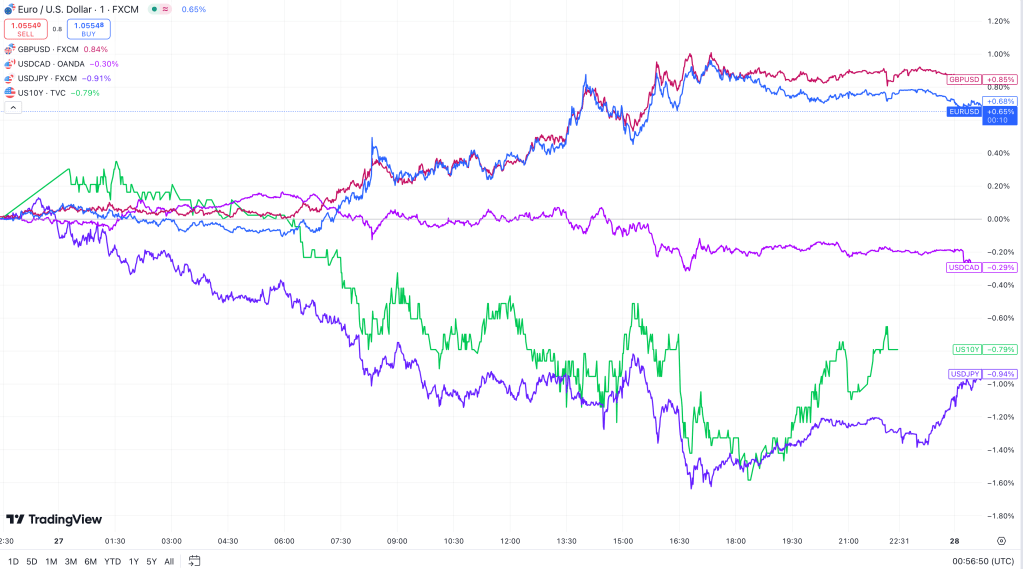

- US yields drove FX markets with the USD experiencing significant depreciation in the overnight period followed by a muted US session.

- The Euro gained momentum after ECB’s Isabel Schnabel remarked that she sees “only limited room for further rate cuts,” pushing EUR/USD higher.

- There was little to no reaction to better-than-expected US GDP and jobless claims data, along with in-line inflation figures. However, the USD weakened after the data digestion, as markets speculated that the Fed might lean toward a rate cut in December due to robust growth, a strong job market, and sticky inflation.

- US 10-year yields have returned to pre-election levels, with bond markets now pricing in a 65% chance of a 25 bp rate cut in December, up from 60% yesterday, pressuring the USD.

- The JPY appreciated for the third consecutive day, with a close-to-close move of nearly 200 pips. This was driven by expectations of a December rate hike in Japan and a potential cut in the US, though the extent of the move appears to be an overreaction.

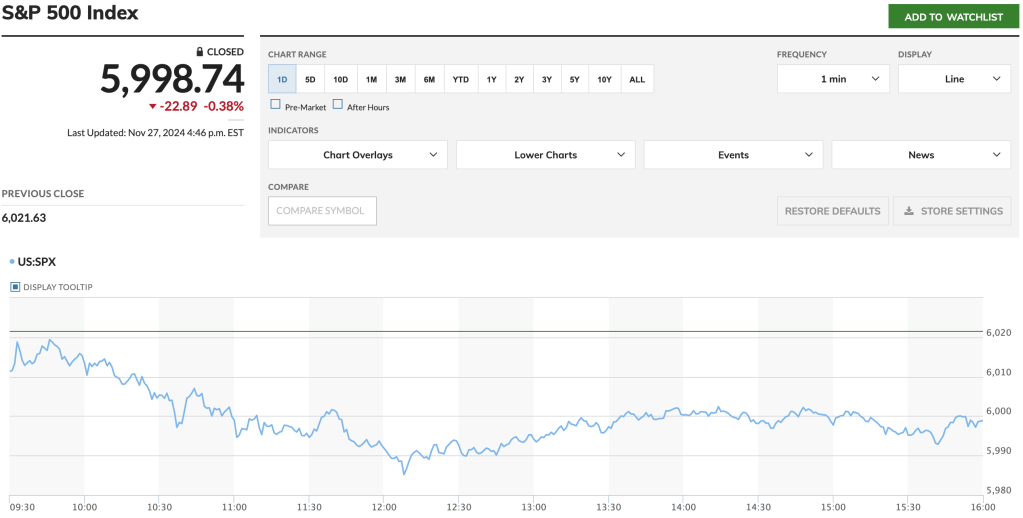

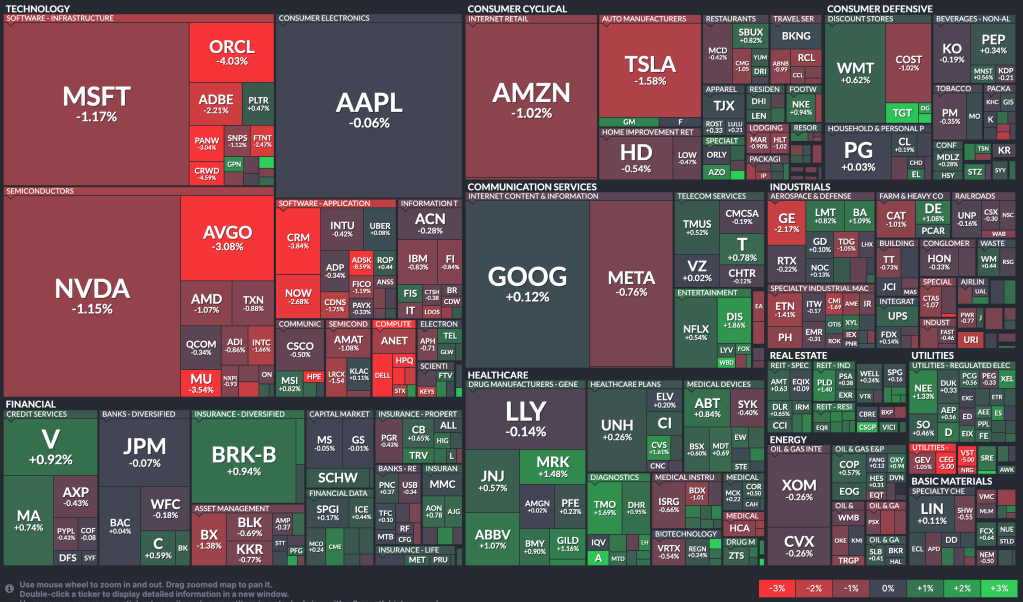

- The S&P 500 ended its six-day winning streak, closing 0.4% lower, weighed down by Big Tech losses. Dell and HP both fell 12% after earnings, dragging down AI and semiconductor-related sectors.

Tomorrow Outlook:

- We saw significant moves across markets today, likely driven by reduced US money liquidity due to the upcoming Thanksgiving weekend. I expect some of these moves to revert to yesterday’s close by Monday, provided there are no major developments in geopolitical tensions or comments from Trump.

News Tomorrow(11/29): Eurozone CPI at 5:00 AM

Sources: Marketwatch(https://www.marketwatch.com/), , Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/), Sectorspdrs(https://www.sectorspdrs.com/sectorheatmap)

Leave a comment