News Today(12/2): Manufacturing PMI for Italy, France, Germany and Eurozone at 3:45 AM, 3:50 AM, 3:55 AM and 4:00 AM respectively, UK Manufacturing PMI at 4:30 AM, ISM Manufacturing PMI at 9:45 AM, Fed Member Bostic Speech at 12:00 PM and Fed Member Waller Speech at 3:15 PM

Highlights:

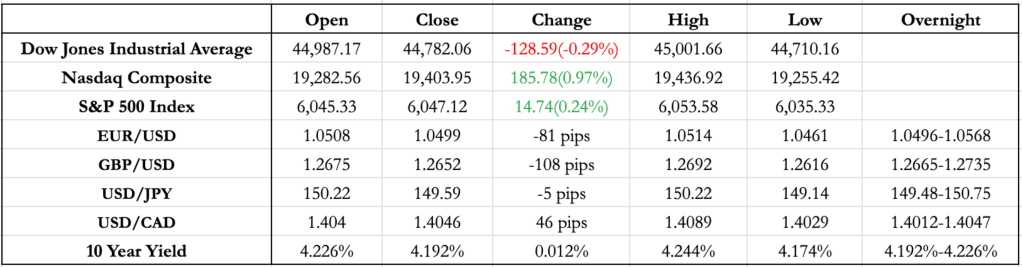

- Weak Europe and UK PMI drove the overnight session, along with concerns about a potential collapse of the French government, leading to EUR and GBP weakening.

- Positive comments by BOJ Governor Ueda regarding interest rate hike, along with rising odds of a U.S. rate cut in December, have supported JPY over the past week, with USD/JPY closing below 150 today.

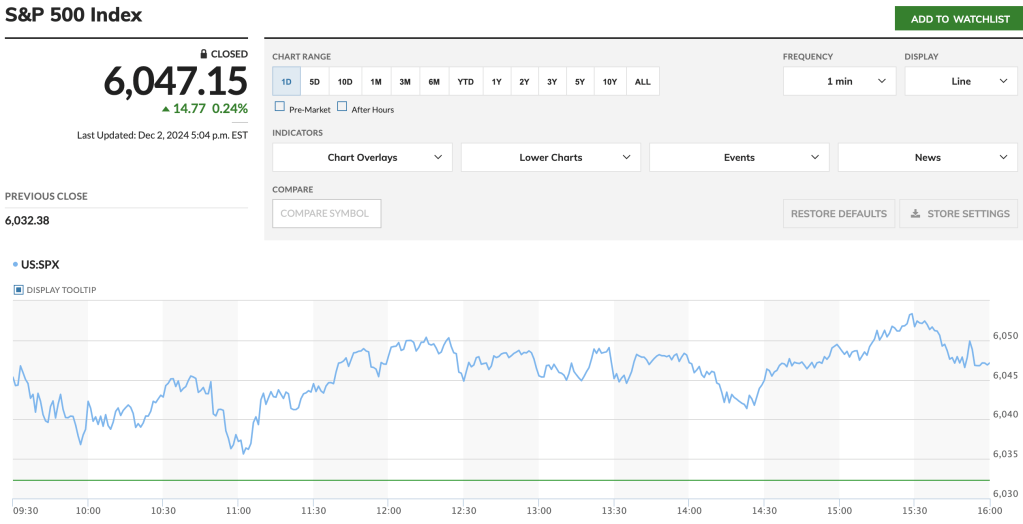

- U.S. PMI came in better than expected, and optimism around a rate cut helped U.S. equities close at new highs.

- Fed member Bostic noted that inflation is not on a clear downward trajectory but sees no chance of it reigniting, suggesting support for a December rate cut.

- Fed member Waller also mentioned he is leaning toward a December cut, depending on incoming data.

- Bonds are now pricing in a 75% chance of a December rate cut, according to the FedWatch tool.

Tomorrow Outlook:

- It will be a busy week with U.S. Services PMI on Wednesday and U.S. Non-Farm Payrolls (NFP) on Friday.

- Strong U.S. growth, combined with the momentum in U.S. equities, could drive a further rally, especially as other major economies continue to struggle.

- USD strengthening may pause if robust U.S. growth persists, but weakness in other economies could still support a stronger USD in relative terms.

FX Markets:

- EUR/USD continues to depreciate due to persistently weak growth data, with the Euro’s brief appreciation on Bostic and Waller’s comments about a U.S. rate cut quickly fading. This highlights a weakening Euro driven more by weak growth differentials than interest rate differentials. If strong U.S. economic data persists, EUR/USD could breach 1.04 again this week.

- USD/JPY has had a strong two-week rally, driven initially by the Israel-Gaza conflict and more recently by the stronger rate differential following the BOJ’s December rate hike. While the interest rate differential favors Japan, its weaker growth outlook could eventually lead to a reversal in USD/JPY, especially after Trump takes US office.

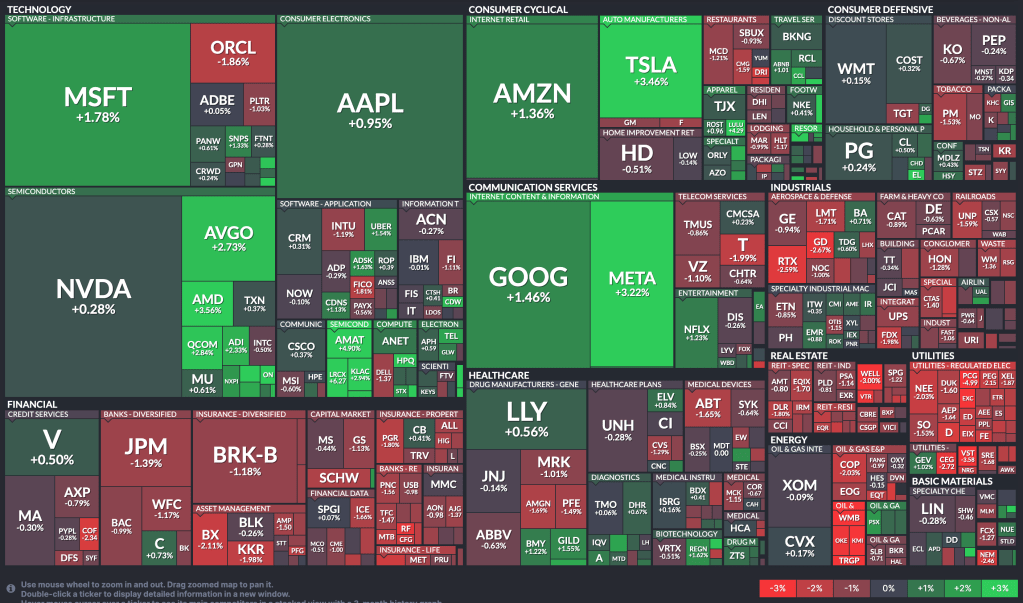

US Equity Markets:

- The rally today in US Equities was led by Big Tech stocks with Tesla leading the pack at 3.5% which can be seen from the Nasdaq closing price.

- Over the past eight years, December has posted positive returns in five out of eight years, with the declines in 2018 and 2022 driven by Fed rate hikes and geopolitical uncertainties – namely the US-China trade war in 2018 and the Russia-Ukraine war escalation in 2022.

News Tomorrow(12/3): US JOLTS at 10:00 AM, Fed’s Kugler’s speech at 12:35 PM and Fed’s Goolsbee’s at 3:45 PM.

Sources: Marketwatch(https://www.marketwatch.com/), , Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/), Sectorspdrs(https://www.sectorspdrs.com/sectorheatmap)

Leave a comment