News Today(12/3): US JOLTS at 10:00 AM, Fed’s Kugler’s speech at 12:35 PM and Fed’s Goolsbee’s at 3:45 PM.

Highlights:

- South Korean President Yoon imposed martial law in the morning, but it was rejected by parliament, prompting the military to storm the National Assembly. However, by 4 PM, President Yoon said he will lift the martial law following the national assembly vote.

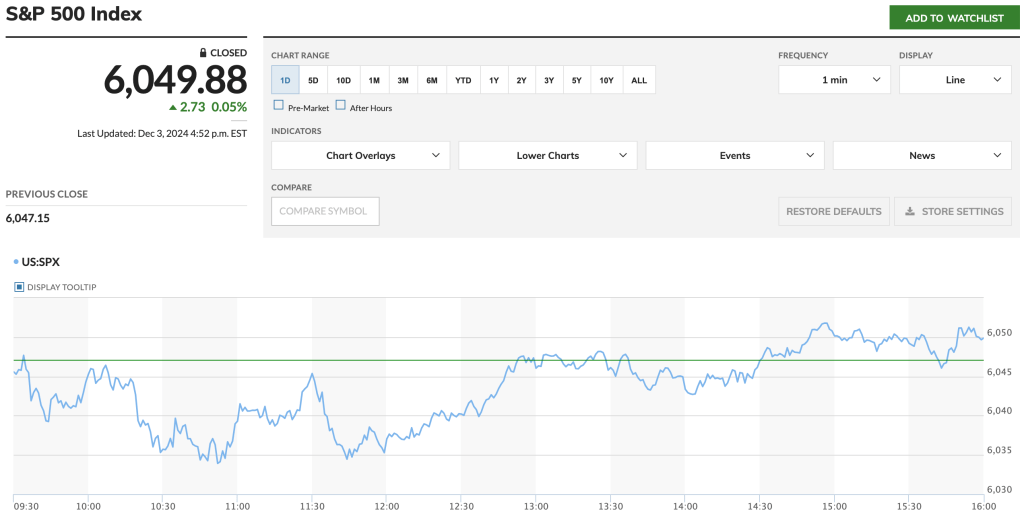

- U.S. equities remained almost unchanged, trading in a tight range, likely positioning ahead of key events: Services PMI, ADP employment change, Powell’s speech tomorrow, and NFP on Friday.

- U.S. JOLTS data came in better than expected (7.74M vs. 7.48M), reinforcing the narrative of a resilient U.S. economy.

- Fed member Kugler stated that inflation appears to be on track to return to the 2% target based on recent data.

- Fed member Daly echoed similar views, adding that a rate cut this month is neither certain nor off the table.

- Fed member Goolsbee suggested that rates could decline significantly over the next year.

- Bonds now price in a 72% chance of a December rate cut, down from 75% yesterday, according to the FedWatch tool.

Tomorrow Outlook:

- This week is packed with data releases and central bank speeches from around the globe.

- The U.S. economy’s strength narrative remains intact, driven by robust growth, inflation, and jobs data. Only a significantly weak print, like August’s NFP, could disrupt this momentum.

- In contrast, global economies continue to struggle, likely supporting USD strength due to the widening growth differential.

- This U.S. strength, coupled with optimism around potential Trump tax cuts, is expected to drive equities higher

News Tomorrow(12/4): European Countries Services PMI at 3:15 AM, 3:45 AM, 3:50 AM, 3:55 AM, Eurozone Services PMI at 4:00 AM, BOE Governor Bailey’s speech at 4:00 AM, UK Services PMI at 4:30 AM, Eurozone PPI at 5:00 AM, US ADP employment change at 8:15 AM, ECB President Lagarde speech at 8:30 AM, US Services PMI at 10:00 AM, ECB President Lagarde speech again at 10:30 AM, Fed Chair Powell Speech at 1:45 PM and Beige book at 2:00 PM

Sources: Marketwatch(https://www.marketwatch.com/), , Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/), Sectorspdrs(https://www.sectorspdrs.com/sectorheatmap)

Leave a comment