News Today(12/4): European Countries Services PMI at 3:15 AM, 3:45 AM, 3:50 AM, 3:55 AM, Eurozone Services PMI at 4:00 AM, BOE Governor Bailey’s speech at 4:00 AM, UK Services PMI at 4:30 AM, Eurozone PPI at 5:00 AM, US ADP employment change at 8:15 AM, ECB President Lagarde speech at 8:30 AM, US Services PMI at 10:00 AM, ECB President Lagarde speech again at 10:30 AM, Fed Chair Powell Speech at 1:45 PM and Beige book at 2:00 PM

Highlights:

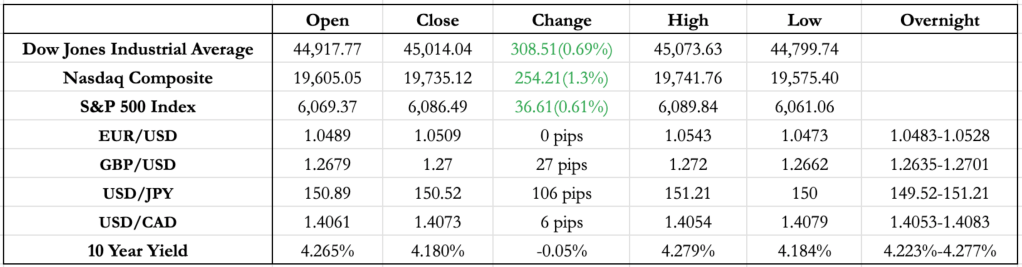

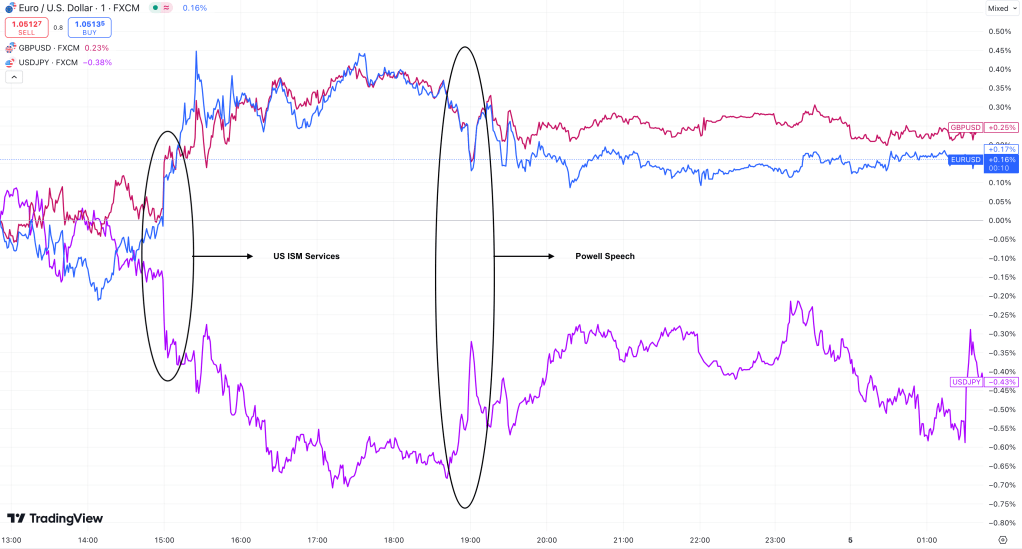

- BOE Governor Bailey mentioned the possibility of four rate cuts next year, causing an initial 30-pip drop in GBP, but the reaction quickly faded as the news was not a major surprise.

- European countries saw mixed Services PMI results, while the Eurozone’s slightly better print may offer some relief to the Euro and ease ECB concerns about growth.

- The U.S. ADP employment change showed a slight miss (146K vs. 150K), but market reaction was muted, given the well-known lack of correlation between ADP and the more significant NFP report due Friday.

- Fed non-voting member Musalem echoed recent Fed members’ comments, noting that inflation remains sticky at 3% and suggesting that the “time may be nearing to consider slowing the pace of rate reductions”.

- U.S. Services PMI missed expectations (52.1 vs. 55.5), marking the first indication of slowing growth. USD depreciated significantly following the release, driving the trend until Powell’s afternoon speech.

- Yields fell on the PMI miss and continued to decline, closing the day down 5bp. The odds of a 25bp rate cut by the Fed in December now stand at nearly 80%, according to the FedWatch tool.

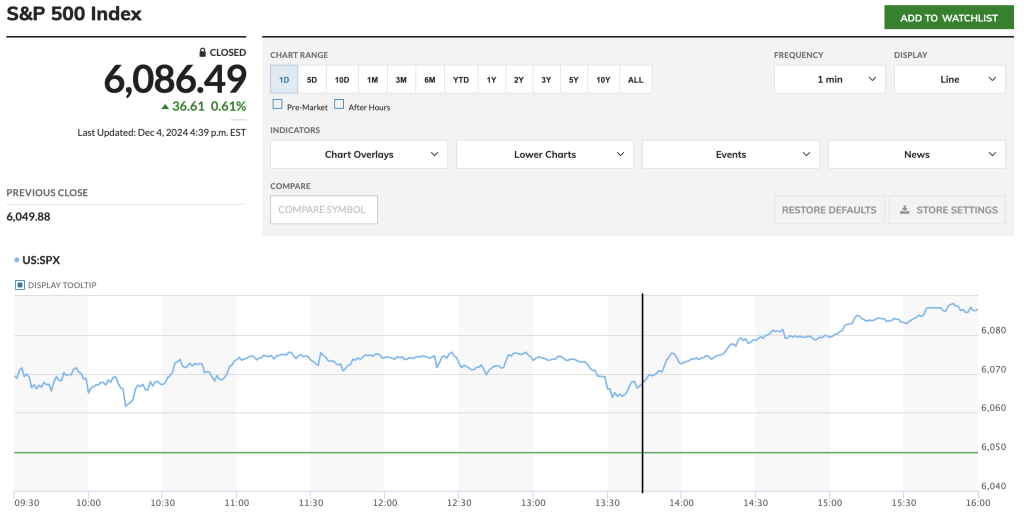

- Powell made optimistic remarks about the U.S. economy, noting stronger-than-expected growth and resilience in the labor market, while acknowledging inflation remains slightly elevated. He avoided commenting on Trump’s tariff policies but emphasized that he is not concerned about Fed remaining independent of the government.

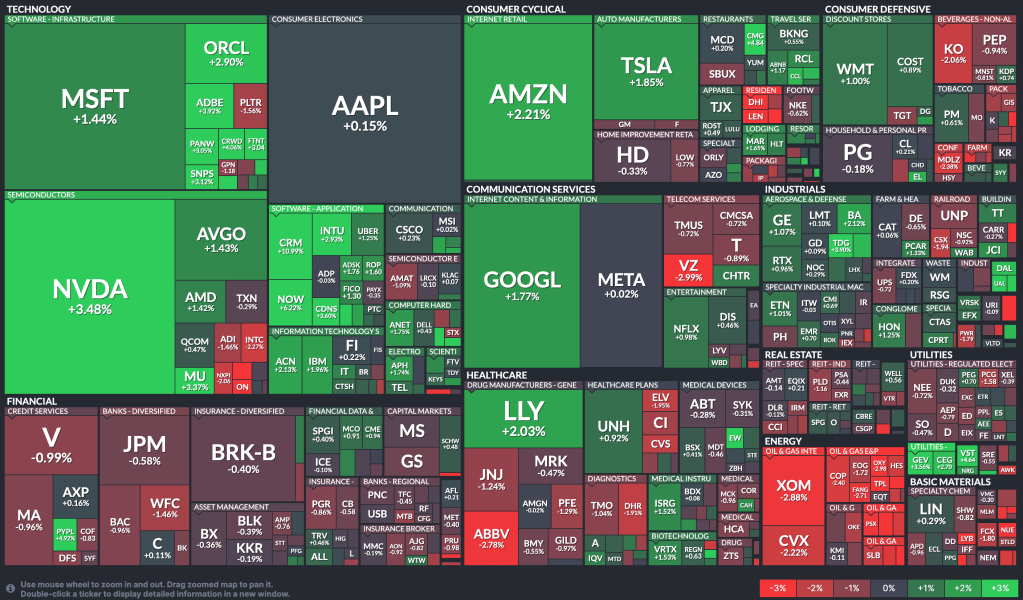

- U.S. equities had a slow open, trading in a tight range despite the PMI miss. However, Powell’s comments spurred a rally, with the Nasdaq leading the gains, closing up 1.35%, marking a 3% weekly gain.

Tomorrow Outlook:

- A 25bp rate cut by the Fed appears to be priced in, as evidenced by a significant drop in yields but minimal movement in G10 currency pairs.

- Growth differentials are now playing a larger role in driving currency markets. While the Eurozone’s slightly better PMI print may offer some relief, the Euro remains under pressure due to the ongoing French government collapse.

- Equity momentum from today is likely to continue since there are no major economic news or earnings reports tomorrow.

- Expect a slow trading day with a tight range, where the opening trend may dictate market direction.

News Tomorrow(12/5): Eurozone Retail Sales at 5:00 AM and US Jobless Claims at 8:30 AM.

Sources: Marketwatch(https://www.marketwatch.com/), , Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/), Sectorspdrs(https://www.sectorspdrs.com/sectorheatmap)

Leave a comment