News Today(12/5): Eurozone Retail Sales at 5:00 AM and US Jobless Claims at 8:30 AM

Highlights:

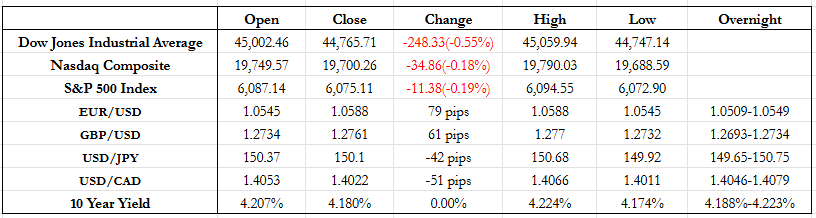

- Eurozone retail sales data was mixed, with month-on-month figures missing expectations but year-on-year results beating forecasts, leading to a muted reaction in FX markets.

- U.S. jobless claims were also mixed: Initial Jobless Claims came in higher than expected (224K vs. 215K), while Continuing Jobless Claims were lower than expected (1.871M vs. 1.91M). Notably, this marks the first increase in initial claims in six weeks, though the market showed no significant reaction.

- BTC surged to 100K after Trump appointed crypto supporter Paul Atkins as the next SEC chair, fueling expectations of crypto-friendly regulation.

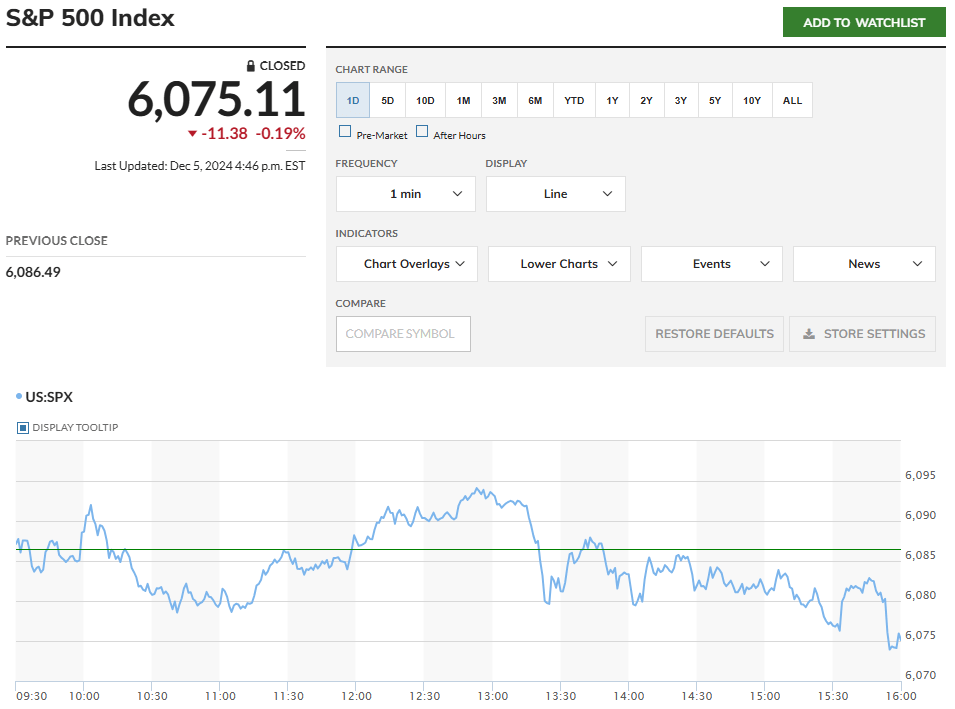

- Yields initially spiked 3bp on the U.S. jobless claims data but ended the day unchanged, reducing the odds of a 25bp Fed rate cut in December to 70%, down from 78% yesterday.

- Tight overnight range for all G10 pairs, except USD/JPY which saw over a 100-pip range, with slight USD weakening spilling into the U.S. session.

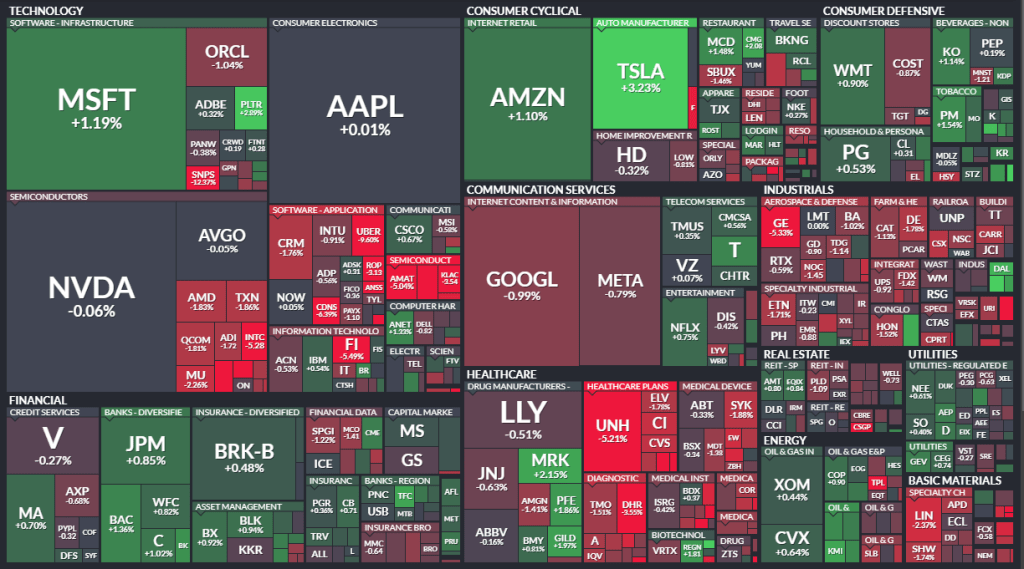

- Tesla rose by over 3% after a Bank of America analyst increased the company’s price target.

Tomorrow Outlook:

- An important GDP print for Europe in the overnight session could bolster positive growth expectations if it meets or exceeds forecasts. Despite the political uncertainty from the collapse of the French government, EUR/USD remains largely unmoved, suggesting this event has already been priced in.

- Tomorrow’s U.S. Non-Farm Payrolls (NFP) report is set to be a major driver for both FX and equities. A result in line with or better than expectations could push U.S. equities toward a >30% return for the year (currently YTD ~29%).

- The odds of a 25bp Fed rate cut in December may remain unchanged unless the data significantly surpasses expectations. Conversely, a weaker-than-expected print could strengthen the case for a cut.

News Tomorrow(12/6): Germany Industrial Production at 2:00 AM, Eurozone Employment change and GBP at 5:00 AM, US NFP at 8:30 AM, US Michigan Consumer Sentiment at 10:00 AM and Fed Speakers at 10:30 AM, 12:00 PM and 1:00 PM

Sources: Marketwatch(https://www.marketwatch.com/), , Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/), Sectorspdrs(https://www.sectorspdrs.com/sectorheatmap)

Leave a comment