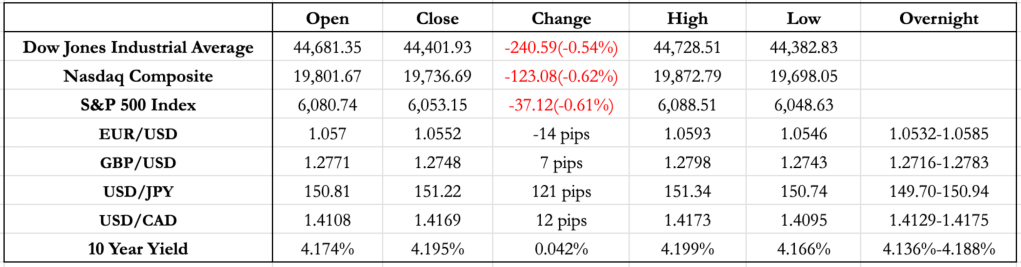

News Today(12/9): Japan GDP at 6:50 PM(12/8), Oracle(ORCL) – 0.58% of S&P500 earnings after market close

Highlights + Tomorrow Outlook:

- Japan’s GDP came in stronger than expected, showcasing a resilient economy. However, the reaction in markets was subdued, with USD/JPY breaking above 151 for the first time this month. The stronger data reinforces the case for a potential BOJ rate hike, which may lend short-term support to the yen. Markets currently assign a 50% probability to a hike, which is going to lead to heightened volatility during the week of the hike.

- The subdued reaction to Japan’s GDP data, combined with little to no impact from the US jobs report on Friday, led to a delayed JPY depreciation in the overnight session, which extended into the US trading hours.

- USD/CAD showed no signs of relief, edging further higher following Friday’s weaker employment data. The odds of a 50bp rate cut on Wednesday (12/11) are now nearing 70%, and if implemented, it could further weaken the CAD.

- Oil prices climbed over 1.5%, driven by geopolitical instability following the ousting of Syrian President Bashar al-Assad and comments by Chinese officials about China’s pivot toward a more accommodative monetary policy.

- The probability of a 25 basis point Fed rate cut in December remains steady at 85%.

- Unless the CPI or the PPI is a significantly better than expected, rate cut by Fed this month is most likely confirmed with FX Market already pricing it in all the major currency pairs.

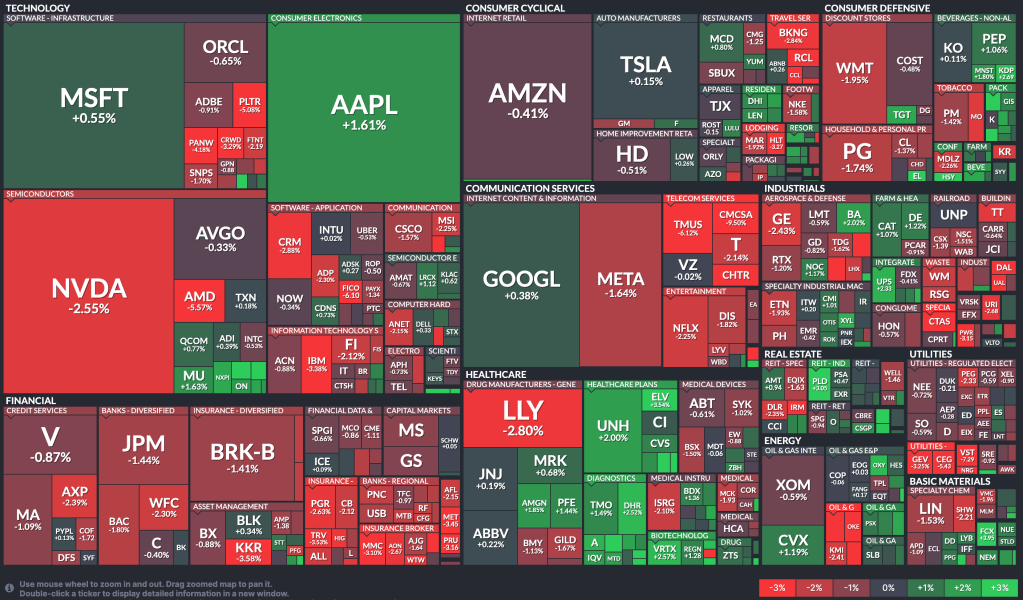

- Nvidia shares declined by 2.5% after China’s market regulator initiated an antitrust investigation against the company, pulling down the broader semiconductor sector.

- Oracle reported weaker-than-expected earnings, missing estimates on both revenue and adjusted profit, resulting in a 5%-7% decline in after-hours trading.

- Even a slight miss on PPI or CPI could trigger a significant drawdown, given the waning momentum in equities across indexes and industries.

- Yields reversed Friday’s gains and more, closing up by 4.3bps today, while trading within a tight range during the US session.

News Tomorrow(12/10): Germany CPI at 2:00 AM and Eurogroup Meeting at 2:00 AM

Sources: Marketwatch(https://www.marketwatch.com/), , Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/), Sectorspdrs(https://www.sectorspdrs.com/sectorheatmap)

Leave a comment