News Today(12/10): Germany CPI at 2:00 AM and Eurogroup Meeting at 2:00 AM

Highlights:

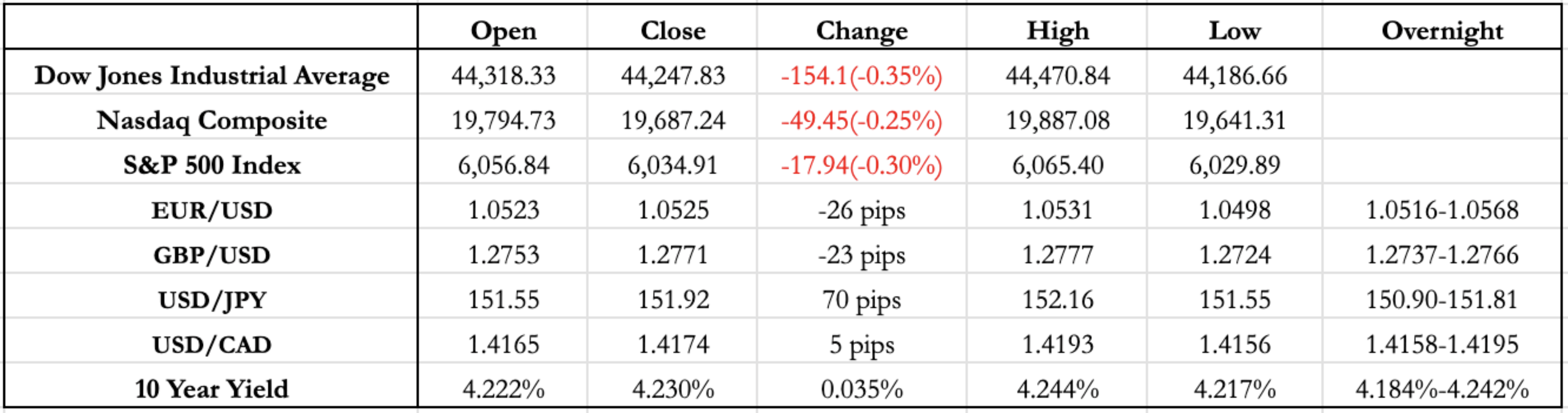

- The 10-year U.S. Treasury yield extended its rally, reaching weekly highs, reflecting strong economic data and expectations of sustained growth. This makes aggressive Federal Reserve rate cuts less likely.

- The probability of a 25 basis point Fed rate cut in December remains steady at 85%. With this move priced in, attention has shifted to next year, where declining odds of an additional 25bp cut in January are pushing U.S. yields higher.

- Germany’s GDP was in line with expectations, but the market reaction was muted, with U.S. yields driving the dollar’s movement in both the overnight and U.S. sessions.

- USD strength persisted, with JPY bearing the brunt despite Japan’s in-line GDP print yesterday. Upcoming rate decisions by the Bank of Canada (BoC) on Wednesday (12/11) and the European Central Bank (ECB) on Thursday (12/12) could prompt further USD depreciation.

- Google’s stock surged over 5% after the company revealed a new quantum computing chip, which they claim could mark a breakthrough in the field.

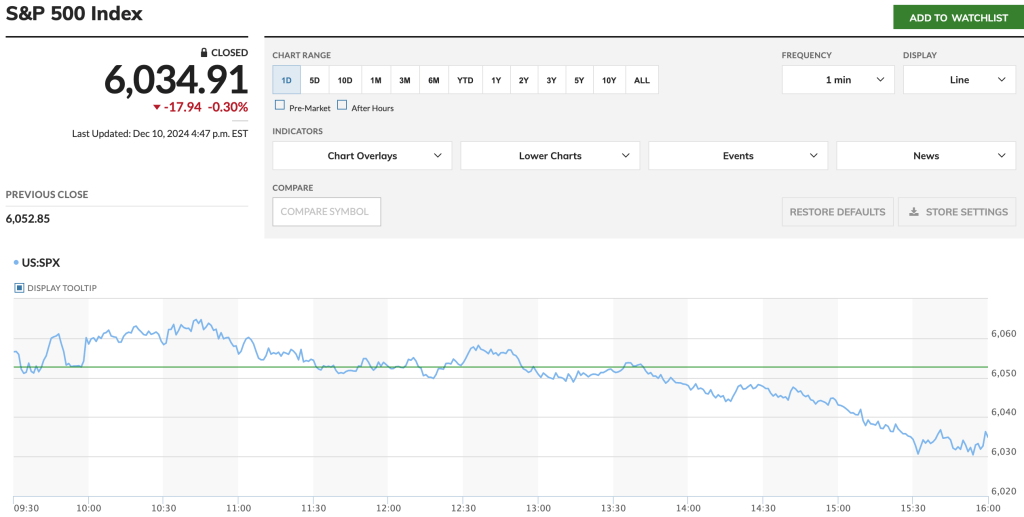

- Equities lost their December gains over the past three days, showing a lack of support to maintain upward momentum. Despite no major news, the market struggled to close higher, with small intraday gains of 0.25%-0.5% getting eroded by close.

- The tight range in FX and equities so far this week suggests a potential breakout over the next two days, with CPI and PPI data tomorrow and the day after.

Tomorrow Outlook:

- EUR/USD briefly broke below 1.05 during the US session but managed to close above it. With US inflation data and the ECB’s rate cut decision scheduled for this week, the strengthening of the USD, combined with inflation numbers that have largely been in-line or exceeded expectations, we could see EUR/USD test the yearly low of 1.0375.

- USD/JPY has been trending higher this week, with the JPY depreciating nearly 200 pips. It broke above the 152 in the US session today, closing at a two-week high. The likelihood of a BOJ rate hike remains uncertain, with current odds standing at 30%. Therefore, we may continue to see a similar range with a slight weakening trend, which could shift or strengthen once a BOJ rate hike is confirmed.

- Equities could experience a final rally before the Christmas holiday season, even if U.S. inflation prints align with expectations this week.

News Tomorrow(12/11): US CPI at 8:30 AM, Bank of Canada(BOC) Interest rate decision at 9:45 AM, BOC Press Conference at 10:30 AM, US Treasury 10-Year Note auction at 1:00 PM and Adobe(ADBE) earnings – 0.47% of S&P500 after market close

Sources: Marketwatch(https://www.marketwatch.com/), , Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/), Sectorspdrs(https://www.sectorspdrs.com/sectorheatmap)

Leave a comment