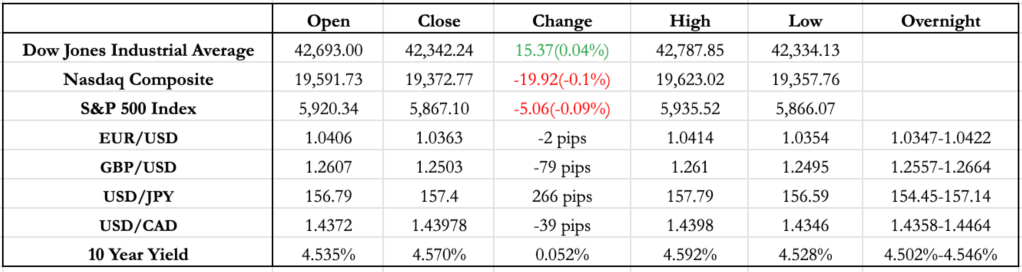

News Today(12/19): BOJ Interest rate decision at 10:00 PM, BOE Interest rate decision at 7:00 AM, US GDP and Initial Jobless Claims at 8:30 AM, Existing Home Sales at 10:00 AM

Highlights:

- The BOJ held interest rates steady while maintaining their cautious stance, emphasizing that future cuts would depend on supportive data. This decision, combined with the Fed’s announcement yesterday, pushed USD/JPY above 157.5 during the trading day.

- Similarly, the BOE kept rates unchanged, as widely anticipated. However, more committee members favored a rate cut than expected, signaling a shift from the BOE’s longstanding cautious easing approach. This added downward pressure on GBP/USD, causing it to break below 1.25.

- U.S. GDP came in stronger than expected (3.1% vs. 2.8%), alongside better-than-expected Jobless Claims. These solid economic indicators reinforced the U.S. growth differential, driving USD appreciation against all major currency pairs during the U.S. session, following a partial recovery in the overnight session.

- The most notable move today was in the 10-year yields, which hit a high nearly 5bp above yesterday’s close. There was no reversion overnight or during the U.S. session, maintaining upward momentum.

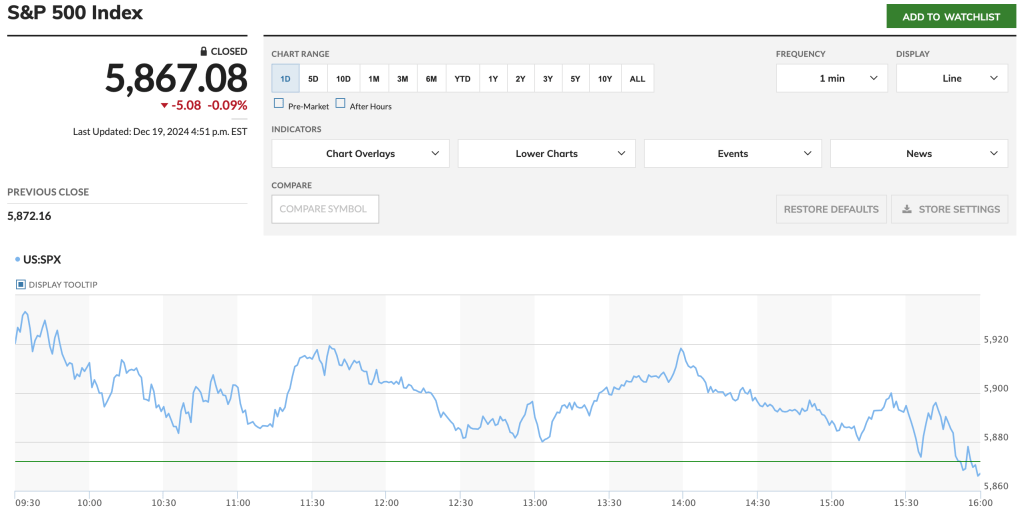

- Equities opened strongly, with all major indices up 0.7%-0.8%, attempting to recover from yesterday’s 3% drop. However, the initial gains proved unsustainable, as markets struggled to hold those levels and erased even modest gains in the final 30 minutes of trading.

Tomorrow Outlook:

- The 10-year yields have climbed nearly 30 basis points this month alone, reaching their highest levels since June. While the initial rise earlier in the month was likely a reaction to the U.S. election and its implications for the Fed’s easing outlook, the continued increase appears to be an overreaction. A pullback in yields could be expected at the start of the new year, once the market has had time to fully digest this news.

- The BOE’s shift away from its cautious easing stance is set to exert additional pressure on GBP/USD, not only from an interest rate differential perspective but also from a growth differential standpoint. With this shift, GBP/USD could potentially test its yearly lows around 1.2350.

- EUR/USD held above yesterday’s low and traded sideways during both the overnight and U.S sessions. However, downside risks remain as the pair continues to hover near 2-year lows, with the growth differential still favoring the USD.

- The BOJ’s decision to hold rates steady, coupled with a hawkish tone regarding the timing of future adjustments, pushed USD/JPY up nearly 300 pips from yesterday’s close. BOJ Governor expressed optimism about the Japanese economy but emphasized the need for more consistent data to align with recent strong growth prints. He also highlighted inflation as a lingering risk. Breaking the 160 level may prove challenging without additional supportive data, but Japan’s CPI release next week (12/26) could provide the momentum needed to surpass 160 before year-end. The last time USD/JPY broke 160 was in July, before the Yen carry trade debacle.

News Tomorrow(12/20): UK GDP at 2:00 AM

Sources: Marketwatch(https://www.marketwatch.com/), , Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/)

Leave a comment