News Today(12/20): UK Retail Sales at 2:00 AM, US Core PCE at 8:30 AM, Michigan Consumer Confidence at 10:00 AM

Highlights:

- UK Retail Sales came in worse than expected (0.2% vs 0.5%), but the market reaction was muted. However, this adds to the growing pressure on GBP/USD, compounded by the BOE’s shift in its conservative easing stance.

- There are increasing concerns about a potential U.S. government shutdown after the House rejected a short-term spending bill last night. Republican leaders made significant changes to an earlier bipartisan deal to align with President-elect Trump’s demands. With the deadline to approve the bill and temporarily fund the government set for Saturday morning, the risk of a shutdown is growing. Despite this, the development has yet to have any noticeable impact on the markets.

- The US Core PCE, which tracks changes in the prices of goods and services purchased by consumers and is the Fed’s preferred inflation gauge, exceeded expectations (0.1% vs 0.2%).

- Throughout the day, several Fed speakers addressed inflation uncertainties and linked it to anticipated policy from the incoming administration. They reiterated expectations of rate cuts next year, with Chicago Fed member Goolsbee (a non-voting member) offering the most optimistic outlook. Some notable Fed speaker comments from the day were:

- Fed’s Goolsbee: “Need to have rates come down somewhere near neutral”; “Think rates will be going down next year”

- Fed’s Williams: “Labor market not adding to inflationary pressures, see room for more rate cuts”; “Don’t think we’re at the neutral rate at all”

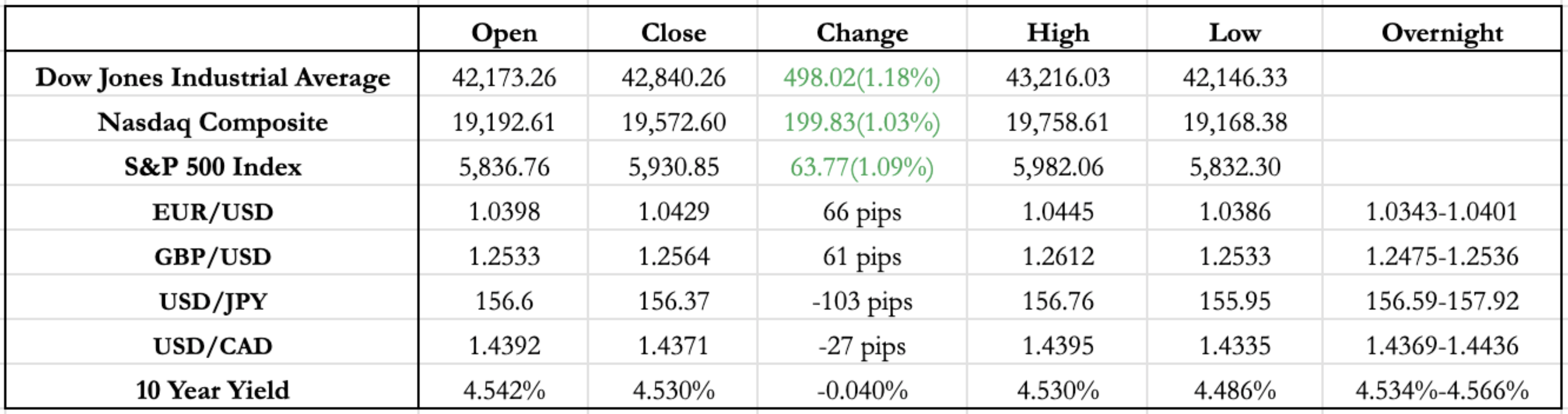

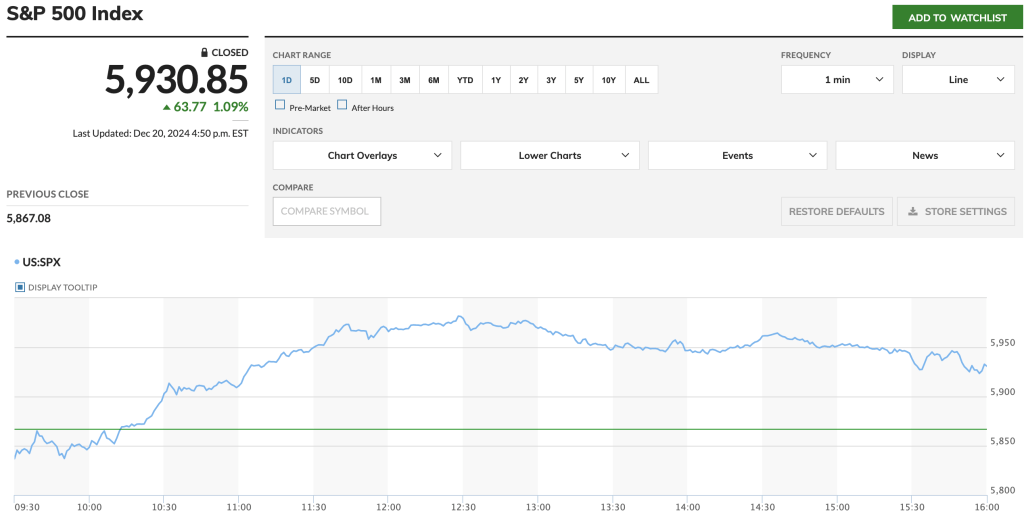

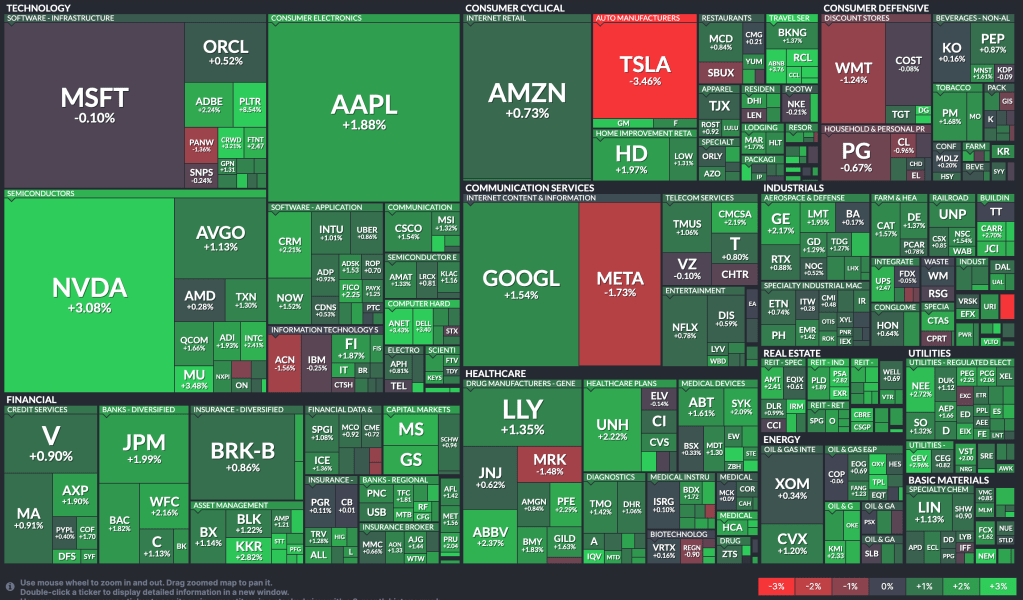

- Equities staged their biggest rally since July, driven by the better-than-expected Core PCE data and dovish Fed commentary, recovering more than 50% of the losses from the FOMC day.

- US yields also cooled significantly, dropping nearly 5bp. This tightening of the interest rate differential contributed to USD depreciation across all major currency pairs.

Tomorrow Outlook:

- With next week being Christmas week, trading is likely to be slow, with minimal significant trend moves expected.

- The optimism fueled by better-than-expected PCE data and dovish comments from Fed speakers could carry into the start of the new year, especially with no major news or earnings scheduled for the remainder of the year.

News Tomorrow(12/23): UK GDP at 2:00 AM

Sources: Marketwatch(https://www.marketwatch.com/), , Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/)

Leave a comment