News Today(12/20): UK GDP at 2:00 AM

Highlights:

- The U.K. GDP print came in lower than expected (0% vs. 0.1%) but elicited a muted market reaction. This, combined with yesterday’s weak U.K. Retail Sales data, adds to the mounting pressure on GBP/USD, further compounded by the BOE’s shift in its conservative easing stance.

- Tight ranges persisted across all major FX currency pairs, with no clear trends emerging overnight or during the U.S. session. Liquidity remained intact for all pairs, but looked like with limited trading activity.

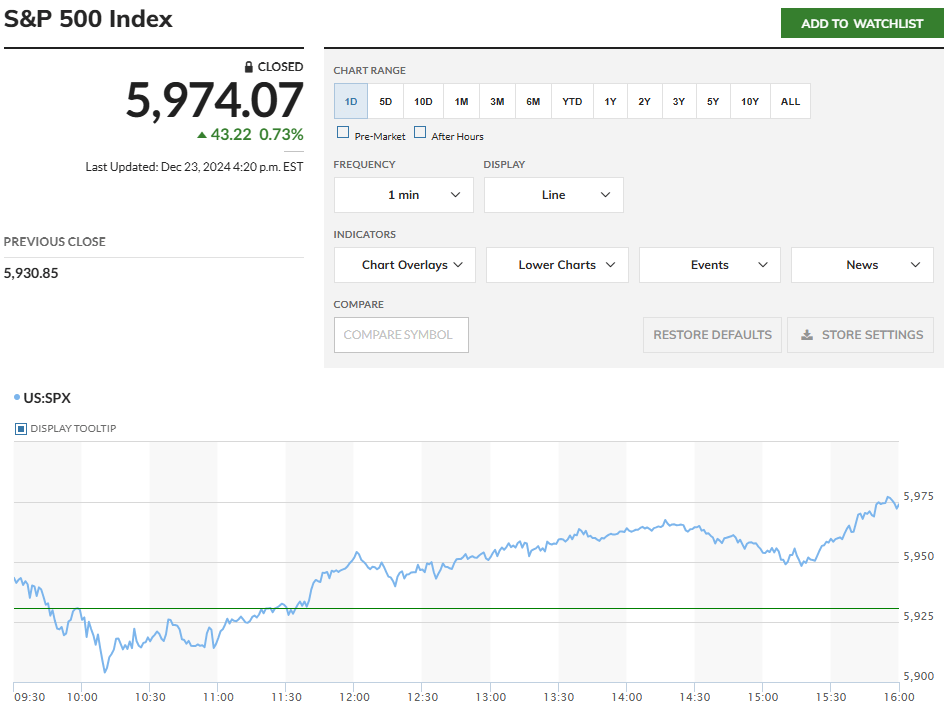

- Equities continued their rebound after the 3% drop on FOMC day, driven primarily by gains in the Mag-7 and other tech stocks, while small-caps have yet to recover from their drawdown. Lilly(LLY) was one of the biggest winner today after weight-loss drug was approved for sleep apnea.

- US Yields remain the standout story post-FOMC. While other assets, particularly FX and Equities, have retraced almost 50% of their moves back to pre-FOMC levels, yields continue to climb higher. Not even the optimistic rate easing comments from Fed members on Friday could halt this trend. The US 10-year yield is now up nearly 40bps this month.

Looking Forward:

- With no major news expected until the start of next year, I anticipate markets will trade sideways for the remainder of the year. While the S&P 500 might attempt to break 6000 again, it will likely fall short due to a lack of momentum.

- US yields have been climbing steadily since the FOMC meeting, with the bond market now pricing in just one rate cut next year, compared to the two indicated in the Fed’s dot plot. Currently, there’s a 90% probability priced in for no rate cut at the January 29 meeting. However, this outlook could shift significantly if no major policy changes related to tariffs occur after President-elect Trump takes office on January 20. While Fed officials, including Powell, did not explicitly cite tariffs as an inflationary risk, it was a key underlying factor in their cautious stance. If significant tariff-related policies fail to materialize, the Fed may reconsider its position.

- Among the major currency pairs, GBP/USD appears poised to depreciate further, as much of the recent weak economic data has yet to be fully priced in.

- USD/JPY breached 157.5 following the BOJ’s decision to hold rates steady. With Japan’s CPI data set to release on Thursday (12/26) after the close, the pair could gain further momentum to test 160. Even an in-line or slightly weaker CPI print could intensify pressure on the JPY, as it would likely diminish the chances of a BOJ rate hike in January.

News Tomorrow(12/23): Christmas Eve

Sources: Marketwatch(https://www.marketwatch.com/), , Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/)

Leave a comment