News Today(1/2): Spain Manufacturing PMI at 3:15 AM, Italy Manufacturing PMI at 3:45 AM, Germany Manufacturing PMI at 3:55 AM, Euro Manufacturing PMI at 4:00 AM, US Jobless Claims at 8:30 AM, US Manufacturing PMI at 9:45 AM

Highlights:

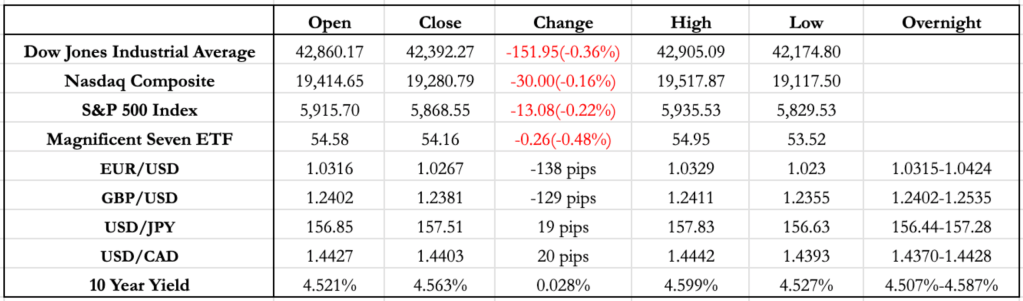

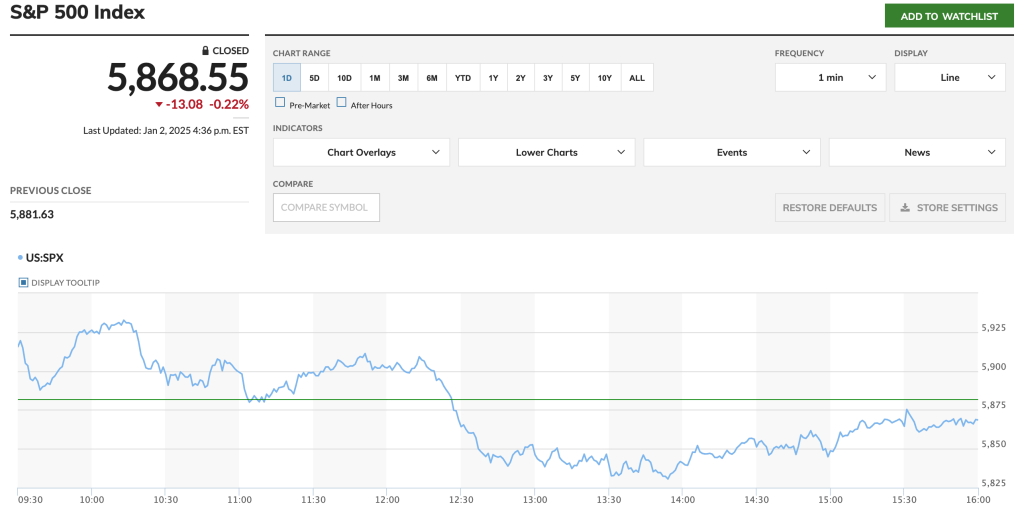

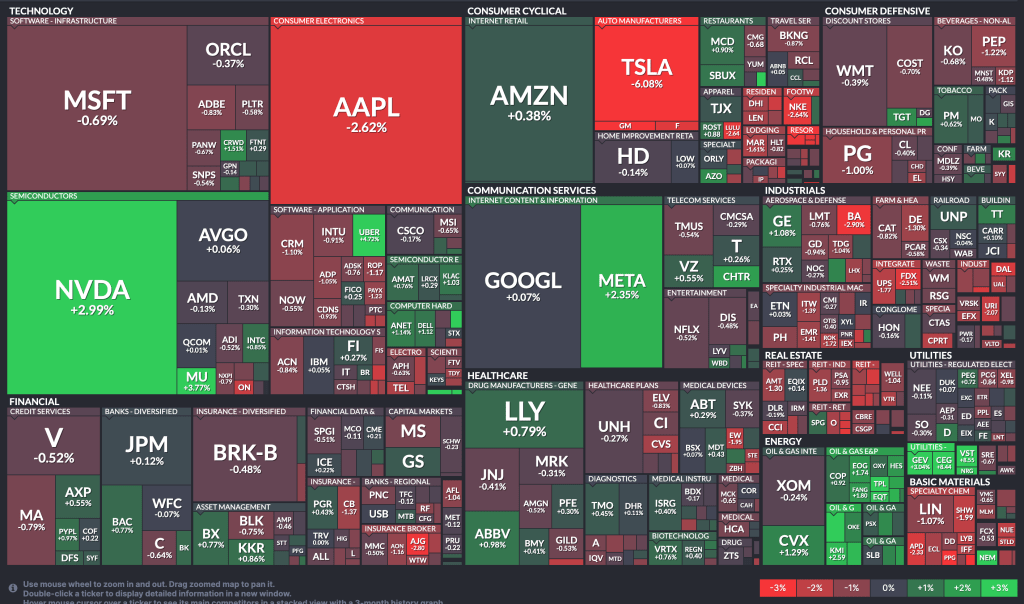

- Equities closed slightly lower today after an attempted bounce in the morning, following last week’s sharp 3% drawdown. The drawdown last week appeared to be driven by heavy selling flows in a thin liquidity environment, rather than any new information or catalyst. Similarly, today’s session saw some buying interest early on, but the lack of follow-through and broader support led to a reversal, with the market ultimately ending the day in the red.

- The dollar strengthened significantly against all major pairs, with the Euro and GBP taking the biggest hit, both losing over 100 pips. While there wasn’t a major news driver, the moves coincided with in-line Euro PMI, a hotter-than-expected UK Housing Price Index, and strong U.S. data, including better-than-expected PMI and stronger jobs numbers.

- Unlike the Euro and GBP, the Yen has held its ground with minimal movement over the past three weeks following the BOJ’s decision to keep rates unchanged. This suggests that the interest rate differential is already fully priced in, and the lack of intervention from the Japanese government during this period reinforces this view.

- Tesla experienced its largest drawdown in three weeks and closed below $400 after weak delivery data, marking the first time in a decade that the company has missed its delivery estimates.

Outlook:

- With in-line Euro inflation and growth data, combined with the ECB’s hawkish stance, EUR/USD faces increased pressure and could reach parity (1.0) this month, especially with key U.S. data releases like CPI, PPI, and NFP scheduled for next week.

- The BOE’s recent shift from its long-standing hawkish stance to a more dovish outlook, marked by a larger-than-expected number of members voting for a rate cut (1 vs. 3), adds further downside pressure to GBP/USD. The BOE’s dovish shift, combined with weak economic data, continues to weigh on GBP/USD. If the pair breaks the yearly low of 1.23, it could see a sharp drop toward 1.20 in short order.

- The U.S. equities market is clearly still operating in a lower liquidity environment. However, with key economic data releases scheduled next week and the potential for year-start institutional buying flows, we could see a solid 3%-4% rebound. That said, it’s worth noting the significant outflows from U.S. equities in December-this creates a scenario where even slightly weaker data, despite improved liquidity, could trigger a sharper 5%-7% drawdown.

News Tomorrow(1/3): Germany Unemployment rate at 3:55 AM, ISM Manufacturing PMI at 10:00 AM, ECM Member Lane & Fed Member Barkin Speech at 11:00 AM

Sources: Marketwatch(https://www.marketwatch.com/), , Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/)

Leave a comment