News Today(1/6): Eurozone Services PMI at 4:00 AM and Germany CPI at 8:00 AM

Highlights:

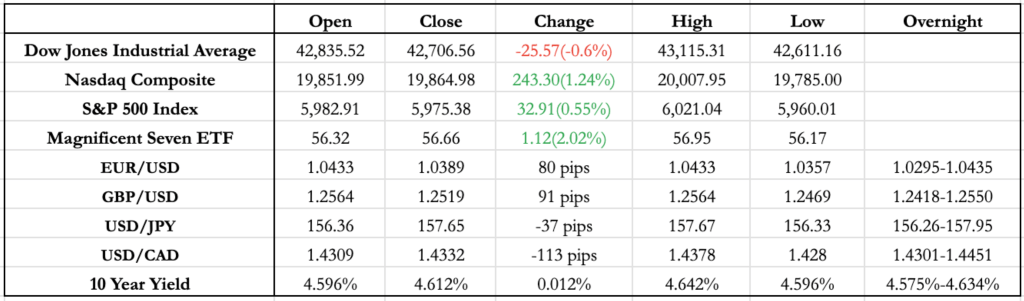

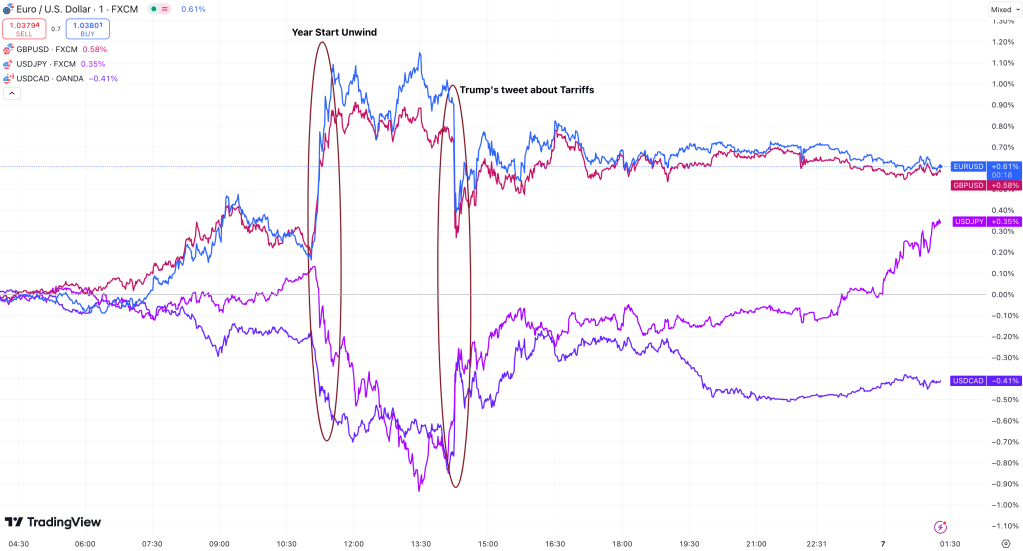

- As the first full trading week began and liquidity returned to normal, FX pairs made a strong recovery against the USD around 5 AM. This followed Friday’s 100-pip USD rally, which happened without any major news.

- President-elect Trump called the Washington Post’s report on tariffs “wrong,” leading to a sharp rise in the USD just 15 minutes before the market opened.

- Michael Barr announced that he is stepping down from his role as the Fed’s Vice Chair of Supervision. He did not provide a specific reason, but I would like to think it had something to do with his appointment to the position by President Biden. However, he confirmed that he will remain a Fed member until the end of his term in 2032.

- While the Eurozone Services PMI came in roughly in line or slightly better than expected, the significantly weaker CPI is likely to exert downward pressure on the Euro.

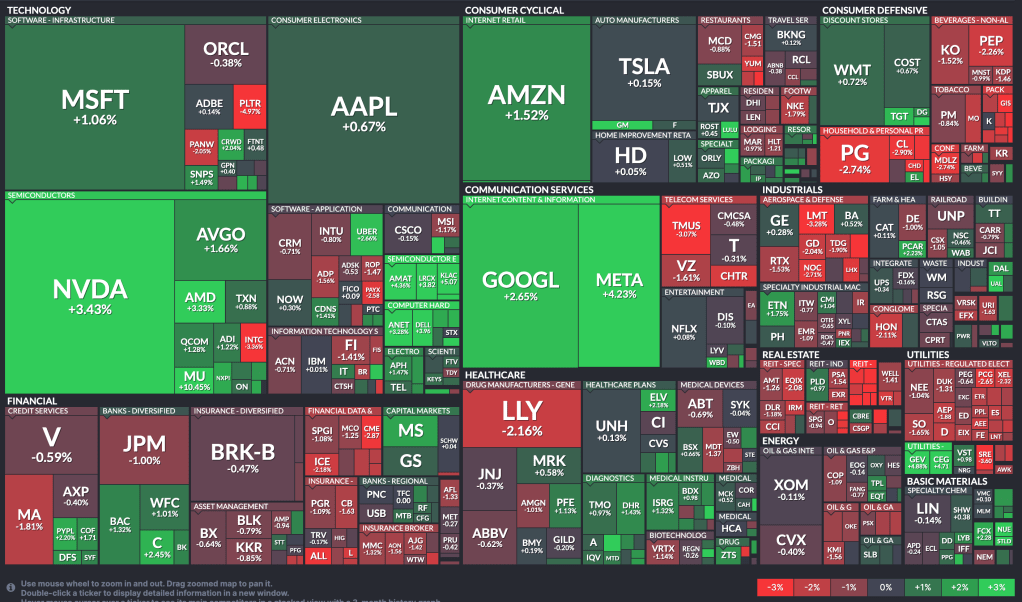

- Equities extended their year-start rally, picking up from Friday’s momentum. The S&P 500 briefly breached the $6000 mark during the session but lacked the volume and momentum to sustain it, giving back half of its gains by the close.

- Nvidia hit an all-time high, finishing just below $150. Once again, the rally was driven by mega-cap stocks, as reflected in the strong performance of the Mag-7 index(MAGS).

Outlook:

- Germany’s CPI, being one of the first European countries to report, came in higher than expected. Along with the ECB’s dowish stance on rate easing, this will likely continue to put pressure on EUR/USD, potentially pushing it to breach parity (1.0).

- Compared to other major FX pairs, USD/JPY has been the most stable, trading within a 100-pip range. With no new developments or comments from the BOJ on a potential rate hike, this week’s US data releases will likely decide whether the pair breaks the 156-158 range. Given the recent strong US data, I believe it’s more likely that USD/JPY will breach 160 before it drops to 155.

- It seems that institutional buying flow has yet to fully penetrate the market, as reflected in the volumes. With a jam-packed week ahead, even an in-line print could push Equities higher, potentially breaking through the 6099 level.

News Tomorrow(1/7): Eurozone CPI & Unemployment rate at 5:00 AM, ISM Services PMI & US JOLTS Jobs Opening at 10:00 AM

Sources: Marketwatch(https://www.marketwatch.com/), , Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/)

Leave a comment