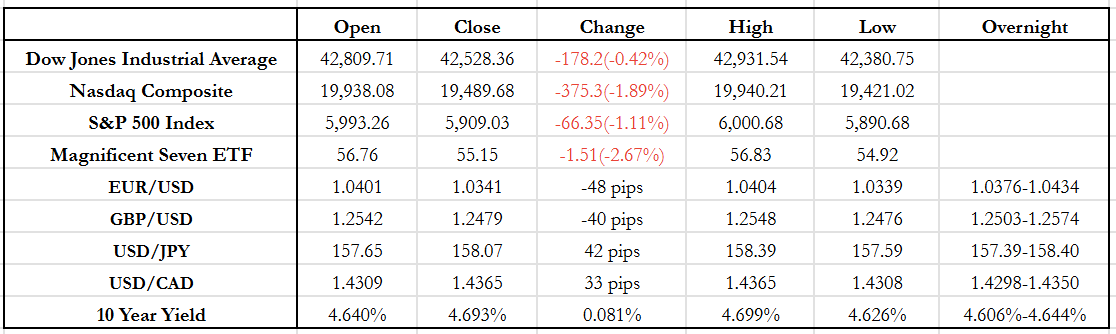

News Today(1/7): Eurozone CPI & Unemployment rate at 5:00 AM, ISM Services PMI & US JOLTS Jobs Opening at 10:00 AM

Highlights:

- The Eurozone CPI data came in as expected but remains above 2.5%, pulling EUR/USD lower during the overnight session.

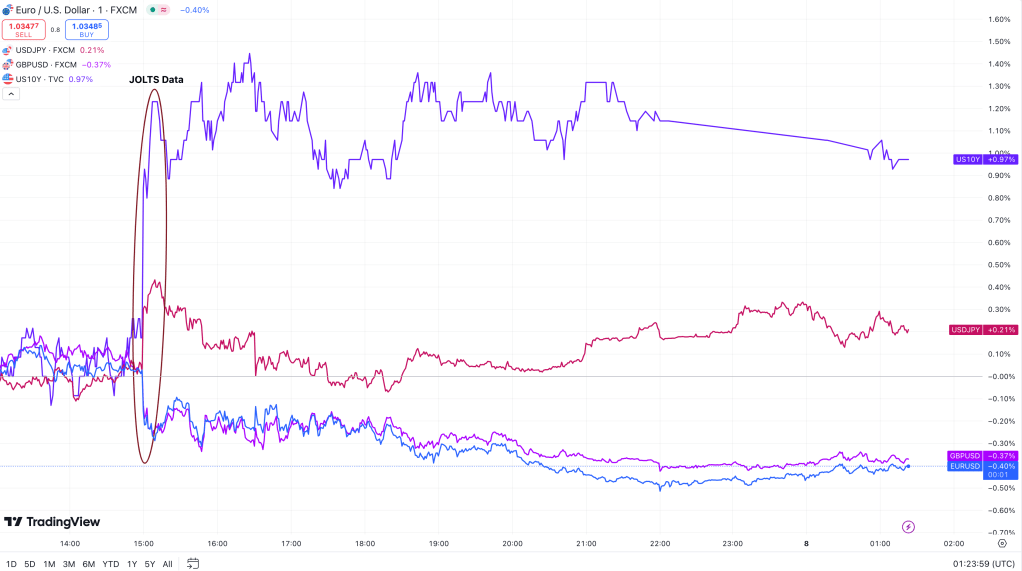

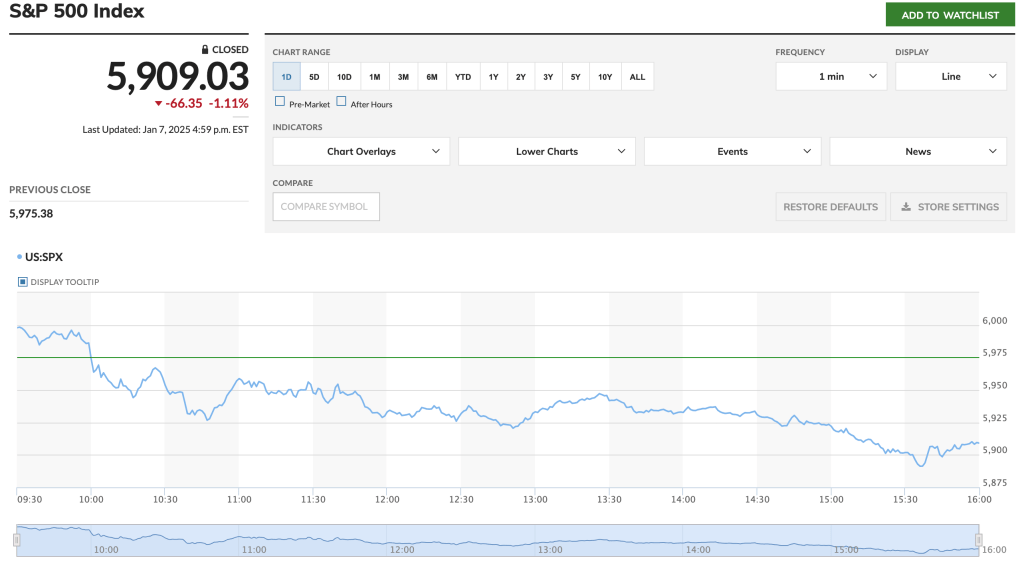

- In the U.S., the JOLTS Job Openings report surprised to the upside (8.1M vs. 7.7M), accompanied by better-than-expected Services PMI figures. This reinforces the likelihood of a Fed rate pause this month and led to immediate USD strengthening, setting the tone for the day. The strong data also pushed the 10-Year Treasury yield to its highest level since May of last year.

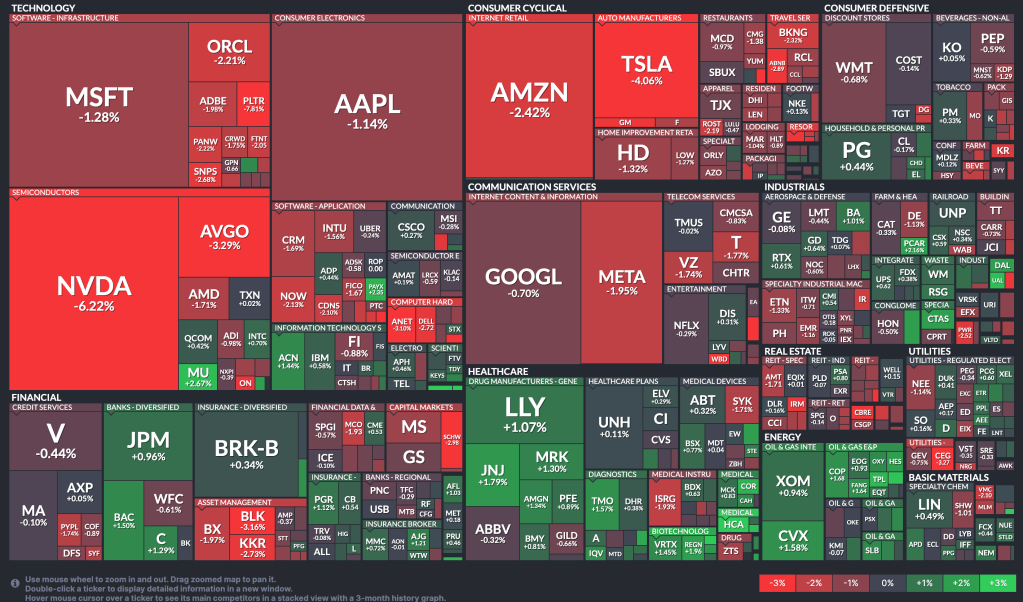

- Meanwhile, Mega-Cap stocks, primarily the Mag-7, saw a pullback for the first time this year, giving back over 50% of their early-year gains as markets adjust expectations for potential interest rate cuts later this year.

- The plot above illustrates that U.S. 10-Year Treasury Yields experienced a significant spike following the release of the JOLTS Job Openings and U.S. Services PMI data, maintaining those elevated levels through the close. According to the FedWatch tool, this data marginally increased the probability of only one rate cut this year by 0.7%. However, the 8 basis point jump in 10-Year Yields appears to be an overreaction in this context.

- Trump reaffirmed tariffs on Canada and Mexico during his press conference from Mar-a-Lago. He also stated that he would reverse Biden’s recent ban on offshore energy drilling in 625 million acres of federal waters as soon as he takes office.

Outlook:

- Compared to other major FX pairs, USD/JPY has been the most stable, as I highlighted yesterday. This is evident in the chart above, where the pair recovered most of its value after the initial reaction to the JOLTS data release. This indicates strong resistance at the 158 level. However, given the strength of the US economy, the hawkish Fed outlook on interest rates, and the lack of clear signals from the BOJ regarding potential hikes, we are likely heading toward the 160 level this week.

- The Eurozone CPI data released today met expectations but remains well above the ECB’s 2% target. Adding to the pressure, Germany’s CPI, which came in higher than anticipated yesterday, underscores persistent inflation challenges. Coupled with the ECB’s dovish stance on rate easing and the resilience of the U.S. economy, the downward pressure on EUR/USD is likely to persist, increasing the probability of a breach of parity (1.0).

- In contrast to Euro, GBP/USD has shown slightly more resilience than the Euro, though it continues to face significant downward pressure due to the BOE’s recent dovish shift in monetary policy. The 1.23 level has been a strong support since last year. However, consistently better-than-expected US growth data could result in a break below this level, potentially leading to a sharper depreciation in GBP/USD.

News Tomorrow(1/8): Germany Retail Sales at 2:00 AM, Eurozone PPI at 5:00 AM, US ADP Employment Change at 8:15 AM, Fed Member Waller speech at 8:30 AM and FOMC minutes at 2:00 PM

Sources: Marketwatch(https://www.marketwatch.com/), , Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/)

Leave a comment