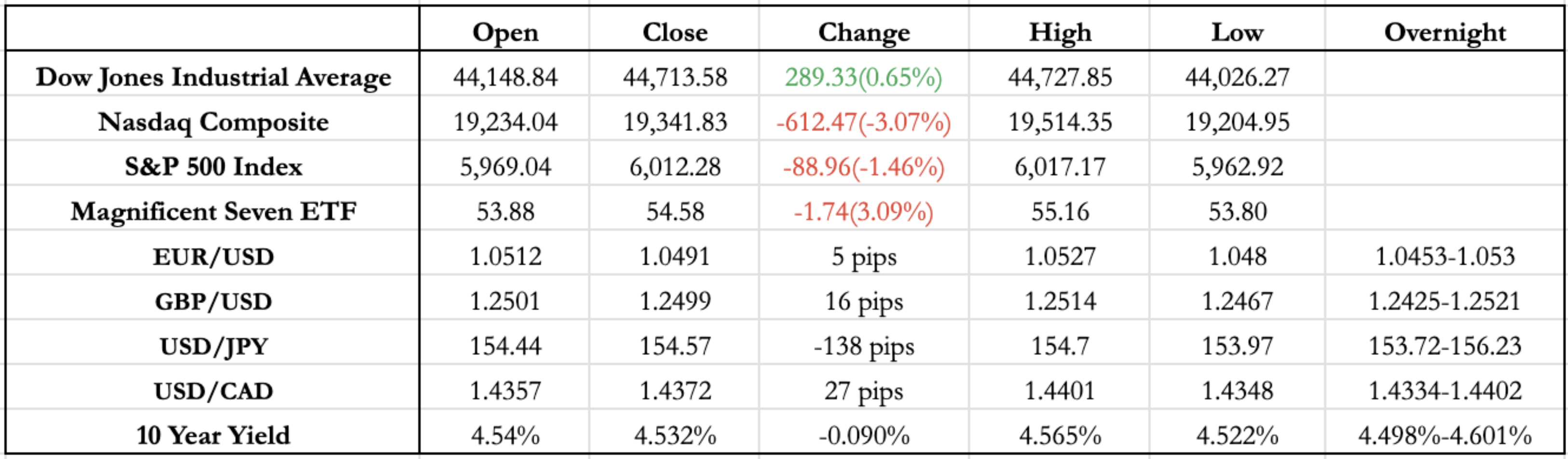

News Today(1/27): US New Home Sales at 10:00 AM

Highlights:

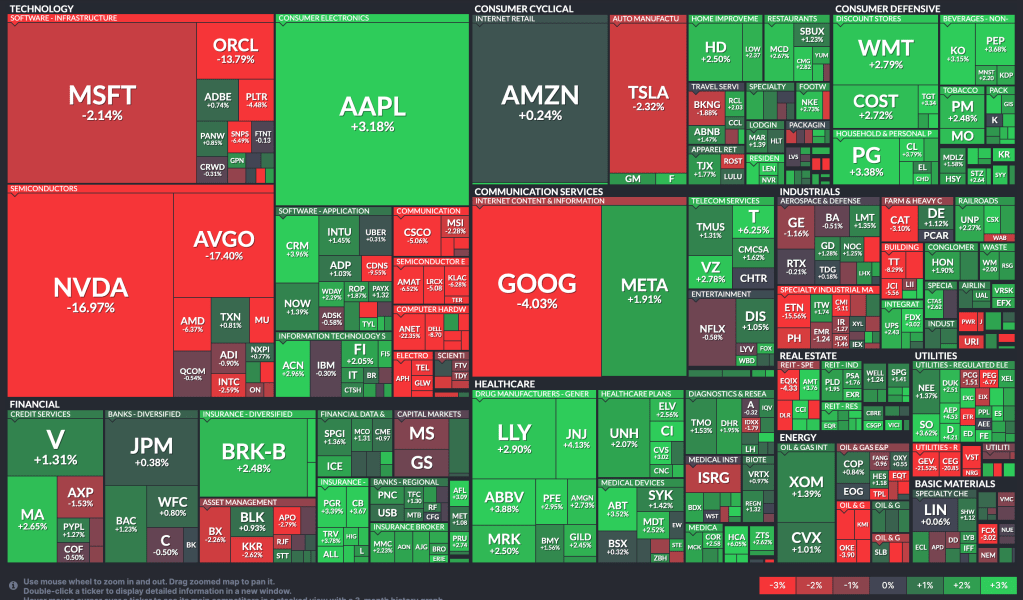

- DeepSeek, a Chinese version of ChatGPT that uses lower-performing Nvidia chips and significantly less data, caused a massive sell-off today after becoming the most downloaded app on the App Store.

- Nvidia, which had its best year last year due to increased demand for chips driven by the AI boom, saw its biggest drawdown to date, dropping 17%. Broadcom (AVGO), another American chip manufacturer, was also hit hard, ending the day down 18%. Oracle (ORCL) fell 14%, as it is part of the $500 billion Stargate AI project launched by the President last week.

- The drop in yields, combined with the tech sell-off, led to a strong day for Consumer Defensive stocks and Utilities.

- In FX markets, USD/JPY strengthened, gaining 100 pips today after a similar move on Friday. This followed the BOJ’s 25bp hike and hawkish tone, signaling readiness to raise rates further. However, BOJ Governor Ueda did not provide a timeline for the next hike.

- There were no comments from the President-elect today.

Outlook:

- The Fed decision is on Wednesday, but the focus will likely shift to the FOMC press conference, as the market has already priced in nearly 100% certainty of a rate pause this month.

- Today’s sell-off in tech stocks is understandable, given the premium baked into the sector from AI-driven optimism, which has also been reflected in semiconductor stocks. However, considering the current political environment and the U.S.’s firm stance on restricting semiconductor exports to China, along with DeepSeek’s relatively small market exposure compared to ChatGPT (which has been live for over six months), there’s a strong chance of a bounce back this week. This could be further supported by optimistic comments from Fed Chair Powell on Wednesday.

- In the Eurozone, recent economic data has been in line with expectations, but CPI remains above the 2% target (at 2.4%), while GDP growth lags significantly at 0.4% – a stark contrast to the U.S.’s stronger figures. The ECB’s shift to a more dovish stance hasn’t helped EUR/USD either, further pressuring the interest rate differential. Although EUR/USD is trading 300 pips above its yearly low of 1.0180, the risk of the Euro breaking parity (1.0) remains high due to weaker economic fundamentals and the ECB’s dovish outlook.

- Compared to other global economies, Japan has not been as prominently targeted by the President for tariffs, which has allowed its currency to remain relatively firm. At the same time, there has been no intervention by the BOJ or the Japanese government to support the Yen over the last two months. This strengthens the case for USD/JPY to appreciate further, especially if the Fed maintains its hawkish stance.

- After the initial two days of volatility following the inauguration, USD/CAD has been fairly stable, showing little reaction to any news about tariffs. It has traded within a narrow 100-pip range of 1.43-1.44 throughout the past week, with no clear trend emerging.

News Tomorrow(1/28): ECB President Lagarde Speech at 12:00 PM, BOJ Monetary Policy minutes at 18:50 PM

Sources: Marketwatch(https://www.marketwatch.com/), , Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/)

Leave a comment