News Today(1/29): BOE Governor Bailey Speech at 9:15 AM, BoC Interest rate decision at 9:45 AM, BoC Press Conference at 10:30 AM, Fed Interest rate decision at 2:00 PM, FOMC Press Conference at 2:30 PM, Meta(2.82% of S&P500), Tesla(2.18% of S&P500), Microsoft(6.34% of S&P500), and IBM(0.41% of S&P500) Earnings after market close

Highlights:

- The Bank of Canada (BoC) cut rates by 25bps, which was in line with expectations. However, the noteworthy point was the BoC citing US proposed tariffs as one of the reasons behind their decision.

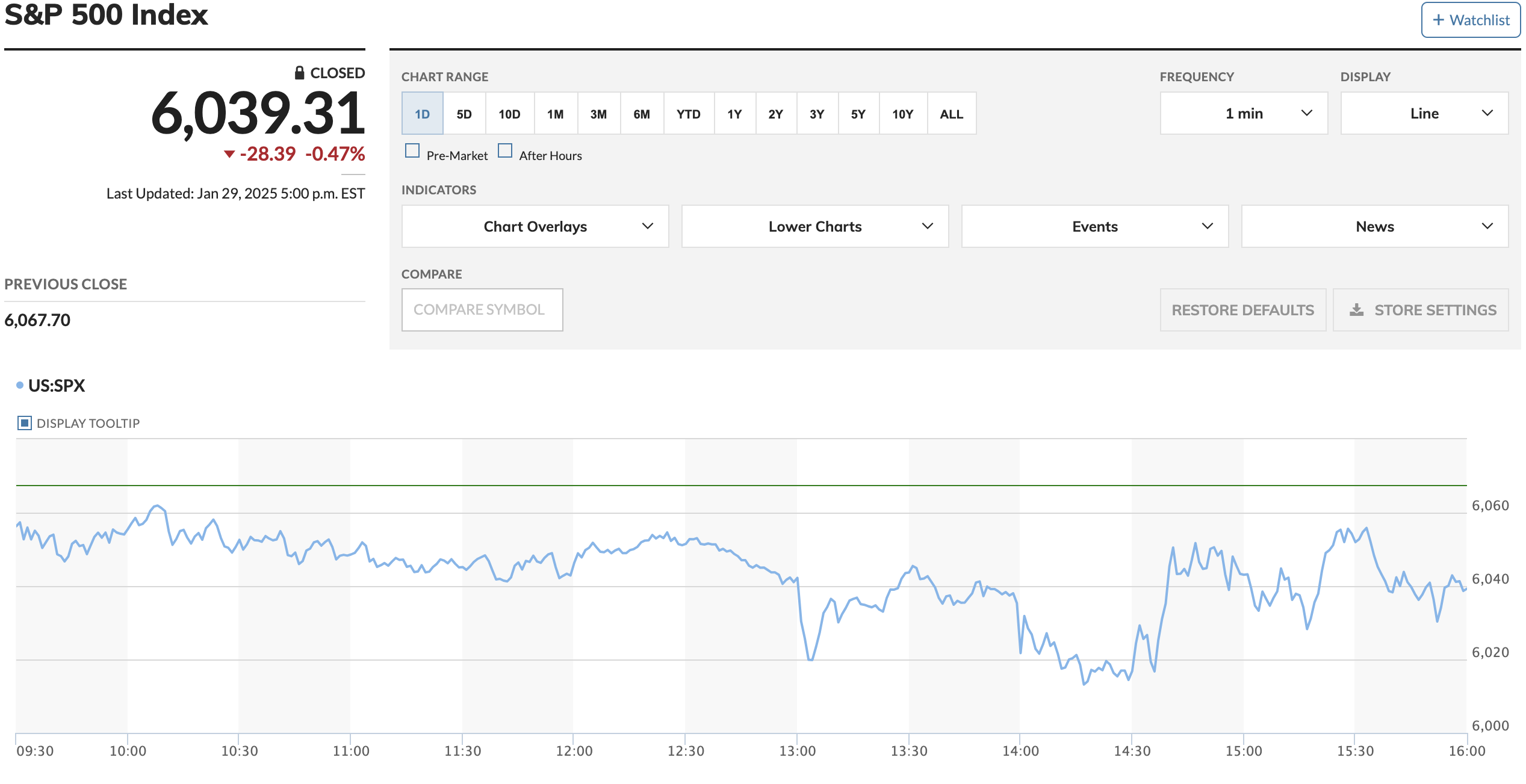

- The US Fed decided to hold rates constant this meeting, which was already priced in and in line with expectations. The notable point was the Fed members mentioning they may adjust the stance of monetary policy as appropriate if risks emerge, as stated in their FOMC statement. Fed Chair Powell reiterated the strength of the economy and that inflation has made progress, but remains somewhat elevated. The most optimistic comment during the FOMC conference came when Fed Chair responded to a question, stating that they don’t need to see inflation go all the way to target to cut rates.

- The small optimism after the FOMC conference did allow equities to close higher from the day’s lows, whereas most major FX pairs showed little to no reaction, trading within a 30-pip range during the FOMC statement and the conference.

- Tesla reported weaker-than-expected revenue and EPS, yet the stock is trading up 5% in after-market trading, indicating some positive sentiment in the market.

- Mark Zuckerberg commented, “We now have a US administration that is proud of our leading companies, prioritizes American technology winning, and will defend our values and interests abroad.” This points to a positive sentiment towards tariffs and other proposed initiatives. Meta posted better-than-expected EPS and revenue, although they revised their expense guidance upward for the year. The stock is trading up 4% in after-market trading.

- Microsoft exceeded expectations for both EPS and revenue, though they missed on revenue from their Azure business. Additionally, they revised their guidance lower for the fiscal 3rd quarter.

Outlook:

- US GDP tomorrow will likely come in line with or better than expectations, as all the macroeconomic data leading up to it does not suggest any doubt.

- The renewed optimism from the Fed regarding rate easing, along with big tech earnings after the close, will add further momentum to the bounce back from Monday’s DeepSeek AI-led sell-off. Google has already vocalized their support for the new administration and its policies, and now Meta follows suit. Insights from Apple tomorrow might share further perspectives. Apple is the only company with a significant chunk of business outside the US, so their stance and view will provide interesting insights.

- The ECB rate decision, similar to the Fed’s, is almost confirmed and priced in at a 25bp rate cut. The ECB has maintained a dovish tone over the last three meetings, and their weak economic print has not helped EUR/USD. Unless there’s a drastic shift to a hawkish tone-unlikely given there’s been no better-than-expected growth, inflation, or jobs report to date-EUR/USD will likely weaken, especially with the US GDP release and further rally in the US stock market.

- Although the BoC cited US tariffs as one of the reasons for the 25bp cut, looking at the FX market, it seems very much priced in, with USD/CAD showing less than a 40-pip range at the BoC decision and during the BoC conference. We’re still trading at the 2-year highs but have been in the 1.43-1.44 range since the US election. The next defining move will likely come when the tariffs are actually implemented or an executive order is signed, which will most likely break the COVID peak of 1.46.

News Tomorrow(1/30): Germany GDP at 4:00 AM, Eurozone GDP at 5:00 AM, ECB Interest rate decision at 8:15 AM, ECB Press Conference at 8:45 AM, US GDP at 8:30 AM, Mastercard(0.87% of S&P500) Earnings before market open, Apple(7.00% of S&P500), Visa(1.12% of S&P500) and Intel(0.17% of S&P500), and Earnings after market close, Japan CPI at 6:30 PM

Sources: Marketwatch(https://www.marketwatch.com/), , Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/)

Leave a comment