News Today(1/30): Germany GDP at 4:00 AM, Eurozone GDP at 5:00 AM, ECB Interest rate decision at 8:15 AM, ECB Press Conference at 8:45 AM, US GDP at 8:30 AM, Mastercard(0.87% of S&P500) Earnings before market open, Apple(7.00% of S&P500), Visa(1.12% of S&P500) and Intel(0.17% of S&P500), and Earnings after market close, Japan CPI at 6:30 PM

Highlights:

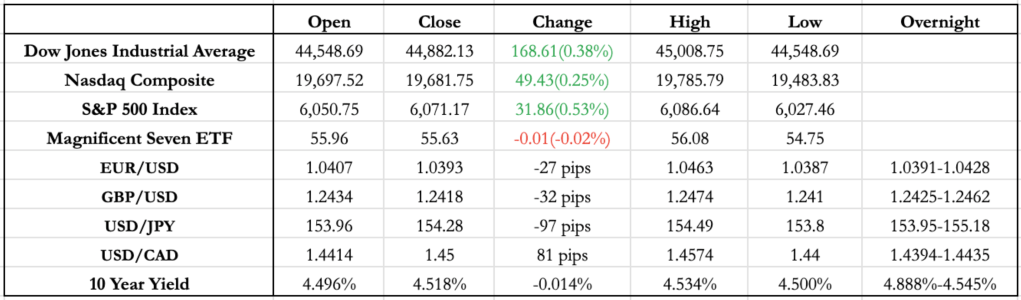

- The ECB cut rates by 25bps, as widely expected, leading to no immediate market reaction. However, EUR/USD found some relief during the ECB press conference when President Lagarde hinted at a slightly less dovish stance, stating that a larger rate cut was never part of the discussion.

- US GDP came in lower than expected (2.3% vs. 2.6%), a surprise given the last three readings were in line with or better than expectations. There were no clear indications leading up to the release that pointed to weaker growth. However, with heightened volatility surrounding Big Tech earnings and Trump’s latest comments, the market largely ignored the data. That said, this miss does tilt expectations slightly toward earlier Fed rate cuts.

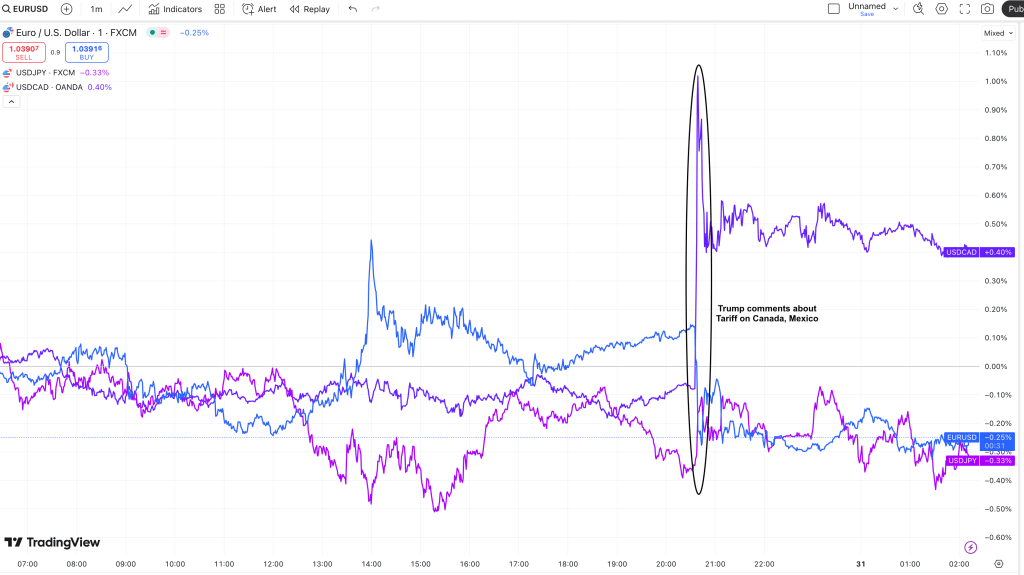

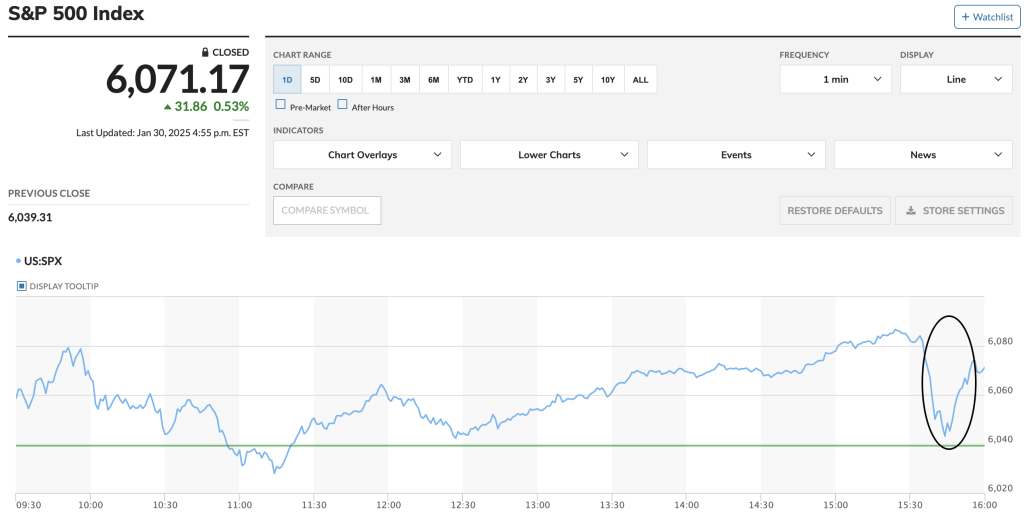

- Trump’s comments on tariffs-particularly his stance on Mexico and Canada-added to market turbulence. He mentioned being undecided on oil tariffs but confirmed that other tariffs would take effect from February 1st. This triggered a brief bout of volatility, with most currency pairs retracing to pre-news levels, except USD/CAD, which touched its COVID-era high and closed at a new peak. Even equity markets saw a sharp decline, though losses were erased closer to the options expiry.

News Tomorrow(1/31): Eurozone CPI at 5:00 AM, ISM Manufacturing PMI at 10:00 AM

Sources: Marketwatch(https://www.marketwatch.com/), Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/)

Leave a comment