News Today(1/31): US Core PCE 8:30 AM, Fed Member Bowman speech at 8:30 AM, US GDP at 8:30 AM, Exxon(0.93% of S&P500) and Chevron(0.51% of S&P500) Earnings before market open

Highlights:

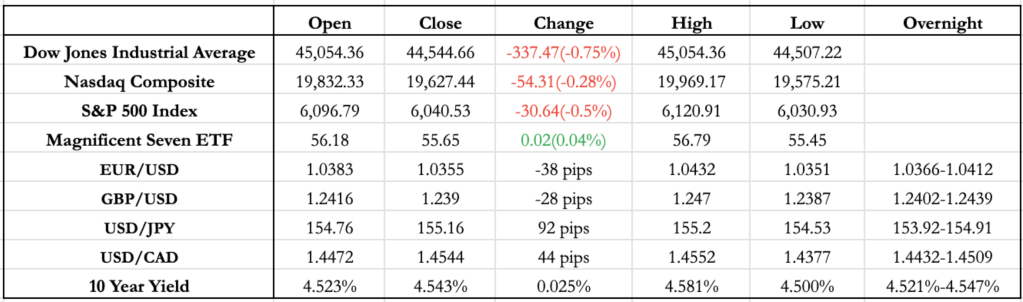

- US Core PCE, a key gauge for inflation, came in line with expectations, while personal spending remained higher than expected. This gives the Fed room to push rate cuts further back. Even though the print matched expectations, persistently elevated inflation has pushed expectations for the first rate cut further toward year-end.

- Fed member and voting member Goolsbee was satisfied with the inflation print but expressed concern over tariffs and their impact. He mentioned that if tariffs affect prices, the Fed will have to take that into consideration when making decisions.

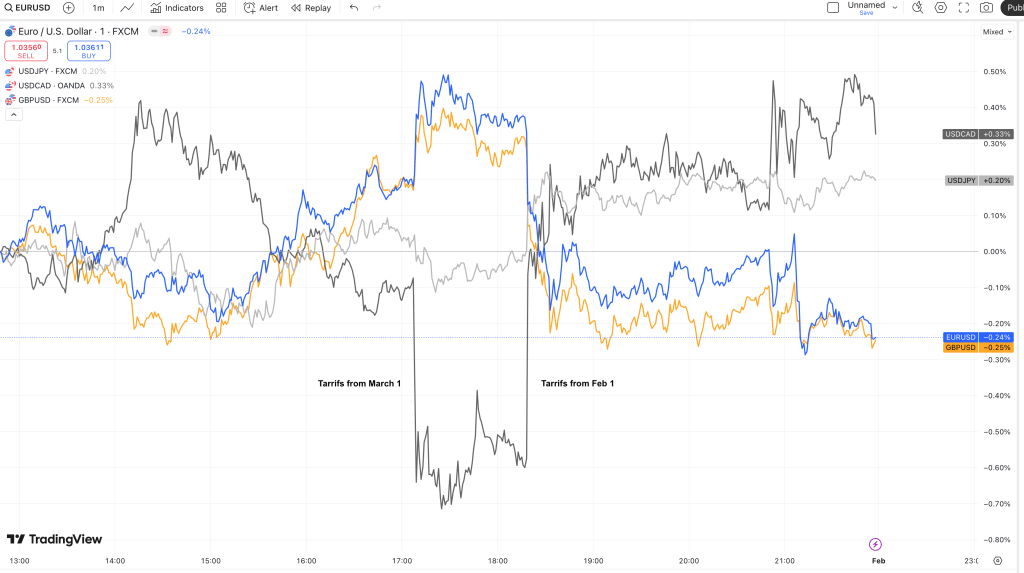

- More Trump-driven volatility hit the markets today, first with news that Trump will impose tariffs on Canada and Mexico starting March 1, whereas the earlier expectation was February 1. This led to a nearly 100-pip drop in USD/CAD, along with a 25-pip jump in EUR/USD and GBP/USD. However, the USD depreciation was short-lived as the White House later confirmed that the new tariffs against Canada and Mexico will, in fact, take effect from February 1.

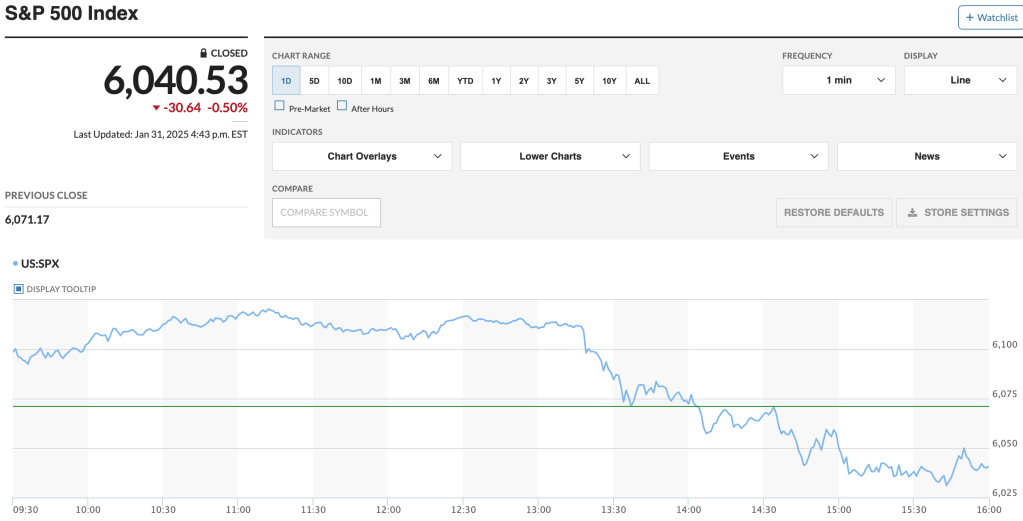

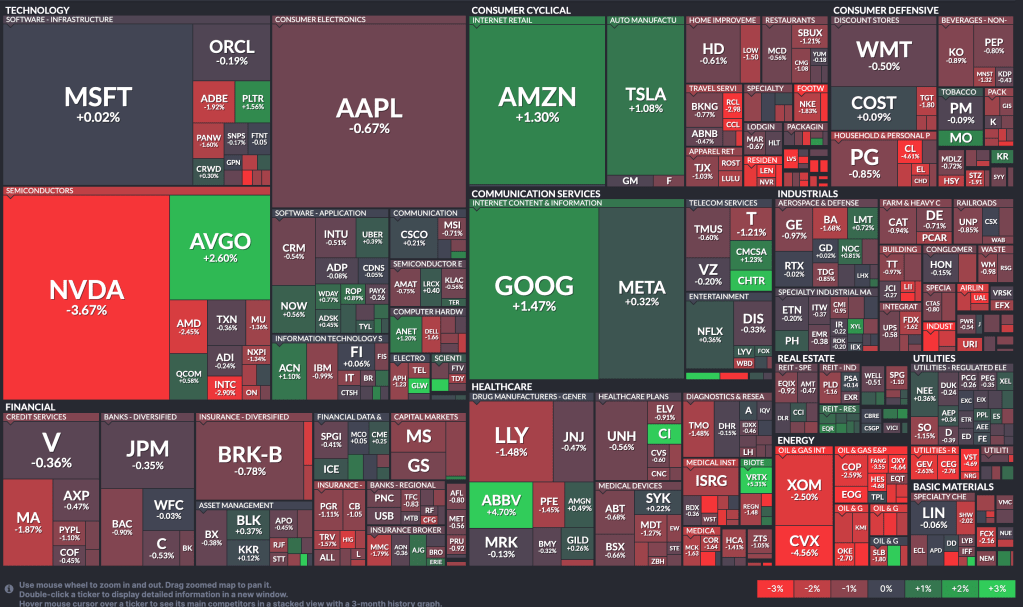

- Equities rallied on slightly better-than-expected earnings but saw a sharp drawdown after Trump’s tariff news resurfaced. It was one of the rare days where the Mag7 ended flat while the S&P 500 was dragged lower, primarily by energy companies. The sell-off in energy was driven by weak earnings from Chevron and concerns over new tariffs, which also included oil and gas.

News Tomorrow(3/1): Eurozone CPI at 5:00 AM, ISM Manufacturing PMI at 10:00 AM

Sources: Marketwatch(https://www.marketwatch.com/), Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/)

Leave a comment