News Today(2/3): US Core PCE 8:30 AM, Fed Member Bowman speech at 8:30 AM, US GDP at 8:30 AM, Exxon(0.93% of S&P500) and Chevron(0.51% of S&P500) Earnings before market open

Highlights:

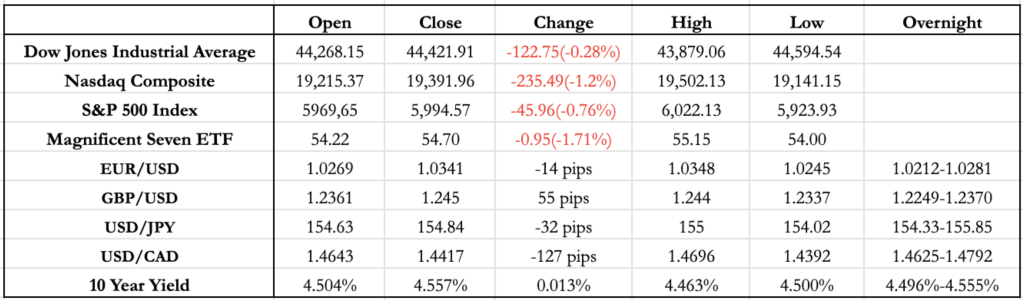

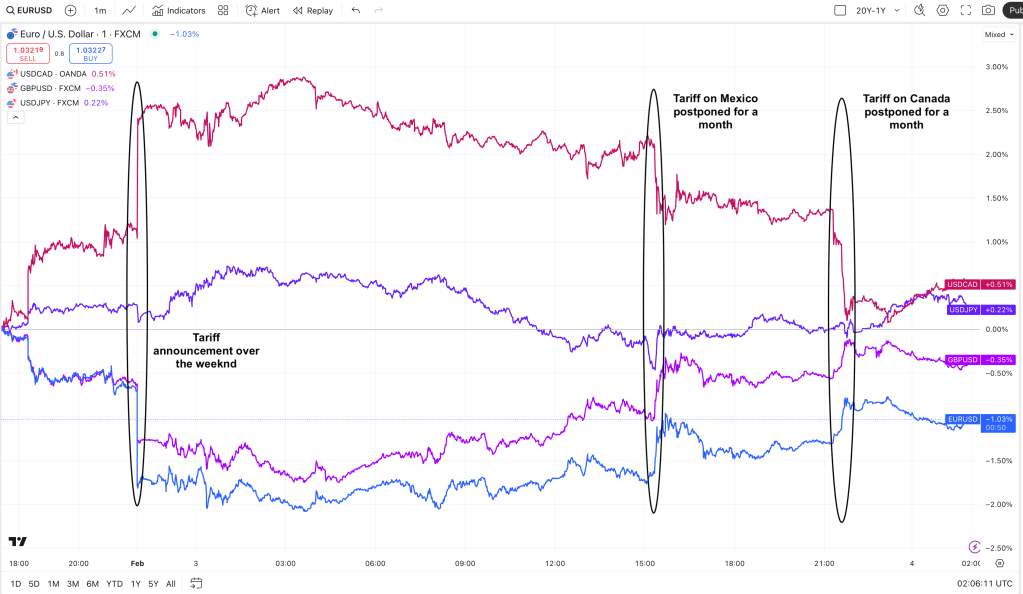

- Over the weekend, former President Trump announced a 25% tariff on imports from Canada, Mexico, and China, set to take effect on Tuesday(2/4). This triggered a sharp reaction in the markets, with EUR/USD dropping to a pre-market low of 1.0125, which is still more than 100-pip less from the official overnight Monday open. Meanwhile, USD/CAD surged to its highest level since the 2008 Global Financial Crisis, as concerns over trade tensions fueled demand for the dollar.

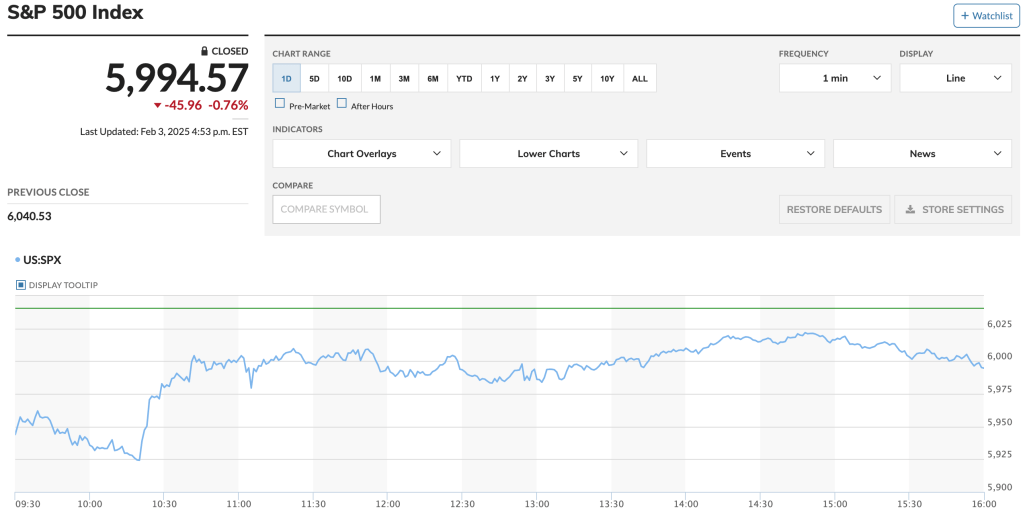

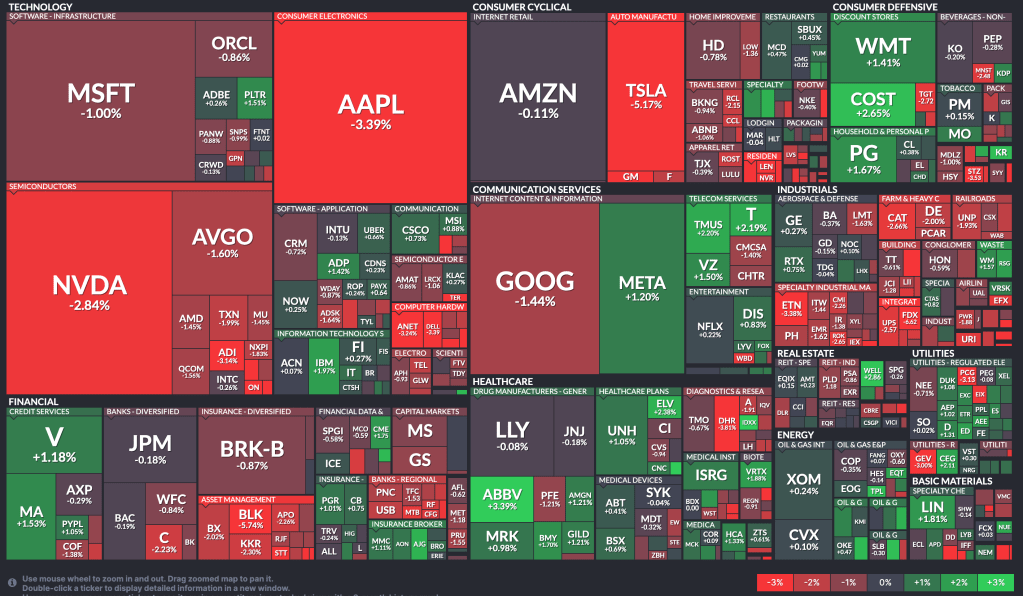

- Adding to the pressure, both Canada and Mexico signaled retaliatory tariffs, further weighing on their respective currencies. Equity markets also reacted negatively, opening down 2%, as investors priced in higher inflation risks and a delay in expected rate cuts.

- However, sentiment improved around 10:20 AM, when the U.S. announced a one-month delay on tariffs for Mexico after an agreement was reached in which Mexicao promised for increased military deployment at the border. This sparked a modest recovery in equities, while the USD pared back 30-40% of its weekend gains against other currencies.

- Later, after market close, news broke that tariffs on Canada would also be delayed by one month, which effectively erased nearly all of the USD’s earlier appreciation.

- Amid the tariff-driven volatility, Eurozone CPI came in higher than expected, further constraining the ECB’s policy flexibility. While the central bank has generally maintained a dovish bias, its comments during the last meeting were slightly hawkish, and this inflation print limits its ability to ease further. The data adds further pressure on EUR/USD, compounding the impact of trade tensions.

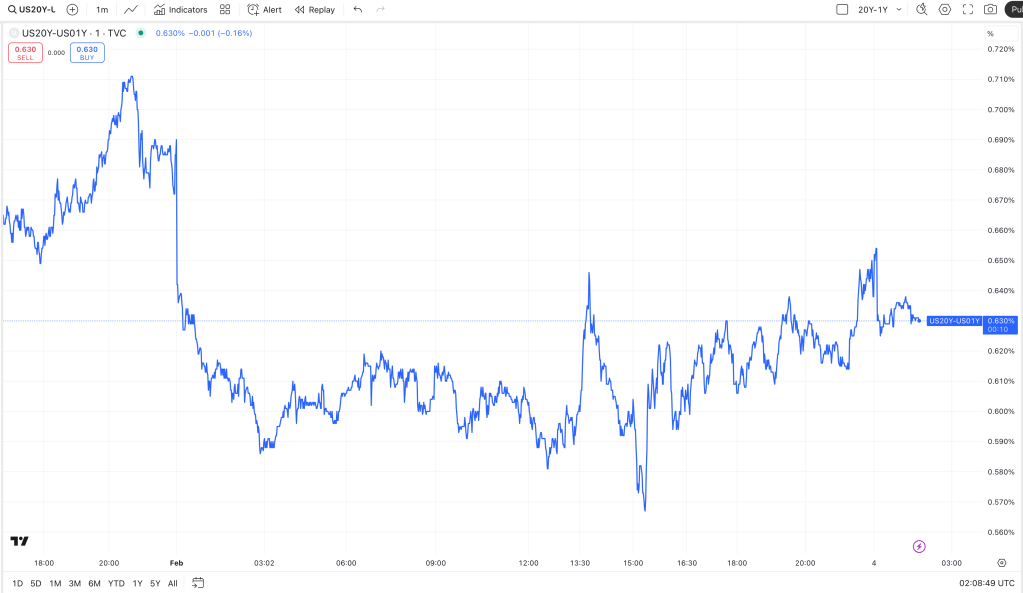

- Another notable development today was the decline in the spread between 20-year and 1-year yields, driven by a larger drop in back-end yields relative to the front end. This suggests either weaker future growth expectations or a shift in flows toward risk-free assets amid heightened uncertainty. However, the move more likely reflects a further delay in expected rate cuts, as the market reassesses the Fed’s path forward.

- Tech earnings once again came in in line with or better than expectations, but the overall pressure from tariffs and inflation weighed on equities. However, the tariff delay announcement after market close, combined with tomorrow’s earnings releases, could help fuel a rebound-unless new tariff imposition news emerges to dampen sentiment

News Tomorrow(2/4): Pfizer, PepsiCo, Spotify and PayPal earnings before Market Open, US JOLTS Job Openings at 10:00 AM, AMD(), Google(GOOGL + GOOG – 4.24% of S&P500) earnings after Market Close

Sources: Marketwatch(https://www.marketwatch.com/), Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/)

Leave a comment