News Today(2/6): Eurozone Retail Sales at 5:00 AM; BOE Interest rate decision at 7:00 AM; Eli Lilly(1.27% of S&P500) earnings before Market Open; Amazon(4.43% of S&P500) earnings after Market Close

Highlights:

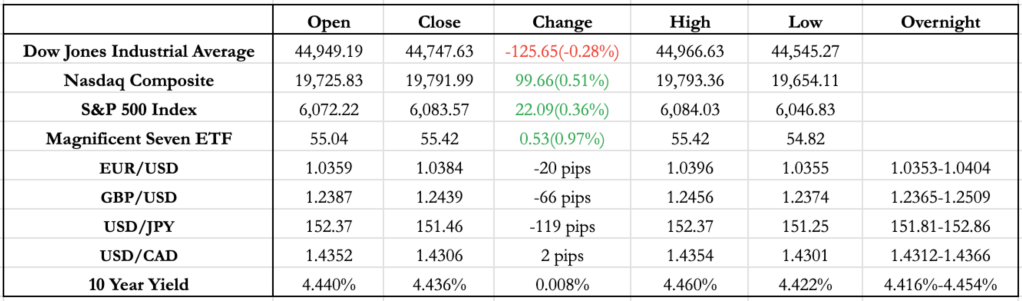

- The Bank of England (BoE) cut rates by 25bps, which was expected, but more members voted for a cut this time (9 vs. 8), leading to an initial 50-pip drop in GBP/USD. However, most of that move was reversed by the close.

- Meanwhile, renewed tariff threats on China, with no peace talks scheduled, pushed JPY higher, as it continued to serve as a safe-haven asset for Asian markets amid rising uncertainty.

- After the tariff threat on Canada was postponed, CAD has been gaining against USD this week, with USD/CAD trading at similar or better levels than before the US tariff volatility began.

- Looking ahead, tomorrow’s NFP report will be under intense scrutiny, especially after this week’s weaker JOLTS data and higher jobless claims. While ADP (private employment) came in better than expected, risks remain tilted toward a weaker NFP print. Even a small sign of labor market weakness could significantly shift Fed rate cut expectations, potentially weakening the USD for the first time since Trump took office.

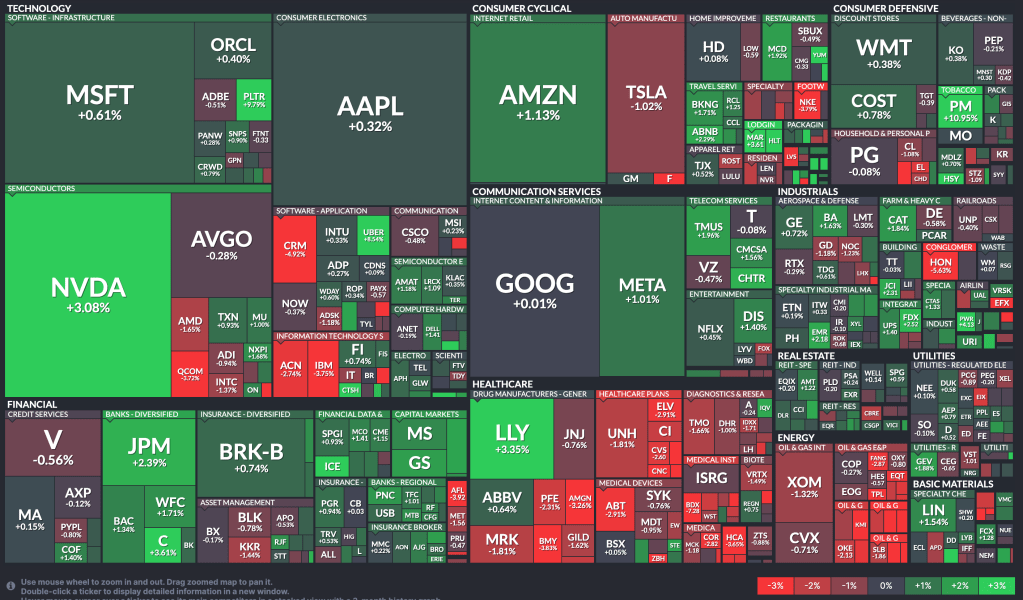

- In earnings, Amazon reported results in line with expectations, but its weaker growth projections led to the stock trading 5% lower in after-hours trading.

News Tomorrow(2/7): BOE Chief Economist Pill speech at 7:15 AM, US NFP at 8:30 AM

Sources: Marketwatch(https://www.marketwatch.com/), Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/)

Leave a comment