News Today(2/12): US CPI at 8:30 AM and Powell Testifies against before Congress

Highlights:

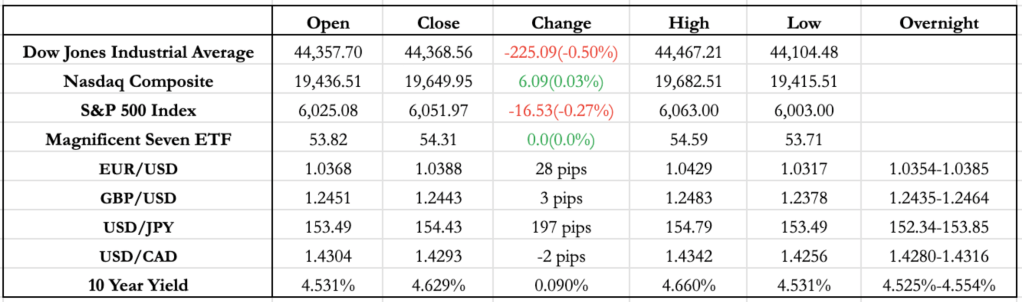

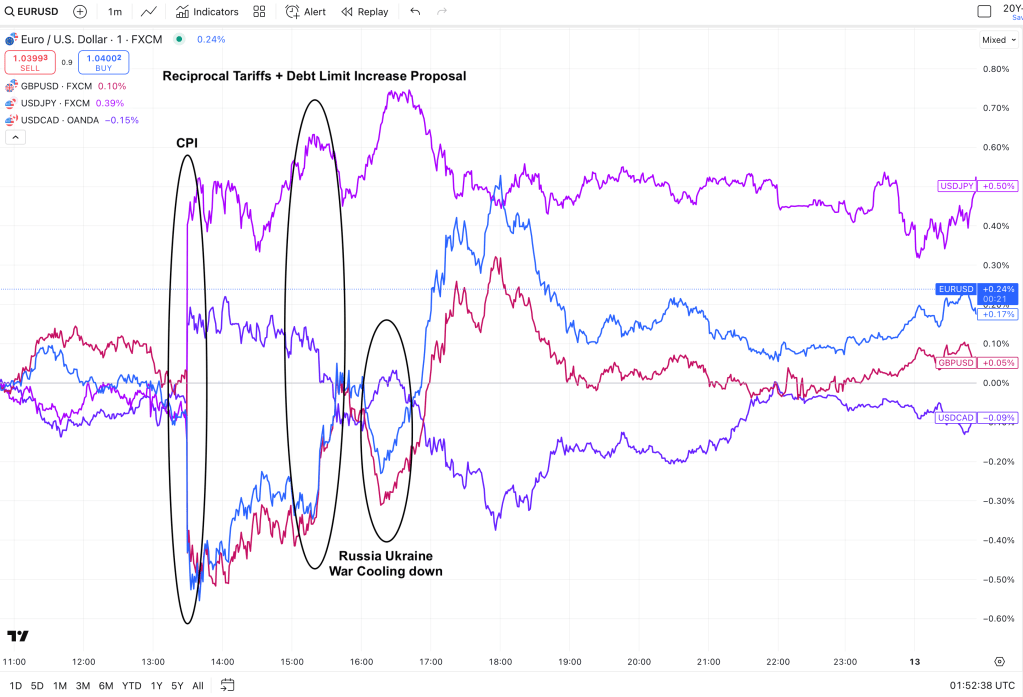

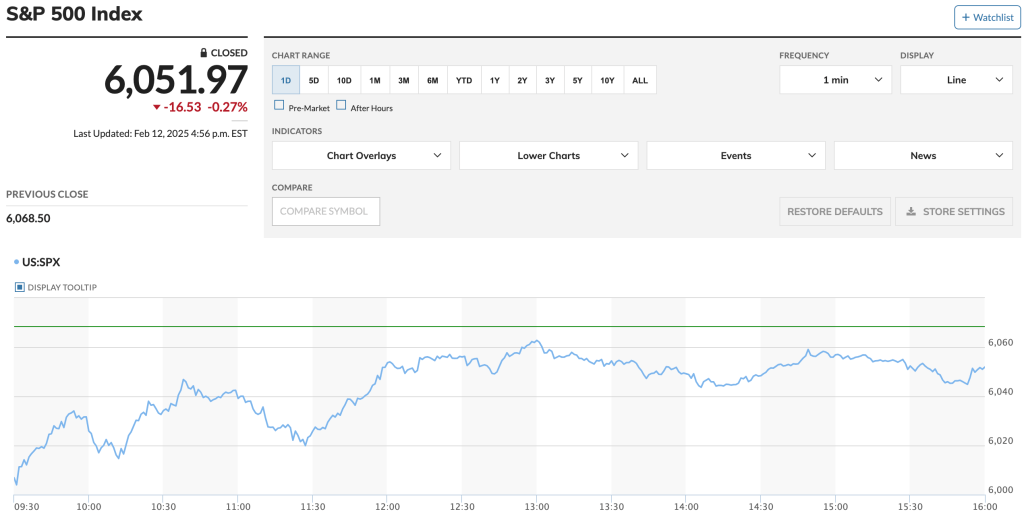

- US CPI came in significantly higher than expected (0.5% vs. 0.3%), triggering a strong market reaction as it pushed rate cut expectations further back in the year. According to the FedWatch tool, the odds of no rate cut until December now stand at 28.5%. This print led to a 1% drawdown in equities, while major FX pairs saw 50-70 pips of depreciation against the dollar. US 10-year yields jumped 10bps, rising above 4.6% – close to the highest level since Trump took office.

- Some of the dollar’s gains were pared after Trump’s economic adviser Hassett said tariffs remain a work in progress and discussions on reciprocal tariffs with other countries had begun earlier in the morning. Additionally, the House proposed raising the debt limit to $4T, reducing some of the uncertainty around fiscal policy.

- Later in the day, news broke that Trump had a call with Putin, discussing the war in Ukraine among other topics. This triggered further USD depreciation, erasing all of the dollar’s post-CPI gains as some of the reserve currency premium was priced out.

- From the close, it’s clear that USD/JPY took the biggest hit today. JPY lost 100 pips on the CPI print and never recovered, even as tensions around the Russia-Ukraine war eased. This was largely because JPY had served as Asia’s reserve currency during the conflict. The US session moves followed a 100-pip drop overnight after BOJ Governor Ueda reaffirmed that rates would stay flat with no further hikes. USD/JPY has been the most volatile pair since the US elections, driven by tariff uncertainty and geopolitical risks, but the broader weakness still stems from the interest rate differential and Japan’s weaker growth outlook.

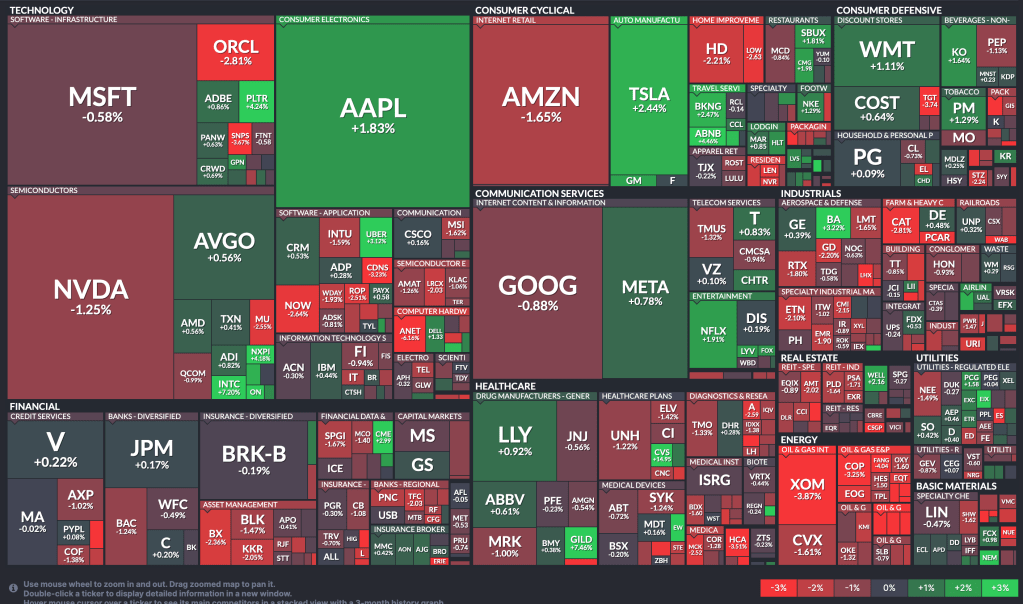

- Equities opened 1% lower but managed to claw back losses, closing unchanged. The ongoing earnings momentum, the debt limit increase proposal, and cooling war tensions helped offset the initial sell-off.

News Tomorrow(2/13): UK GDP at 2:00 AM and US PPI at 8:30 AM

Sources: Marketwatch(https://www.marketwatch.com/), Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/)

Leave a comment