News Today(11/12): HD(Home Depot) – 0.79% of S&P before Market Open., SPOT(Spotify) after Market Close.

Germany CPI at 2:00 AM, UK Clairmont Change(~Jobless Claims) + UK Unemployment Rate at 2:00 AM. Fed Speakers at 10:00 AM, 10:15 AM and 2:00 PM.

Highlights:

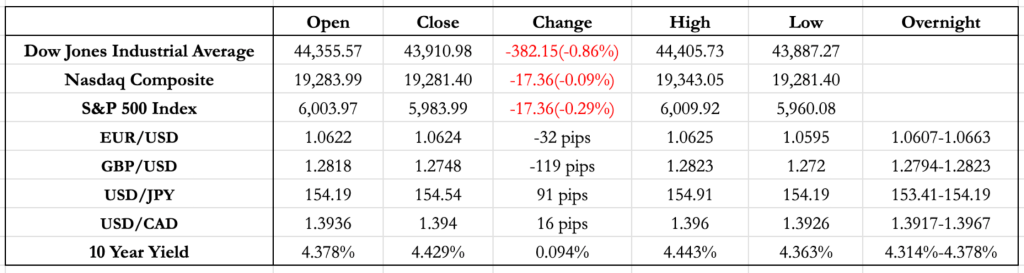

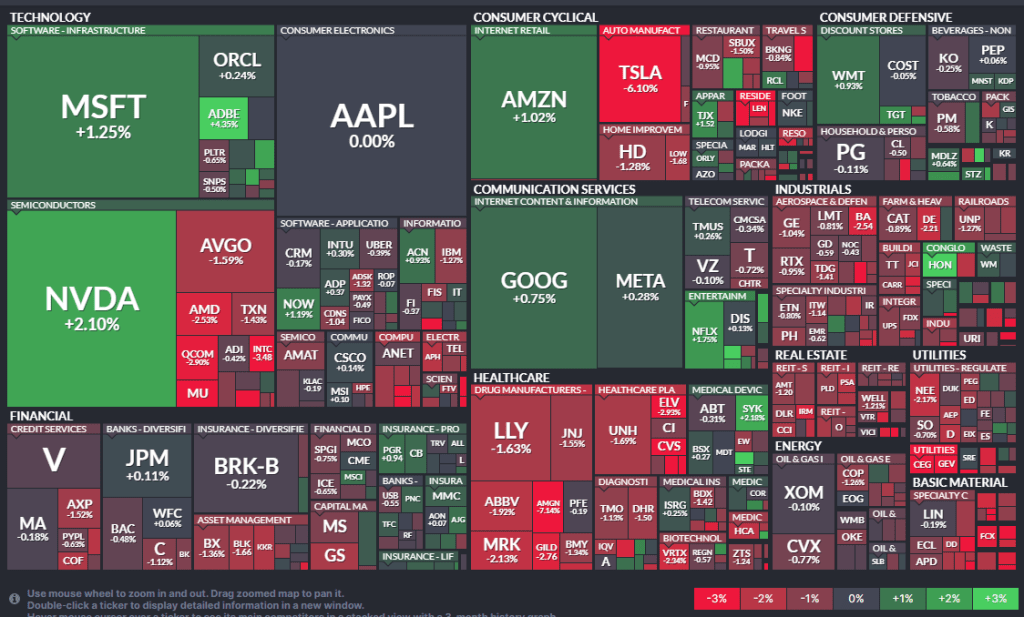

- Since the US elections, most market movements have been driven by two main themes: the “Trump Trade” and “Inflationary Pressure”. The “Trump Trade” has been realized in Tesla, Banks, Industrials, Bitcoin, Oil and the USD. Meanwhile, “Inflationary Pressure” relates to rising yields, fueled by expectations that Trump’s policies could boost inflation, which has pushed both yields and the USD up together.

- Today was the first day these trends showed a clear divergence. The Trump Trade slowed down, while Inflationary Pressure continued, lifting yields and lowering the chances of a 25bp Fed rate cut from 65% to 60%. This was the main factor driving USD gains against other currencies.

- Based on movements since the US election, FX markets appear to be pricing in a significantly lower probability of a 25bp rate cut by the Fed in December compared to the bond market.

- Tesla dropped 6% and Industrials also saw a pull back with Dow Jones closing down 0.85%.

- Bitcoin and Oil remain unchanged, suggesting that Trump Trade momentum hasn’t completely faded.

- The US inflation data this week will be crucial for the USD. If inflation meets or better than expectations, it could give a boost to the Trump Trade. However, to fully counter the momentum of the Trump Trade, we would need a significantly weaker-than-expected inflation print.

FX Markets:

- EUR/USD continued its decline, breaking below 1.06 in the U.S. session after already losing 60 pips in the overnight session. Although there has been no news concerning the Eurozone economy or any official comments, U.S. inflationary expectations are pulling the EUR down. With U.S. inflation data due this week, we may only see relief if inflation significantly worse than expectations and pushes the Fed to cut rates by 25 basis points in December with full certainty. Some of the weakening in the EUR is also coming from political uncertainty in Germany.

- GBP/USD finally succumbed to USD strength, slipping 120 pips from yesterday’s close – a move only slightly smaller than the 140 pips drop seen on the day following the U.S. election. The UK jobs numbers yesterday were a mixed bag, with the Unemployment rate coming in higher but Average Earnings and Claimant Count change (Jobless Claims) coming in better than expectations. In hindsight, it appears much of GBP’s resistance to USD pressure over the past two days was based on these figures, but it ultimately gave in. With momentum now against the GBP, we could see a break below the pre-Yen carry trade debacle level of 1.2690.

- USD/JPY similar to GBP, also succumbed to USD strength today, closing at 154.5 – the same level as the day following the U.S. election. Without any indications from the BoJ that they will actively take measures to stabilize the JPY, we might see USD/JPY breaking above 158.25, the high from this summer before the Yen Carry Trade began.

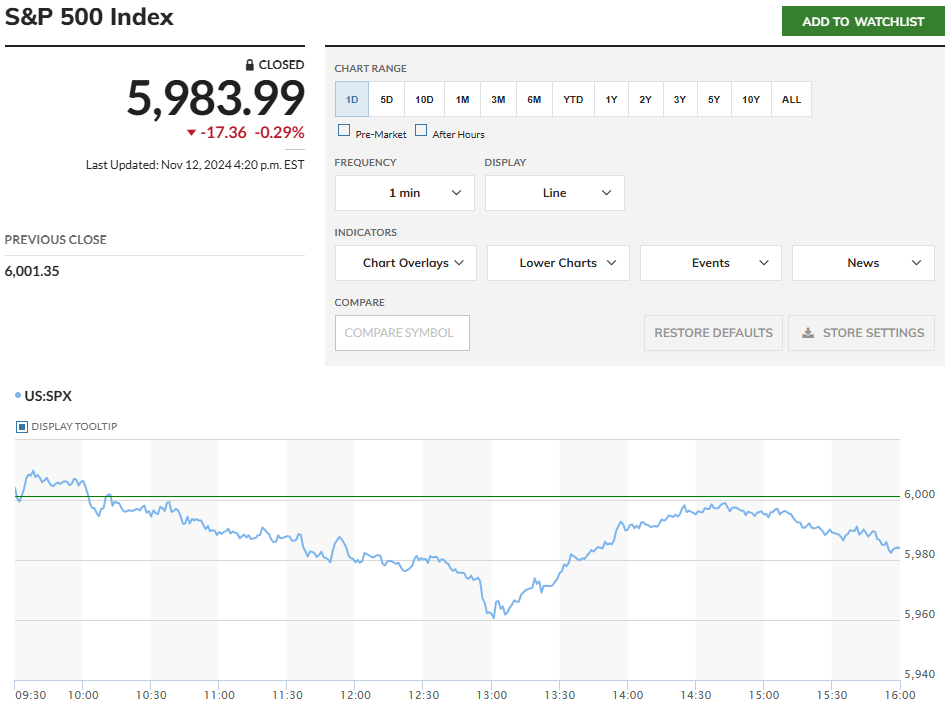

US Equity Markets

- Home Depot saw a 1.25% drawdown despite beating on EPS and revenue, due to their comments about continued weaker consumer demand as a result of high interest rates.

- Spotify jumped nearly 6% after close on their earnings call, which showed they added 6 million more premium subscribers compared to the expectation of 5.2 million.

- TSLA saw a 6.5% drawdown after a slight slowdown in the “Trump trade.”

News Tomorrow(11/13): CSCO(Cisco Systems) – 0.46% of S&P after Market Close.

BoE Monetary Policy Report Hearings around 8:00 AM, US CPI at 8:30 AM, Fed Speakers at 9:30 AM and 9:45 AM.

Sources: Marketwatch(https://www.marketwatch.com/), Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/), Federal Reserve Bank of St. Louis(https://fred.stlouisfed.org/series/CSCICP02CNM460S), scmp.com, econotimes.com.

Leave a comment