News Today(12/11): US CPI at 8:30 AM, Bank of Canada(BOC) Interest rate decision at 9:45 AM, BOC Press Conference at 10:30 AM, US Treasury 10-Year Note auction at 1:00 PM and Adobe(ADBE) earnings – 0.47% of S&P500 after market close

Highlights:

- Muted reaction on the on-line CPI print at the number in the FX market with the range being less than 20 pips across the board in the first minute. But after the digestion of the number, saw USD appreciation across the board owing to continuing outperforming US growth numbers.

- Bank of Canada(BOC) cut 50 bp today which was largely expected(~80% odds of 50bp) and it led to almost 50 pip drop and CAD gain but it was gradually washed away by close leading to a very nominal gain.

- 10 Year yields dropped almost 5bp momentarily after the CPI print but eroded away the gains and then some closing in 4bp higher which was also helped by the 10 Year auction.

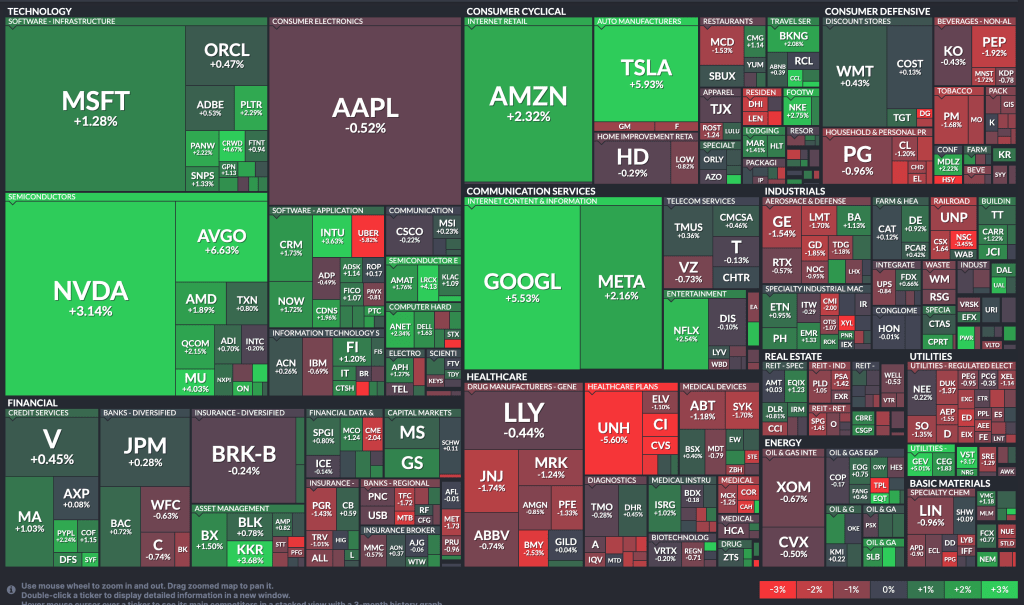

- Apple teamed up with Broadcom to develop its first ever server chip designed specifically for AI which led to Broadcom’s(AVGO) stock price soaring 6.6%.

- Google continues its rally on the back of their new quantum chip announcement from yesterday closing in at up 5.5%.

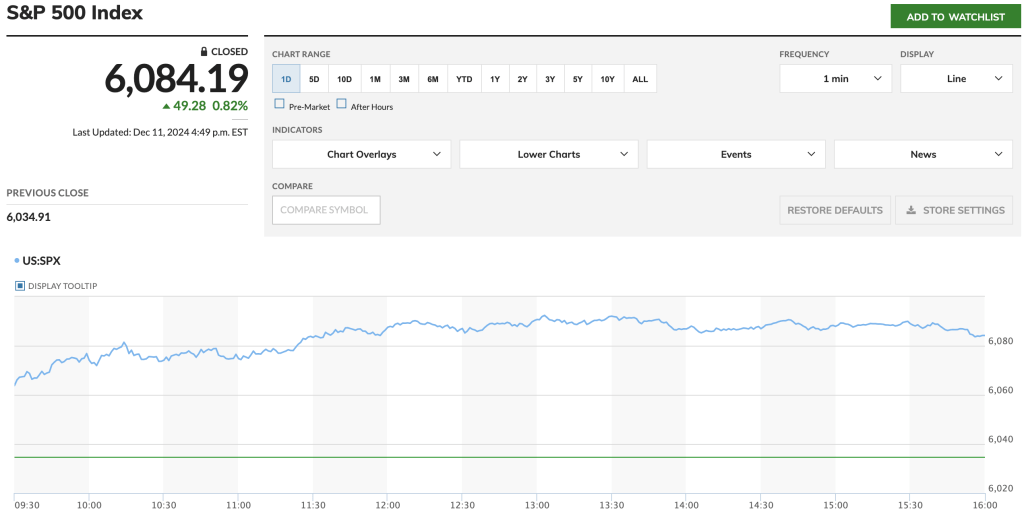

- Equities saw another impetus the CPI print with Nasdaq closing above $20,000 which was also helped by the above mentioned news.

- Adobe posts better than expected revenue as well as EPS but weaker growth forecasts for 2025 which led to 9% downtick in after market trading.

Tomorrow Outlook:

- EUR/USD closed below 1.05 for the first time in the last 1 week and the momentum will most likely continue after ECB cut 25bp tomorrow. The chances for 50bp cut have gone to zero compared to last week but no change in the momentum is still for the Euro Weakening which also has not been helped by the political unstability in France. Although, the recent growth numbers have been as per expectation which could act as a floor if it is reflected in the comments by the ECB officials in the conference tomorrow after the rate cut.

- USD/JPY for the 3rd day consecutive day continues to weaken. Although, we haven’t seen any headline comment form BOJ or the finance minister, USD/JPY continue to have 100+ pips range in the overnight session. The weakening trend will most likely continue unless BOJ decide to hike 25bp this month, the odds for which stand at 30% as of now.

- Amid all the volatility of US inflation and growth data, potential future tarrifs by US and political uncertaninity globally, GBP/USD has maintanied its ground trading in a tight range with no weakening trend. This has been helped by the market expectaoin that BOE will hold the rates constant this month just like November.

- Equities rally most likely will continue further which will only be helped by US PPI tomorrow. Unless the PPI is significantly worse, no reason for the rally to stop.

News Tomorrow(12/12): European Central Bank(ECB) Interest rate decision at 8:15 AM, US PPI at 8:30 AM, ECB Press Conference at 8:45 AM, US Treasury 30-Year Note auction at 1:00 PM and Broadcom(AVGO) earnings – 1.56% of S&P500 and Costco(COST) earnings – 0.86% of S&P500 after market close

Sources: Marketwatch(https://www.marketwatch.com/), , Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/)

Leave a comment