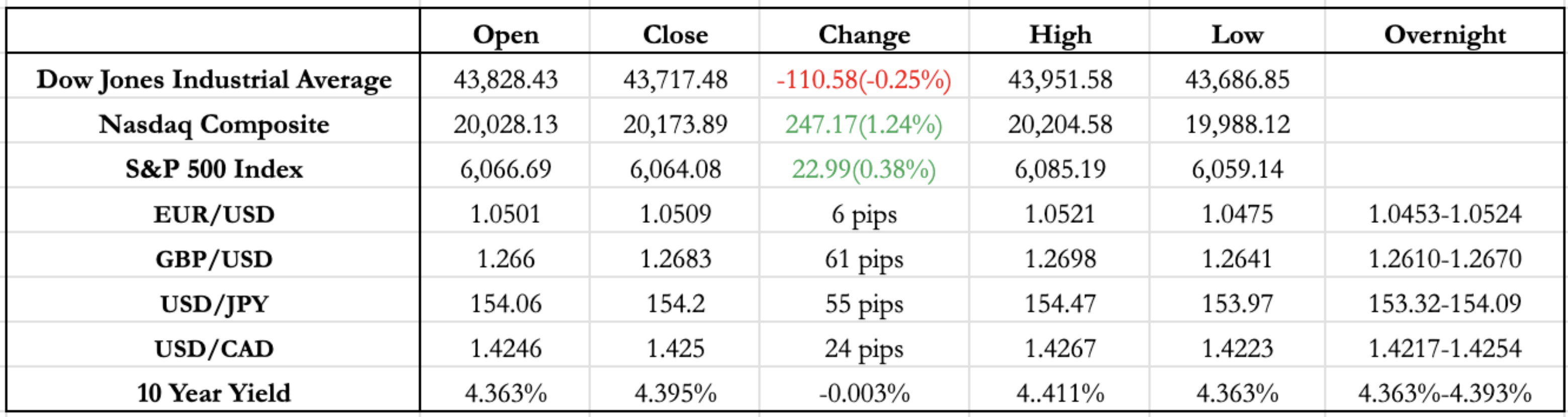

News Today(12/16): ECB President Lagarde speech at 3:15 AM & 3:30 AM, France PMI at 3:15 AM, Germany PMI at 3:30 AM, Eurozone PMI at 4:00 AM, UK PPI at 4:30 AM and US PMI at 9:45 AM

Highlights:

- The better-than-expected Eurozone PMI print initially provided some relief for the euro, strengthening it by nearly 15 pips. However, the gains were short-lived after ECB President Lagarde, speaking at the Annual Economics Conference, indicated they remain open to further rate cuts if inflation data continues to show signs of easing.

- The UK PMI delivered mixed results, with Services exceeding expectations while Manufacturing disappointed. Nonetheless, the overall release was taken positively by markets, boosting GBP by 30 pips. The upward momentum for sterling extended into the U.S session.

- U.S PMI also reflected a mixed picture, with Services outperforming expectations while Manufacturing lagged. Although the immediate reaction to the print was muted, USD weakening started following the options expiry at 10:00 AM.

- Bitcoin continues its post-election rally, crossing and maintaining levels above 100K since Friday’s close, and closing above 105K today.

- According to the FedWatch Tool, bonds are currently pricing in an 81% probability of a hold for the next Fed interest rate decision, with a 25 bp cut already priced in for this month.

- In a joint appearance, Trump and SoftBank Group CEO Masayoshi Son announced that SoftBank plans to invest $100 billion in the U.S over the next four years.

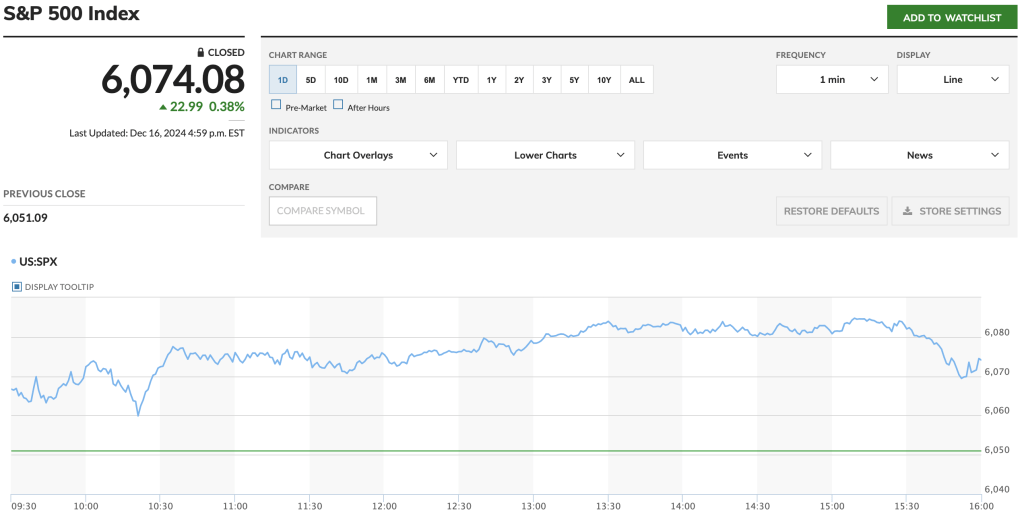

- Nasdaq continued its rally, gaining another 1% today and extending its monthly gains to 7.5%. Broadcom (AVGO), Tesla (TSLA), and Google (GOOG) led the charge.

- Broadcom and Apple’s collaboration on Apple’s first-ever server chip, announced last week, has been a major driver for Broadcom, with its stock soaring 40% in the past week.

- Google sustained its momentum, fueled by last week’s announcement of their new quantum chip, pushing shares up over 7.5% in the past week.

- Tesla’s rally also continued, driven by continued Trump optimism and analysts raising their price targets. The stock is now up nearly 90% since the U.S election.

- After market close, news emerged that U.S. President-elect Donald Trump’s transition team has recommended sweeping changes aimed at cutting off support for electric vehicles and charging stations.

Tomorrow Outlook:

- Retail Sales tomorrow is likely to be a dud, given that recent US data has largely been in line with expectations. And also, the market seems to be paying more attention to Trump’s anticipated policies than the latest macroeconomic figures.

- Mixed FX trends are emerging in the market as interest rate differentials begin to narrow.

- USD/JPY weakening trend has been consistent over the past week, driven by falling odds of a BOJ rate hike, now down to 20%. The gradual nature of the move over the last week has so far avoided any BOJ intervention or comments aimed at stabilizing the Yen. While I expect the JPY weakening trend to persist, it could pause this week ahead of the Fed rate cut decision on Wednesday (12/18).

- EUR/USD hasn’t strengthened as much as recent growth data would suggest, but it showed promising signs of breaking the 1.06 level twice last week. The lack of momentum for the Euro can be attributed to the ECB’s optimistic stance on easing as well the collapse of France government. However, the strong growth data has definitely narrowed the growth differential, which had been much wider during the summer.

- Unlike the Euro, GBP/USD has been supported by the BOE’s conservative stance on interest rate easing, with nearly a 90% chance of a rate hold on Thursday (12/19). The uncertainty surrounding the UK budget and its implications for inflation has been weighing on GBP/USD. However, if UK data continues to come in line with expectations, it could lead to further strengthening of the GBP.

- The optimism surrounding Trump’s policies, coupled with positive news on AI and chips, has further boosted equities, with the Nasdaq leading the charge. The MAG-7 stocks have also contributed significantly to the gains. With no major earnings reports left this month and only a few key macroeconomic numbers (Retail Sales, GDP, and PCE – all this week), the rally is likely to persist through to the year-end.

News Tomorrow(12/17): UK Unemployment rate at 2:00 AM, Canada CPI at 8:30 AM and US Retail Sales at 8:30 AM

Sources: Marketwatch(https://www.marketwatch.com/), , Reuters(https://www.reuters.com/), finviz(https://finviz.com/), fedwatch-tool(https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html), Tradingview(https://www.tradingview.com/)

Leave a comment